Innovations in Food Technology

Technological advancements in food processing are playing a pivotal role in shaping the Hydrolyzed Plant Protein Market. Innovations such as enzymatic hydrolysis and membrane filtration are enhancing the quality and functionality of hydrolyzed plant proteins. These technologies not only improve the nutritional profile but also expand the applications of these proteins in various food products. As manufacturers adopt these cutting-edge techniques, the market is likely to witness an influx of new products that cater to diverse consumer preferences. The integration of advanced processing methods is expected to drive growth within the Hydrolyzed Plant Protein Market, making it more competitive and appealing.

Increasing Health Consciousness

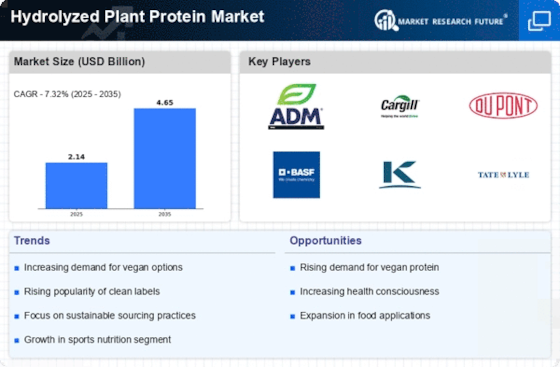

The Hydrolyzed Plant Protein Market is experiencing a surge in demand driven by a growing awareness of health and wellness among consumers. Individuals are increasingly seeking protein sources that are not only nutritious but also easily digestible. Hydrolyzed plant proteins, known for their high bioavailability, cater to this need effectively. As consumers become more informed about the benefits of plant-based diets, the market for hydrolyzed plant proteins is likely to expand. Reports indicate that the plant-based protein sector is projected to grow at a compound annual growth rate of over 10% in the coming years, suggesting a robust future for the Hydrolyzed Plant Protein Market.

Rising Demand for Functional Foods

The Hydrolyzed Plant Protein Market is benefiting from the increasing consumer interest in functional foods. These foods, which offer health benefits beyond basic nutrition, are gaining traction among health-conscious individuals. Hydrolyzed plant proteins are often incorporated into functional food products due to their ability to enhance protein content while providing additional health benefits. This trend aligns with the growing consumer preference for foods that support overall well-being. Market analysis suggests that the functional food sector is on an upward trajectory, which could lead to increased opportunities for hydrolyzed plant proteins within the Hydrolyzed Plant Protein Market.

Expansion of Vegan and Vegetarian Diets

The Hydrolyzed Plant Protein Market is significantly influenced by the rising adoption of vegan and vegetarian diets. As more individuals transition to plant-based lifestyles, the demand for alternative protein sources has intensified. Hydrolyzed plant proteins serve as an excellent option for those seeking to meet their protein requirements without animal products. This shift is not merely a trend; it reflects a broader societal movement towards sustainable eating practices. Market data indicates that the demand for plant-based proteins is expected to reach substantial figures, further solidifying the position of hydrolyzed plant proteins within the Hydrolyzed Plant Protein Market.

Sustainability and Environmental Concerns

Sustainability is becoming a crucial factor influencing consumer choices, and the Hydrolyzed Plant Protein Market is no exception. As environmental concerns rise, consumers are increasingly favoring plant-based proteins over animal-derived options. Hydrolyzed plant proteins are perceived as a more sustainable choice, contributing to lower carbon footprints and reduced resource consumption. This shift towards sustainability is prompting manufacturers to innovate and develop eco-friendly products, further enhancing the appeal of hydrolyzed plant proteins. Market trends indicate that sustainability-focused products are likely to gain a larger share of the market, positioning the Hydrolyzed Plant Protein Market favorably in the evolving food landscape.