Market Analysis

In-depth Analysis of Hydraulic Fluid Market Industry Landscape

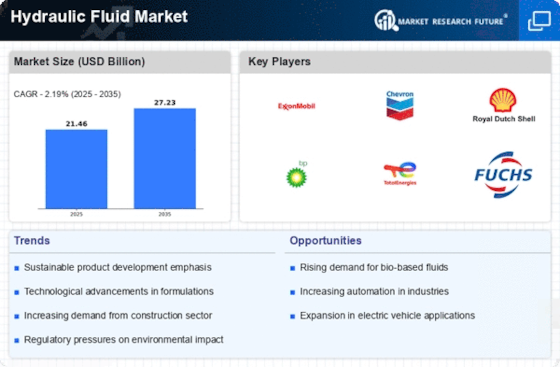

The hydraulic fluid market operates within a dynamic landscape influenced by various factors. At its core, this market revolves around the demand for hydraulic fluids, essential in powering hydraulic machinery across industries. The dynamics of this market are shaped by several key elements, including technological advancements, regulatory standards, industry trends, and economic factors.

For years, manufacturers have been improving hydraulic fluid to increase Eco-durability, safety, and efficiency. Only a few manufacturers produce high-quality hydraulic fluids, and if you need some, you need to research the manufacturer to make sure you get the best product on the market. Finding the balance between performance and price is critical, and by combining both, you will end up with the best solution for your needs. Market growth is driven by industrial growth in Africa, Asia-Pacific, and the Middle East, along with increased process automation in most industries.

Technological advancements play a significant role in shaping the hydraulic fluid market. Innovations in hydraulic systems and machinery drive the demand for more efficient and specialized fluids. Manufacturers continually develop new formulations to meet the evolving needs of modern hydraulic equipment. These advancements often focus on improving fluid performance, durability, and environmental sustainability, driving market dynamics through innovation and competition.

Regulatory standards also heavily impact the hydraulic fluid market. Governments worldwide impose regulations concerning environmental protection, workplace safety, and product quality. Compliance with these standards influences product development, production processes, and market access. Manufacturers must navigate a complex regulatory landscape, ensuring their products meet or exceed requirements while remaining competitive in the market.

Industry trends reflect shifting preferences and priorities within various sectors that rely on hydraulic machinery. For example, increasing emphasis on renewable energy drives demand for hydraulic fluids suitable for use in hydraulic systems powering wind turbines and solar panels. Similarly, the automotive industry's focus on electric vehicles influences the demand for specialized hydraulic fluids used in braking and steering systems. Market players must stay abreast of these trends to capitalize on emerging opportunities and stay competitive.

Economic factors such as GDP growth, industrial output, and infrastructure development also influence the hydraulic fluid market. Economic downturns can lead to reduced industrial activity and capital expenditure, affecting demand for hydraulic machinery and fluids. Conversely, periods of economic expansion typically stimulate investment in infrastructure projects and industrial automation, driving demand for hydraulic fluids. Fluctuations in commodity prices, exchange rates, and labor costs further shape market dynamics, influencing pricing strategies and supply chain management.

Market dynamics in the hydraulic fluid industry are also influenced by factors such as supply chain disruptions, geopolitical events, and natural disasters. Disruptions in the supply chain, whether due to transportation issues, raw material shortages, or geopolitical tensions, can impact production and distribution, leading to market volatility. Natural disasters such as hurricanes, earthquakes, or floods can disrupt manufacturing facilities and infrastructure, affecting both supply and demand for hydraulic fluids.

Furthermore, consumer preferences and environmental consciousness play an increasingly significant role in shaping market dynamics. There is growing demand for environmentally friendly hydraulic fluids with biodegradable and non-toxic properties. As sustainability becomes a key consideration for businesses and consumers alike, manufacturers are under pressure to develop eco-friendly alternatives and reduce the environmental impact of hydraulic fluid production and usage.

Leave a Comment