Top Industry Leaders in the In Memory Computing Market

Competitive Landscape of In-Memory Computing Market:

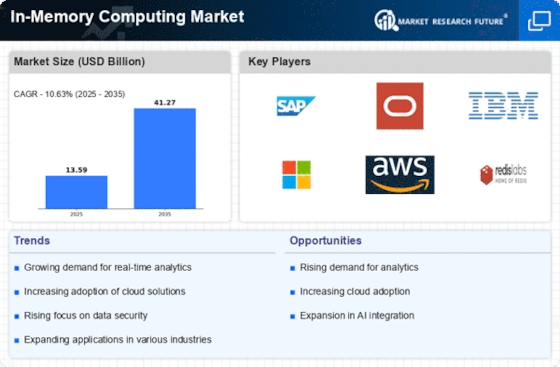

In-memory computing Market, the technology storing data in RAM for lightning-fast processing, is experiencing a surge in adoption across various industries. This rapid growth has fueled a dynamic competitive landscape, marked by established players, ambitious newcomers, and evolving strategies. Let's delve into the key players, their approaches, and the factors shaping market share dominance.

Key Players:

- Microsoft (US)

- Oracle (US)

- SAP (Germany)

- IBM (US)

- SAS Institute (US)

- TIBCO (US)

- Software AG (Germany)

- Fujitsu (Japan)

- Red Hat (US)

- Altibase (US)

- GigaSpaces (US)

- GridGain (US)

- Hazelcast (US)

- MongoDB (US)

- Exasol (Germany),

- Intel (Germany)

- Qlik (US)

- Salesforce (US)

- Workday (US)

- Teradata (US)

- Kognitio (UK)

- Enea (Sweden)

- VoltDB (US)

- McObject (US)

- MemSQL (US)

Strategies for Market Share:

- Specialization: Players like Redis Labs and Gridgain Systems focus on specific in-memory computing solutions, like caching or data grids, catering to niche applications.

- Cloud-First Approach: Cloud providers like Amazon Web Services (AWS) and Google Cloud Platform (GCP) offer in-memory computing services as part of their broader cloud offerings, emphasizing scalability and ease of use.

- Open Source: Apache Spark and Memcached are popular open-source in-memory computing platforms, attracting cost-conscious customers and fostering a vibrant developer community.

- Partnerships and Acquisitions: Collaborations and acquisitions are common, with established players like SAP and Oracle partnering with hardware vendors like Intel and acquiring smaller companies to expand their offerings.

Factors for Market Share Analysis:

- Product Portfolio: Breadth and depth of offerings, including specialized solutions, cloud capabilities, and integration with existing systems, play a crucial role.

- Customer Base: Targeting specific industries and verticals with tailored solutions can give players an edge.

- Pricing and Licensing: Competitive pricing models and flexible licensing options attract customers, especially in cost-sensitive segments.

- Innovation and R&D: Continuous investment in research and development, including new technologies like persistent memory, keeps players ahead of the curve.

New and Emerging Companies:

- Altibase: A South Korean company offering a high-performance in-memory database, gaining traction in Asia and Europe.

- Couchbase: A NoSQL database with in-memory capabilities, popular for its scalability and flexibility.

- MemSQL: An open-source relational database with in-memory capabilities, attracting developers and cost-conscious businesses.

- Tachyon: A distributed in-memory file system, promising high performance for big data analytics.

Current Investment Trends:

- Hybrid Cloud: Vendors are increasingly focusing on hybrid cloud solutions, catering to businesses with on-premises infrastructure and cloud adoption plans.

- Artificial Intelligence (AI) and Machine Learning (ML): In-memory computing is becoming essential for real-time analytics and decision-making, driving demand for integration with AI and ML tools.

- Security and Compliance: Data security and regulatory compliance are becoming critical concerns, prompting vendors to invest in robust security features and compliance certifications.

Latest Company Updates:

January 04, 2024, Dell Technologies announces the launch of its new PowerEdge MX7400 server, optimized for in-memory workloads with high-density memory support.

December 05, 2023, HPE and SAP partner to offer a joint in-memory computing solution for real-time enterprise analytics.

November 15, 2023, Samsung unveils its new DDR5 DRAM modules with improved speed and energy efficiency, targeted at in-memory computing applications.

October 26, 2023, Intel announces the launch of its new Optane Persistent Memory 200 series, designed to deliver faster application performance and improve data persistence in in-memory systems.