Rise in Cybersecurity Threats

The Identity Verification Market is experiencing a notable surge due to the increasing prevalence of cybersecurity threats. Organizations are compelled to adopt robust identity verification solutions to safeguard sensitive data and mitigate risks associated with identity theft and fraud. In 2025, it is estimated that cybercrime will cost businesses over 10 trillion dollars annually, prompting a heightened focus on security measures. This trend indicates a growing recognition of the importance of identity verification as a critical component of cybersecurity strategies. As companies strive to protect their assets and maintain customer trust, investments in identity verification technologies are likely to escalate, driving market growth.

Increasing Demand for Remote Services

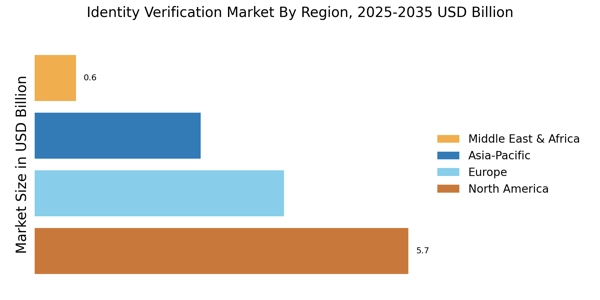

The Identity Verification Market is witnessing a surge in demand for remote services, particularly in sectors such as finance, healthcare, and e-commerce. As businesses transition to digital platforms, the need for secure and efficient identity verification processes becomes paramount. In 2025, it is anticipated that over 70% of customer interactions will occur online, necessitating robust identity verification measures to ensure trust and security. This shift towards remote services is likely to drive the adoption of identity verification solutions that can seamlessly integrate with digital platforms, thereby fostering market expansion. Companies that can provide reliable remote identity verification are positioned to capture a significant share of this growing market.

Growing Awareness of Identity Theft Risks

The Identity Verification Market is benefiting from a growing awareness of identity theft risks among consumers and businesses alike. As incidents of identity fraud continue to rise, individuals are becoming more vigilant about protecting their personal information. This heightened awareness is prompting businesses to implement comprehensive identity verification solutions to reassure customers and build trust. In 2025, it is estimated that identity theft will affect over 14 million individuals, further emphasizing the need for effective verification processes. Consequently, organizations are likely to prioritize investments in identity verification technologies, driving market growth as they seek to mitigate risks and enhance customer confidence.

Regulatory Pressures and Compliance Requirements

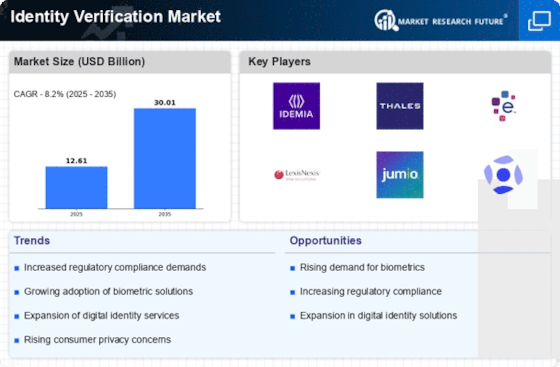

The Identity Verification Market is significantly influenced by regulatory pressures and compliance requirements. Governments and regulatory bodies are increasingly mandating stringent identity verification processes to combat fraud and enhance security. For example, the implementation of Know Your Customer (KYC) regulations in various sectors necessitates that businesses verify the identities of their clients. This trend is expected to drive the market, as organizations invest in compliant identity verification solutions to avoid penalties and maintain operational integrity. By 2025, it is projected that compliance-related expenditures will exceed 20 billion dollars, underscoring the critical role of identity verification in meeting regulatory standards.

Technological Advancements in Identity Verification

Technological innovations are significantly shaping the Identity Verification Market. The integration of artificial intelligence, machine learning, and blockchain technology is enhancing the accuracy and efficiency of identity verification processes. For instance, AI-driven solutions can analyze vast amounts of data in real-time, improving the speed of verification while reducing human error. The market for AI in identity verification is projected to reach 12 billion dollars by 2026, reflecting the growing reliance on advanced technologies. These advancements not only streamline operations but also provide a competitive edge for businesses, thereby propelling the demand for sophisticated identity verification solutions.