-

Executive Summary

-

Scope of the Report

-

Market Definition

-

Scope of the Study

- Research Objectives

- Assumptions & Limitations

-

Markets Structure

-

Market Research Methodology

-

Research Process

-

Secondary Research

-

Primary Research

-

Forecast Model

-

Market Landscape

-

Porter’s Five Forces Analysis

- Threat of New Entrants

- Bargaining power of buyers

- Threat of substitutes

- Rivalry

- Bargaining Power of Suppliers

-

Value Chain/Supply Chain of Human Resource Management Software Market

-

Market Overview of Human Resource Management Software

-

Introduction

-

Growth Drivers

-

Impact Analysis

-

Market Challenges

-

Market Trends

-

Introduction

-

Growth Trends

-

Impact analysis

-

Human Resource Management Software by Deployment

-

Introduction

-

On-Premise

- Market Estimates & Forecast, 2020–2030

- Market Estimates & Forecast by Region, 2020–2030

-

On-Cloud

- Market Estimates & Forecast, 2020–2030

- Market Estimates & Forecast by Region, 2020–2030

-

Human Resource Management Software Market by Organization Size

-

Introduction

-

Small and Medium Enterprises

- Market Estimates & Forecast, 2020–2030

- Market Estimates & Forecast by Region, 2020–2030

-

Large Enterprises

- Market Estimates & Forecast, 2020–2030

- Market Estimates & Forecast by Region, 2020–2030

-

Human Resource Management Software Market by Solution

-

Introduction

-

Work Force Management

- Market Estimates & Forecast, 2020–2030

- Market Estimates & Forecast by Region, 2020–2030

-

Sourcing and Recruitment

- Market Estimates & Forecast, 2020–2030

- Market Estimates & Forecast by Region, 2020–2030

-

Applicant Tracking System

- Market Estimates & Forecast, 2020–2030

- Market Estimates & Forecast by Region, 2020–2030

-

Talent Management

- Market Estimates & Forecast, 2020–2030

- Market Estimates & Forecast by Region, 2020–2030

-

Others

- Market Estimates & Forecast, 2020–2030

- Market Estimates & Forecast by Region, 2020–2030

-

Human Resource Management Software Market by Service

-

Introduction

-

Integration and Deployment

- Market Estimates & Forecast, 2020–2030

- Market Estimates & Forecast by Region, 2020–2030

-

Support and Maintenance

- Market Estimates & Forecast, 2020–2030

- Market Estimates & Forecast by Region, 2020–2030

-

Training and Consulting

- Market Estimates & Forecast, 2020–2030

- Market Estimates & Forecast by Region, 2020–2030

-

Human Resource Management Software Market by Verticals

-

Introduction

-

BFSI

- Market Estimates & Forecast, 2020–2030

- Market Estimates & Forecast by Region, 2020–2030

-

Telecom and IT

- Market Estimates & Forecast, 2020–2030

- Market Estimates & Forecast by Region, 2020–2030

-

Public Sector

- Market Estimates & Forecast, 2020–2030

- Market Estimates & Forecast by Region, 2020–2030

-

Manufacturing

- Market Estimates & Forecast, 2020–2030

- Market Estimates & Forecast by Region, 2020–2030

-

Retail

- Market Estimates & Forecast, 2020–2030

- Market Estimates & Forecast by Region, 2020–2030

-

Healthcare

- Market Estimates & Forecast, 2020–2030

- Market Estimates & Forecast by Region, 2020–2030

-

Transportation and Logistics

- Market Estimates & Forecast, 2020–2030

- Market Estimates & Forecast by Region, 2020–2030

-

Others

- Market Estimates & Forecast, 2020–2030

- Market Estimates & Forecast by Region, 2020–2030

-

Human Resource Management Software Market by Region

-

Introduction

-

North America

- Market Estimates & Human Resources Management Software Market, by Country, 2020–2030

- Market Estimates & Forecast by Deployment, 2020–2030

- Market Estimates & Forecast by Organization Size, 2020–2030

- Market Estimates & Forecast by Solution, 2020–2030

- Market Estimates & Forecast by Service, 2020–2030

- Market Estimates & Forecast by Vertical, 2020–2030

- U.S.

- Mexico

- Canada

-

Europe

- Market Estimates & Human Resources Management Software Market, by Country 2020–2030

- Market Estimates & Forecast by Deployment, 2020–2030

- Market Estimates & Forecast by Organization Size, 2020–2030

- Market Estimates & Forecast by Solution, 2020–2030

- Market Estimates & Forecast by Service, 2020–2030

- Market Estimates & Forecast by Vertical, 2020–2030

- Germany

- France

- U.K

- Rest of Europe

-

Asia Pacific

- Market Estimates & Human Resources Management Software Market, by Country, 2020–2030

- Market Estimates & Forecast by Deployment, 2020–2030

- Market Estimates & Forecast by Organization Size, 2020–2030

- Market Estimates & Forecast by Solution, 2020–2030

- Market Estimates & Forecast by Service, 2020–2030

- Market Estimates & Forecast by Vertical, 2020–2030

- China

- India

- Japan

- Rest of Asia Pacific

-

Rest of the World

- Market Estimates & Human Resources Management Software Market, by Country, 2020–2030

- Market Estimates & Forecast by Deployment, 2020–2030

- Market Estimates & Forecast by Organization Size, 2020–2030

- Market Estimates & Forecast by Solution, 2020–2030

- Market Estimates & Forecast by Service, 2020–2030

- Market Estimates & Forecast by Vertical, 2020–2030

- The Middle East & Africa

- Latin Countries

-

Company Profiles

-

Workday, Inc. (U.S.)

