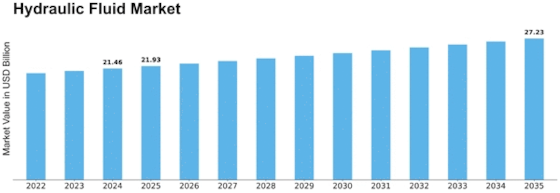

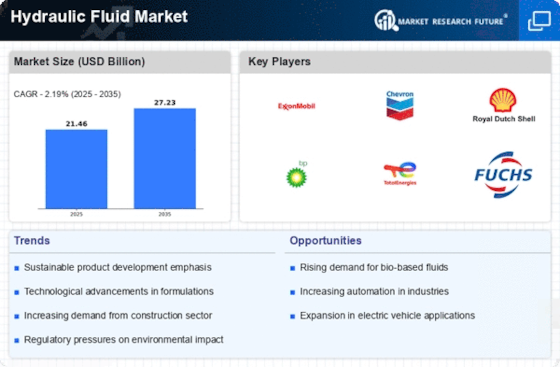

Hydraulic Fluid Size

Hydraulic Fluid Market Growth Projections and Opportunities

The hydraulic fluid market is influenced by various factors that shape its dynamics and growth trajectory. One significant factor is the industrial landscape. Industries such as construction, automotive, aerospace, and manufacturing heavily rely on hydraulic systems for their operations. As these industries expand or contract, the demand for hydraulic fluids fluctuates accordingly. For instance, during periods of economic growth, there is typically increased construction activity, leading to higher demand for hydraulic fluids to power construction equipment.

Many fluids are formulated in various ways; therefore, they function differently and have properties not the same. For example, some fluids become biodegradable so that they do not harm the environment and others have special properties that make them resistant to fire. Fire resistance is one of the most important properties in these fluids, as they work with mechanical components that heat up and cause friction. Fire-resistant hydraulic fluid is usually the first fluid used by aerospace manufacturers because it decreases the possibility of damage.

Another crucial market factor is technological advancements. Innovations in hydraulic systems and fluids lead to the development of more efficient and high-performance products. Manufacturers invest in research and development to create fluids that offer better lubrication, thermal stability, and environmental sustainability. These advancements not only cater to existing applications but also open up new opportunities in emerging sectors, driving market growth.

Environmental regulations also play a pivotal role in shaping the hydraulic fluid market. Governments worldwide are implementing stricter regulations to reduce environmental pollution and promote sustainability. This has led to the development of eco-friendly hydraulic fluids that are biodegradable and less harmful to the environment. Manufacturers need to adapt to these regulations by offering compliant products, which often requires investment in new formulations and production processes.

Market competition is another significant factor influencing the hydraulic fluid market. With numerous players vying for market share, competition is fierce. Companies compete based on factors such as product quality, price, brand reputation, and distribution networks. As a result, manufacturers are constantly innovating and improving their products to stay ahead of the competition. Market consolidation through mergers and acquisitions is also common as companies seek to strengthen their position in the market.

Global economic factors such as GDP growth, inflation rates, and exchange rates also impact the hydraulic fluid market. Economic downturns can lead to reduced industrial activity and lower demand for hydraulic fluids, while economic expansion can fuel growth in key end-user industries. Additionally, currency fluctuations can affect the cost of raw materials and manufacturing, influencing pricing strategies and market dynamics.

Supply chain disruptions pose significant challenges to the hydraulic fluid market. Factors such as natural disasters, geopolitical tensions, and pandemics can disrupt the supply of raw materials and components, leading to shortages and price volatility. Manufacturers need to have robust supply chain management strategies in place to mitigate these risks and ensure continuity of supply.

Consumer preferences and shifting trends also influence the hydraulic fluid market. As awareness of environmental issues grows, there is increasing demand for sustainable and bio-based hydraulic fluids. Similarly, advancements in equipment design and technology drive the need for fluids that can meet the performance requirements of modern hydraulic systems. Manufacturers need to stay attuned to these changing preferences and trends to remain competitive in the market.

Leave a Comment