Top Industry Leaders in the Identity Verification Market

Competitive Landscape of Identity Verification Market: A Deep Dive

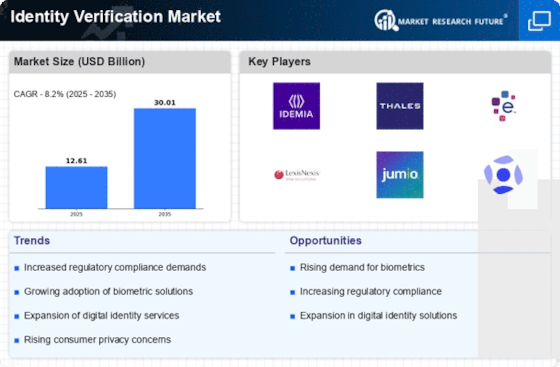

The identity verification market is experiencing a booming surge due to heightened concerns over fraud, regulatory compliance, and digital transformation. This lucrative landscape is teeming with established players, rising startups, and diverse strategies, making it crucial for stakeholders to understand the dynamics at play.

Key Players:

- IDEMIA (France)

- Jumio (US)

- Experian (Ireland)

- GBG (UK)

- Equifax (US)

- Mitek Systems (US)

- Thales Group (France)

- LexisNexis Risk Solutions (US)

- Onfido (UK)

- Trulioo (Canada)

- Acuant (US)

- TransUnion (US)

- AU10TIX (Israel)

- IDology (US)

- Innovatrics (Slovakia)

- Idenfy (Lithuania)

- WebID (Germany)

- IDnow (Germany)

- Applied Recognition (Canada)

- Signicat (Norway)

- SecureKey (Canada)

- IDfy (India)

- Authenteq (Iceland)

- Veri5Digital (India)

- PXL Vision (Switzerland)

- IDMERIT(US)

- Shufti Pro (UK)

- Signzy (India)

- Passbase (Germany)

Strategies for Market Share:

-

Technology Focus: Leaders like IDEMIA and Jumio invest heavily in R&D, constantly improving biometrics, AI-powered document verification, and liveness detection. Startups like Unqork and Sift specialize in niche areas like behavioral analytics and fraud prevention. -

Platform Offerings: Players like GBG and Onfido provide comprehensive verification platforms encompassing KYC/AML compliance, document verification, and fraud scoring. This one-stop-shop approach simplifies integration for clients. -

Vertical Specialization: Acuant and Authenteq cater to specific industries like fintech and healthcare, tailoring solutions to their unique compliance needs and data sensitivities. -

Global Expansion: Established players like Equifax and Experian leverage their extensive global reach to cater to multinational clients, while startups like Shufti Pro are rapidly scaling their presence in emerging markets. -

Partnerships and Acquisitions: Collaborations and acquisitions are common, with leaders like Thales partnering with Jumio for biometric solutions and LexisNexis acquiring Trulioo to strengthen its identity data offerings.

Factors for Market Share Analysis:

-

Product Portfolio: Breadth and depth of solutions offered, including document verification, liveness detection, fraud scoring, and compliance tools. -

Technology Innovation: Investment in R&D, adoption of cutting-edge technologies like AI and blockchain, and accuracy of verification methods. -

Customer Base: Target industries, verticals, and geographical reach, along with the size and loyalty of client portfolios. -

Pricing and Flexibility: Competitive pricing models, customization options, and ease of integration with existing systems. -

Data Security and Privacy: Robust data security infrastructure, adherence to compliance regulations, and commitment to user privacy.

New and Emerging Companies:

-

Socure: Utilizes machine learning and big data to predict and prevent identity fraud in real-time. -

Unqork: Offers a low-code platform for building custom identity verification workflows without coding expertise. -

Sift: Focuses on behavioral analytics and risk scoring to identify suspicious activity and prevent online fraud. -

Clearview AI: Provides facial recognition technology for law enforcement and identity verification applications, raising ethical concerns regarding privacy.

Current Investment Trends:

-

Biometric Solutions: Facial recognition, voice recognition, and fingerprint scanning are gaining traction due to their accuracy and user convenience. -

AI-powered Identity Verification: Machine learning algorithms are improving document verification, fraud detection, and liveness detection capabilities. -

Mobile Identity Verification: Solutions built for mobile devices are crucial for seamless online and offline verification experiences. -

Self-Sovereign Identity (SSI): Decentralized identity management systems are emerging to empower individuals with greater control over their personal data.

Latest Company Updates:

November 2023- Identity security provider Entrust announced Verified Signing, a comprehensive electronic signature offering aimed at increasing trust in digital deals and contracts. The Entrust Verified Signing product integrates identity verification and identity and access governance with digital signatures to authenticate both sides involved in digital transactions. The software can integrate with current workflows or be deployed independently. Entrust’s e-signature software enables companies to authenticate using various credentials like government-issued digital IDs, passports, and corporate badges. The offering can assist organizations in complying with regulations such as the U.S. E-Sign Act and eiDAS. It empowers customers to securely execute high-risk agreements including loans, mortgages, and real estate transactions.

November 2023- FCT, the top nationwide company offering real estate technology and title insurance services, recently launched a new identity confirmation tool for legal professionals called Client ID Verification. It uses face recognition biometrics and reviews government ID documents, cross-checking details against credit bureau and mobile account records to comply with reporting rules from Canada's Financial Transactions and Reports Analysis Centre. Along with fraud prevention, Client ID Verification also simplifies workflows for lawyers, expediting identity checks securely and efficiently. The app will be accessible via FCT's web portal, saving legal teams time while supplying rapid and secure verification.

June 2023- LinkedIn, the professional social networking platform with close to one billion users worldwide who utilize it to connect, search for jobs, and share information, has launched its identity verification capability for members in India. LinkedIn believes identity confirmation should be accessible to all on its platform. Therefore, this capability will be free of charge and available to all eligible LinkedIn members in India.