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

-

SAP SE (Germany)

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

-

Kronos, Inc. (U.S.)

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

-

Oracle Corporation (U.S.)

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

-

Automatic Data Processing, LCC (U.S.)

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

-

Talentsoft (France)

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

-

Ultimate Software Group, Inc. (U.S.)

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

-

Accenture PLC (Ireland)

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

-

Cezanne HR Ltd. (U.K.)

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

-

International Business Machines Corporation (U.S.)

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

-

Ultimate Software (U.S.)

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

-

PricewaterhouseCoopers (India)

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

-

NetSuite, Inc. (U.S.)

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

-

Mercer LLC (U.S.)

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

-

Ceridian HCM, Inc. (U.S.)

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

-

Conclusion

-

-

LIST OF TABLES

-

Table1 Global Human Resource Management Software Market: By Country, 2020–2030

-

Table2 North America Human Resource Management Software Market: By Country, 2020–2030

-

Table3 Europe Human Resource Management Software Market: By Country, 2020–2030

-

Table4 Asia Pacific Human Resource Management Software Market: By Country, 2020–2030

-

Table5 Human Resources Management Software Market, By Country

-

Table6 Human Resources Management Software Market, By Deployment

-

Table7 Human Resources Management Software Market, By Organization Size

-

Table8 Human Resources Management Software Market, By Solution

-

Table9 Human Resources Management Software Market, By Service

-

Table10 Human Resources Management Software Market, By Vertical

-

Table11 Human Resources Management Software Market, By Country

-

Table12 Human Resources Management Software Market, By Deployment

-

Table13 Human Resources Management Software Market, By Organization Size

-

Table14 Human Resources Management Software Market, By Solution

-

Table15 Human Resources Management Software Market, By Service

-

Table16 Human Resources Management Software Market, By Vertical

-

Table17 Human Resources Management Software Market, By Country

-

Table18 Human Resources Management Software Market, By Deployment

-

Table19 Human Resources Management Software Market, By Organization Size

-

Table20 Human Resources Management Software Market, By Solution

-

Table21 Human Resources Management Software Market, By Service

-

Table22 Human Resources Management Software Market, By Vertical

-

Table23 The Middle East & Human Resources Management Software Market, By Deployment

-

Table24 The Middle East & Human Resources Management Software Market, By Organization Size

-

Table25 The Middle East & Human Resources Management Software Market, By Solution

-

Table26 The Middle East & Human Resources Management Software Market, By Service

-

Table27 The Middle East & Human Resources Management Software Market, By Vertical

-

Table28 Human Resources Management Software Market, By Deployment

-

Table29 Human Resources Management Software Market, By Organization Size

-

Table30 Human Resources Management Software Market, By Solution

-

Table31 Human Resources Management Software Market, By Service

-

Table32 Human Resources Management Software Market, By Vertical

-

LIST OF FIGURES

-

Global Human Resource Management Software market segmentation

-

Forecast Methodology

-

Porter’s Five Forces Analysis of Human Resource Management Software Market

-

Value Chain of Human Resource Management Software Market

-

Human Resources Management Software Market, by country (in %)

-

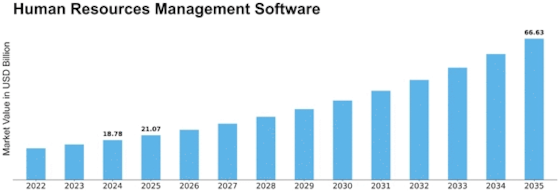

Global Human Resource Management Software Market, 2020–2030,

-

Global Human Resource Management Software Market size by Deployment, 2020

-

Share of Global Human Resource Management Software Market by Deployment, 2020 to 2030

-

Global Human Resource Management Software Market size by Organization Size, 2020

-

Share of Human Resource Management Software Market by Organization Size, 2020 to 2030

-

Global Human Resource Management Software Market size by Solution, 2020

-

Share of Global Human Resource Management Software Market by Solution, 2020 to 2030

-

Global Human Resource Management Software Market size by Service, 2020

-

Share of Global Human Resource Management Software Market by Service, 2020 to 2030

-

Global Human Resource Management Software Market Size by Vertical, 2020

-

Share of Global Human Resource Management Software Market Size by Vertical, 2020

-

"

Leave a Comment