Rising Demand for Energy Efficiency

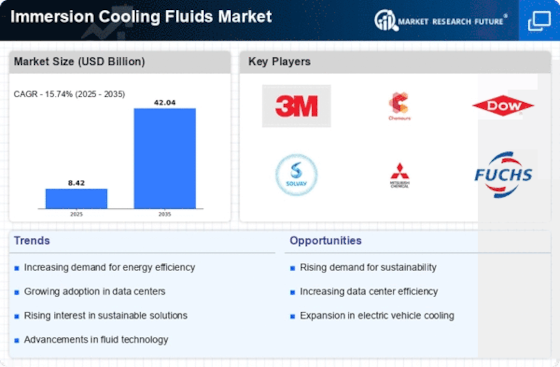

The Immersion Cooling Fluids Market is experiencing a notable surge in demand driven by the increasing emphasis on energy efficiency across various sectors. As organizations strive to reduce operational costs and minimize their carbon footprint, immersion cooling solutions are emerging as a viable alternative to traditional cooling methods. These fluids facilitate superior heat transfer, which can lead to lower energy consumption. According to recent estimates, the adoption of immersion cooling technologies could potentially reduce energy usage by up to 50% compared to conventional air cooling systems. This trend is particularly evident in data centers, where energy efficiency is paramount. Consequently, the immersion cooling fluids market is poised for substantial growth as more enterprises recognize the benefits of these innovative cooling solutions.

Growth in Data Center Infrastructure

The Immersion Cooling Fluids Market is significantly influenced by the rapid expansion of data center infrastructure. With the proliferation of cloud computing and big data analytics, the demand for efficient cooling solutions has escalated. Immersion cooling fluids offer a compelling advantage by providing effective thermal management for high-density computing environments. Reports indicate that the data center market is projected to grow at a compound annual growth rate of over 10% in the coming years, further propelling the need for advanced cooling technologies. As data centers increasingly adopt immersion cooling systems to manage heat dissipation, the immersion cooling fluids market is likely to witness robust growth, driven by the need for enhanced performance and reliability.

Regulatory Support for Sustainable Practices

The Immersion Cooling Fluids Market is increasingly supported by regulatory frameworks that promote sustainable practices in various industries. Governments and regulatory bodies are implementing stringent guidelines aimed at reducing greenhouse gas emissions and encouraging energy-efficient technologies. Immersion cooling solutions align well with these objectives, as they not only enhance energy efficiency but also utilize environmentally friendly fluids. As regulations become more favorable towards sustainable cooling technologies, the immersion cooling fluids market is likely to benefit from increased investments and adoption across multiple sectors. This regulatory support may serve as a catalyst for innovation and growth within the immersion cooling fluids market, as companies seek to comply with evolving standards.

Technological Innovations in Cooling Solutions

The Immersion Cooling Fluids Market is benefiting from ongoing technological innovations that enhance the performance and applicability of immersion cooling solutions. Advances in fluid formulations and materials science are leading to the development of more efficient and environmentally friendly cooling fluids. These innovations not only improve thermal conductivity but also extend the lifespan of the cooling systems. Furthermore, the integration of smart technologies, such as IoT-enabled monitoring systems, is revolutionizing the way cooling is managed in various applications. As these technologies continue to evolve, they are expected to drive the adoption of immersion cooling fluids, making them a preferred choice for industries seeking cutting-edge cooling solutions.

Increasing Adoption in Electronics Manufacturing

The Immersion Cooling Fluids Market is witnessing increased adoption in the electronics manufacturing sector, where efficient cooling is critical for maintaining product quality and performance. As electronic components become smaller and more powerful, the need for effective thermal management solutions has intensified. Immersion cooling fluids provide a unique advantage by allowing for direct cooling of components, thereby reducing the risk of overheating. This trend is particularly relevant in the production of high-performance computing devices and consumer electronics. The electronics manufacturing sector is projected to grow steadily, which may further bolster the immersion cooling fluids market as manufacturers seek reliable cooling solutions to enhance product reliability and efficiency.