Rising Environmental Awareness

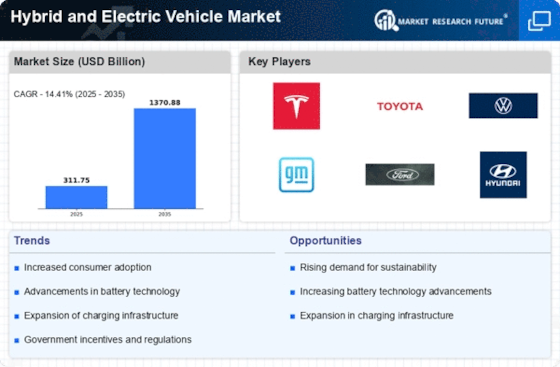

The increasing awareness of environmental issues among consumers appears to be a pivotal driver for the Hybrid and Electric Vehicle Market. As climate change concerns escalate, individuals are more inclined to seek sustainable transportation options. This shift in consumer behavior is reflected in the growing demand for vehicles that produce lower emissions. In 2025, it is estimated that nearly 30% of new vehicle sales will be electric or hybrid, indicating a significant transformation in consumer preferences. The Hybrid and Electric Vehicle Market is thus positioned to benefit from this heightened environmental consciousness, as manufacturers respond by expanding their offerings of eco-friendly vehicles.

Economic Incentives and Subsidies

Government incentives and subsidies for electric and hybrid vehicles are expected to significantly influence the Hybrid and Electric Vehicle Market. Many countries have implemented tax credits, rebates, and grants to encourage consumers to purchase eco-friendly vehicles. For instance, in 2025, it is anticipated that several regions will offer incentives that can reduce the purchase price of electric vehicles by up to 7,500 dollars. Such financial benefits not only make hybrid and electric vehicles more accessible but also stimulate market growth. As consumers become more aware of these incentives, the Hybrid and Electric Vehicle Market is likely to experience a surge in demand, further solidifying its position in the automotive sector.

Advancements in Charging Technology

Technological innovations in charging infrastructure are likely to play a crucial role in the Hybrid and Electric Vehicle Market. The development of fast-charging stations and wireless charging solutions could alleviate range anxiety, a common concern among potential electric vehicle buyers. As of 2025, the number of public charging stations is projected to exceed 1 million, facilitating easier access to charging for consumers. This expansion in charging technology not only enhances the convenience of owning electric vehicles but also encourages more consumers to consider hybrid and electric options. Consequently, the Hybrid and Electric Vehicle Market stands to gain from these advancements, potentially leading to increased adoption rates.

Corporate Sustainability Initiatives

The commitment of corporations to sustainability is emerging as a significant driver for the Hybrid and Electric Vehicle Market. Many companies are adopting green policies and transitioning their fleets to electric or hybrid vehicles as part of their corporate social responsibility strategies. This trend is not only beneficial for the environment but also enhances corporate image and brand loyalty. By 2025, it is projected that over 50% of major corporations will have implemented sustainability initiatives that include the adoption of hybrid and electric vehicles. This corporate shift is likely to create a ripple effect, encouraging consumers to follow suit and further propelling the Hybrid and Electric Vehicle Market.

Improving Vehicle Performance and Range

Enhancements in vehicle performance and range are likely to be a key factor driving the Hybrid and Electric Vehicle Market. Advances in battery technology and electric drivetrains are enabling manufacturers to produce vehicles that not only offer longer ranges but also improved acceleration and handling. As of 2025, several electric vehicle models are expected to achieve ranges exceeding 400 miles on a single charge, making them more competitive with traditional gasoline vehicles. This improvement in performance could attract a broader audience, including those who may have previously been hesitant to switch to electric. Thus, the Hybrid and Electric Vehicle Market is poised for growth as these advancements continue to reshape consumer perceptions.