Top Industry Leaders in the Hybrid Integration Platform Market

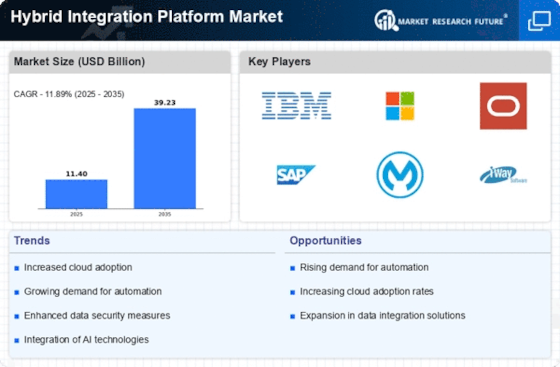

Competitive Landscape of Hybrid Integration Platform Market:

The Hybrid Integration Platform (HIP) market is witnessing robust competition, driven by the increasing demand for seamless integration solutions in today's complex business environment. Key players in this landscape are adopting diverse strategies to gain a competitive edge, with a focus on innovation, partnerships, and strategic acquisitions. Several factors contribute to market share analysis, including product offerings, geographical presence, and customer base. Additionally, new and emerging companies are entering the market, intensifying competition and offering fresh perspectives. Current investment trends highlight a significant influx of capital into companies aiming to capitalize on the growing need for efficient integration solutions.

Key Players:

- Software AG (Germany)

- Informatica (U.S.)

- Dell Boomi (U.S.)

- MuleSoft (U.S.)

- International Business Machines Corporation (U.S.)

- TIBCO Software

- (U.S.)

- Oracle Corporation (U.S.)

- Liaison Technologies (U.S.)

- WSO2 (U.S.)

- Red Hat (U.S.)

Strategies Adopted:

- Innovation and Product Enhancement: Key players prioritize innovation to enhance their product offerings continually. Regular updates and feature additions ensure that the solutions remain aligned with the latest industry trends and technological advancements.

- Strategic Partnerships: Collaboration is a prevalent strategy in the HIP market. Companies form strategic partnerships to expand their market reach, offer complementary services, and create a more comprehensive solution for customers.

- Acquisitions: Strategic acquisitions play a crucial role in consolidating market share. Companies acquire innovative startups or competitors to strengthen their portfolios and gain a competitive advantage.

- Global Expansion: Given the global nature of businesses, players in the HIP market are expanding their geographical presence. This expansion allows them to cater to diverse customer needs and establish a stronger market foothold.

Factors for Market Share Analysis:

- Product Portfolio: The breadth and depth of the product portfolio contribute significantly to market share. Companies offering a comprehensive suite of integration solutions, covering various use cases, are positioned more favorably.

- Geographical Presence: The ability to provide services across different regions enhances a company's market share. A global presence ensures that businesses can effectively meet the integration needs of clients operating in diverse locations.

- Customer Base: The size and diversity of the customer base are key indicators of a company's market share. A broad customer base across industries demonstrates the versatility and adaptability of a company's integration solutions.

- Technological Capabilities: Companies with advanced technological capabilities, such as support for emerging technologies like artificial intelligence and machine learning, are better positioned to capture market share.

New and Emerging Companies:

- SnapLogic: Positioned as an emerging player, SnapLogic focuses on providing a user-friendly integration platform. Its emphasis on ease of use and rapid deployment appeals to businesses looking for quick and efficient integration solutions.

- Jitterbit: Jitterbit offers a scalable and flexible integration platform, gaining traction among businesses with evolving integration needs. Its focus on real-time data connectivity and API management distinguishes it in the market.

- Celigo: Recognized for its iPaaS (Integration Platform as a Service) solutions, Celigo caters to businesses of all sizes. Its specialization in pre-built integrations accelerates the integration process for users.

Current Company Investment Trends:

- Funding in Innovation Labs: Companies are investing significantly in innovation labs to foster research and development. These labs focus on exploring emerging technologies and developing cutting-edge solutions to stay ahead in the competitive landscape.

- Strategic Acquisitions: Investments are directed towards strategic acquisitions, enabling companies to strengthen their product portfolios swiftly. This trend indicates a proactive approach to market consolidation and expansion.

- Marketing and Branding Initiatives: Increased investment in marketing and branding initiatives reflects the competitive nature of the HIP market. Companies are striving to create a distinct identity and build brand awareness to attract a broader customer base.

- Talent Acquisition: With the demand for skilled professionals in the integration space, companies are investing in talent acquisition to ensure they have the expertise required to develop, implement, and support sophisticated integration solutions.

Latest Company Updates:

October 26, 2023: Microsoft announced the general availability of Azure Hybrid Connector, a new service that makes it easier to connect on-premises applications to Azure cloud services.

September 20, 2023: Mulesoft announced the release of MuleSoft Composer 5.5, which includes new features for building and deploying integration flows.

August 10, 2023: Boomi announced the launch of Boomi Flow, a new low-code integration platform.