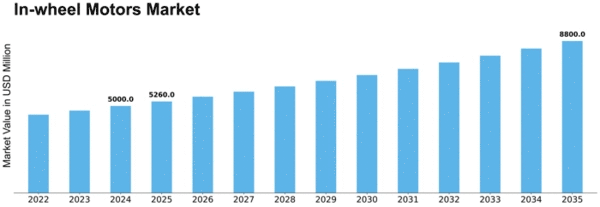

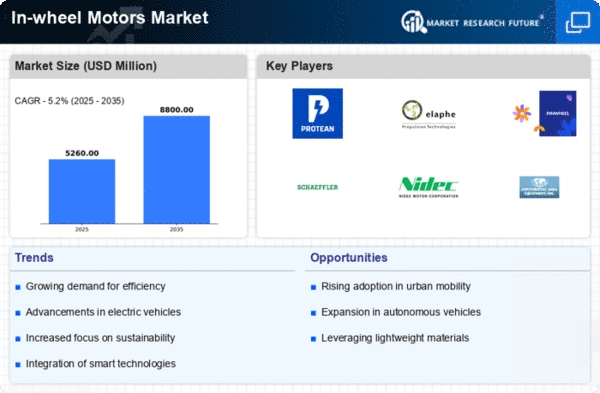

Market Growth Projections

The Global In-wheel motor market is poised for remarkable growth, with projections indicating a market size of 7.63 USD Billion in 2024 and an impressive escalation to 113.8 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate (CAGR) of 27.85% from 2025 to 2035. Such figures reflect the increasing adoption of electric vehicles and the integration of advanced technologies in automotive design. The market's expansion is likely to be driven by various factors, including technological advancements, government policies, and changing consumer preferences. As the industry evolves, stakeholders are expected to capitalize on emerging opportunities, further propelling the market forward.

Rising Focus on Vehicle Efficiency

The rising focus on vehicle efficiency is a significant driver for the In-wheel motor sector. As automotive manufacturers strive to enhance fuel economy and reduce emissions, in-wheel motors present a viable solution. By integrating motors directly into the wheel hub, manufacturers can achieve better weight distribution and lower energy losses. This efficiency is particularly appealing in the context of electric vehicles, where maximizing range is critical. The market's growth trajectory, with an expected valuation of 7.63 USD Billion in 2024, underscores the importance of efficiency in automotive design. As consumer preferences shift towards more efficient vehicles, the demand for in-wheel motors is likely to increase.

Growing Demand for Electric Vehicles

The increasing global demand for electric vehicles (EVs) is a primary driver for the In-wheel motor sector. As consumers become more environmentally conscious, the shift towards sustainable transportation solutions accelerates. In 2024, the market is projected to reach 7.63 USD Billion, reflecting a robust interest in innovative technologies like in-wheel motors. These motors enhance vehicle efficiency by reducing weight and improving space utilization, which is crucial for EV manufacturers. The anticipated growth in EV sales is expected to further bolster the adoption of in-wheel motors, aligning with the industry's trajectory towards cleaner mobility solutions.

Government Initiatives and Incentives

Government initiatives and incentives aimed at promoting electric mobility play a crucial role in driving the In-wheel motor industry. Various countries are implementing policies that encourage the adoption of electric vehicles, including tax rebates, subsidies, and infrastructure development for charging stations. These measures are likely to stimulate demand for in-wheel motors, as they are integral to the design of electric vehicles. With the market expected to grow at a CAGR of 27.85% from 2025 to 2035, supportive government policies are anticipated to create a favorable environment for manufacturers and consumers alike, fostering innovation and investment in this sector.

Emerging Markets and Urbanization Trends

Emerging markets and urbanization trends are reshaping the Global In-wheel motor Industry. As urban populations grow, the demand for efficient and compact transportation solutions rises. In-wheel motors offer a unique advantage in urban settings, allowing for smaller vehicle designs that can navigate congested areas more effectively. This trend is particularly evident in regions experiencing rapid urbanization, where traditional vehicle designs may not suffice. The anticipated growth in these markets is expected to contribute to the overall expansion of the in-wheel motor sector, with projections indicating a market size of 113.8 USD Billion by 2035. Manufacturers are likely to adapt their strategies to cater to these evolving urban mobility needs.

Technological Advancements in Motor Design

Technological advancements in motor design significantly influence the In-wheel motors industry. Innovations such as improved power density, thermal management, and integration of smart technologies enhance the performance and reliability of in-wheel motors. These developments enable manufacturers to produce lighter and more efficient motors, which are essential for modern electric and hybrid vehicles. As a result, the market is likely to experience substantial growth, with projections indicating a rise to 113.8 USD Billion by 2035. The continuous evolution of motor technology not only meets consumer expectations but also aligns with regulatory standards for emissions and energy efficiency.

Leave a Comment