Rising Electric Vehicle Adoption

The Global Hypercharger Market Industry is experiencing a notable surge due to the increasing adoption of electric vehicles (EVs). As governments worldwide implement stringent emission regulations and provide incentives for EV purchases, consumer interest in electric mobility is growing. In 2024, the market is projected to reach approximately 48472.5 USD Billion, reflecting the heightened demand for charging infrastructure. This trend is expected to continue, with projections indicating a market size of 85182.8 USD Billion by 2035. The expansion of EV models and advancements in battery technology further contribute to this growth, necessitating a robust hypercharging network to support the anticipated increase in EV usage.

Growing Demand for Renewable Energy

The increasing demand for renewable energy sources is a significant driver of the Global Hypercharger Market Industry. As more consumers and businesses seek sustainable energy solutions, the integration of renewable energy into hypercharging stations is becoming more prevalent. This shift not only reduces the carbon footprint of electric vehicle charging but also enhances the appeal of EVs among environmentally conscious consumers. The market is poised for growth, with projections indicating a market size of 48472.5 USD Billion in 2024, driven by the alignment of hypercharging infrastructure with renewable energy initiatives. This trend is expected to continue, fostering a more sustainable charging ecosystem.

Expansion of Charging Infrastructure

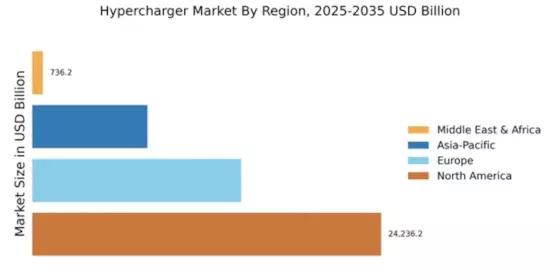

The expansion of charging infrastructure is a pivotal factor driving the Global Hypercharger Market Industry. As electric vehicle adoption accelerates, the need for a comprehensive and accessible charging network becomes increasingly critical. Investments in hypercharger installations are being made by both public and private sectors, aiming to create a seamless charging experience for users. This expansion is expected to support the projected CAGR of 5.26% from 2025 to 2035, as more locations become equipped with hypercharging capabilities. The establishment of charging stations in urban areas, highways, and commercial centers is essential to meet the growing demand for electric vehicle charging solutions.

Government Initiatives and Incentives

Government initiatives play a crucial role in shaping the Global Hypercharger Market Industry. Various countries are implementing policies and providing financial incentives aimed at promoting the installation of hyperchargers. For instance, tax credits, grants, and subsidies are being offered to businesses and municipalities to encourage the development of charging infrastructure. These initiatives not only facilitate the growth of the hypercharger market but also align with broader sustainability goals. As a result, the market is expected to witness a compound annual growth rate (CAGR) of 5.26% from 2025 to 2035, driven by supportive regulatory frameworks that enhance the attractiveness of investing in hypercharging solutions.

Technological Advancements in Charging Solutions

Technological advancements are significantly influencing the Global Hypercharger Market Industry. Innovations in charging technology, such as ultra-fast charging systems and smart charging solutions, are enhancing the efficiency and convenience of charging electric vehicles. These advancements are likely to reduce charging times, making EVs more appealing to consumers. Moreover, the integration of renewable energy sources into charging stations is gaining traction, aligning with global sustainability efforts. As the market evolves, these technological improvements are expected to attract further investments, thereby contributing to the projected growth of the hypercharger market, which is anticipated to reach 85182.8 USD Billion by 2035.