Hot Water Circulator Pump Size

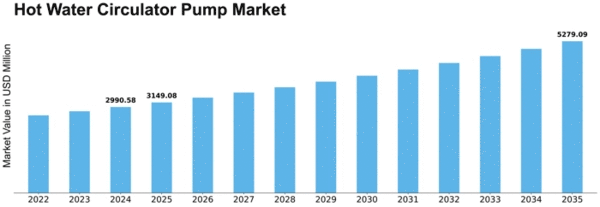

Hot Water Circulator Pump Market Growth Projections and Opportunities

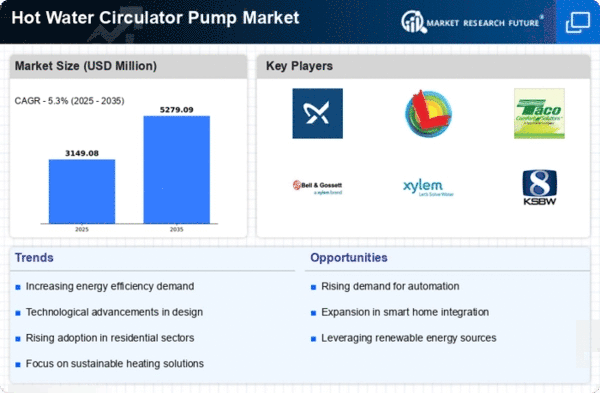

The Hot Water Circulator Pump market is influenced by various market factors that play a crucial role in shaping its dynamics. One of the key drivers of this market is the growing demand for energy-efficient solutions in residential and commercial buildings. As awareness about environmental sustainability increases, consumers and businesses are seeking energy-efficient heating systems, driving the adoption of hot water circulator pumps that help reduce energy consumption and contribute to lower carbon footprints.

Another significant market factor is the increasing emphasis on smart and connected homes. With the rise of smart technologies, consumers are looking for heating systems that can be integrated into smart home ecosystems, allowing them to control and monitor their heating systems remotely. Hot water circulator pumps equipped with smart features, such as Wi-Fi connectivity and mobile apps, are gaining traction in the market as they offer convenience and energy savings to consumers.

Government regulations and initiatives related to energy efficiency also play a pivotal role in shaping the Hot Water Circulator Pump market. Many countries are implementing strict energy efficiency standards and providing incentives for the adoption of energy-efficient heating systems. This regulatory environment encourages manufacturers to develop and promote energy-efficient hot water circulator pumps, fostering market growth.

The construction industry's performance is another significant market factor affecting hot water circulator pumps. The growth of the construction sector, particularly in emerging economies, directly impacts the demand for heating systems. As new buildings and infrastructure projects are undertaken, the need for efficient and reliable hot water circulation becomes essential, driving the demand for circulator pumps in the market.

Technological advancements in pump design and materials also contribute to the market's evolution. Manufacturers are continually innovating to enhance pump efficiency, durability, and performance. The use of advanced materials and design improvements helps in reducing energy losses and improving overall pump reliability, attracting consumers looking for long-lasting and efficient heating solutions.

Market competition is fierce, with several key players vying for market share. This competition drives innovation and product development as companies strive to differentiate themselves by offering unique features, improved energy efficiency, and competitive pricing. End-users benefit from this competitive landscape as it leads to a diverse range of options and solutions in the market.

Global economic conditions also influence the Hot Water Circulator Pump market. Economic stability and growth contribute to increased construction activities and consumer spending, positively impacting the demand for heating systems. On the other hand, economic downturns can result in reduced construction projects and consumer discretionary spending, affecting the market negatively.

Environmental concerns and the push towards renewable energy sources have led to the development of eco-friendly hot water circulator pumps. Manufacturers are increasingly focusing on incorporating sustainable materials and designing pumps that align with environmental standards. This trend responds to the growing consumer preference for eco-conscious products and supports the overall sustainability goals of the industry.

In conclusion, the Hot Water Circulator Pump market is shaped by a combination of factors, including the demand for energy-efficient solutions, the rise of smart homes, regulatory initiatives, construction industry performance, technological advancements, market competition, economic conditions, and environmental considerations. As these factors continue to evolve, the market is expected to witness further innovations and growth in response to the dynamic needs of consumers and the industry.

Leave a Comment