Market Share

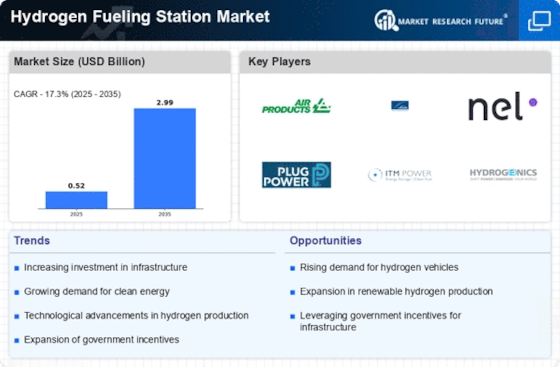

Hydrogen Fueling Station Market Share Analysis

Companies use a variety of market share positioning techniques to acquire a competitive advantage and forge a strong presence in the ever-changing hydrogen fueling station market. Strategic alliances and partnerships are one important technique. To leverage and pool resources, businesses frequently form alliances with other entities, such as energy providers, automakers, or technological companies. These collaborations improve the hydrogen filling station's overall value offer, giving customers access to a more complete and integrated solution. Positioning for market share is heavily influenced by cost competitiveness. Businesses that reduce the cost of producing, distributing, and dispensing hydrogen stand to benefit from a competitive edge. Customers will find hydrogen fuel more appealing when competitive price is provided using sustainable and efficient processes. Geographic expansion is another successful tactic. Businesses carefully consider factors including population density, the availability of hydrogen infrastructure, and regulatory backing when choosing locations for hydrogen fuelling stations. Companies want to take a bigger chunk of the market and satisfy the increasing demand for hydrogen refueling in various areas by systematically broadening their presence. This strategy also contributes to the development of a strong and cohesive network of fuelling stations, which encourages the broad use of hydrogen-powered automobiles. Leading the way in innovation and technology is essential for gaining market share. Leading companies in the business are those who make research and development investments to create technologies for hydrogen production, storage, and dispensing. Innovative technology help filling stations operate more reliably and efficiently while setting businesses apart in a market that is changing quickly. Providing innovative, cutting-edge solutions draws clients and increases a business's market share. Higher profit margins from cost-effective operations also enable businesses to reinvest in new product development and market expansion. Businesses that take an active role in developing standards and regulatory frameworks establish themselves as leaders in their field and help hydrogen become more widely recognized as a practical energy source.

Leave a Comment