Growing Awareness of Patient Safety

The Hospital Acquired Infection Control Market is experiencing growth driven by an increasing awareness of patient safety among healthcare providers and patients alike. As the implications of hospital-acquired infections become more widely recognized, there is a concerted effort to prioritize infection prevention strategies. Educational initiatives and campaigns aimed at both healthcare professionals and the public are fostering a culture of safety, which in turn is leading to higher investments in infection control technologies and practices. Recent surveys indicate that a significant percentage of patients now consider infection rates when choosing healthcare facilities, further emphasizing the importance of robust infection control measures. This heightened awareness is likely to propel the demand for innovative solutions within the market.

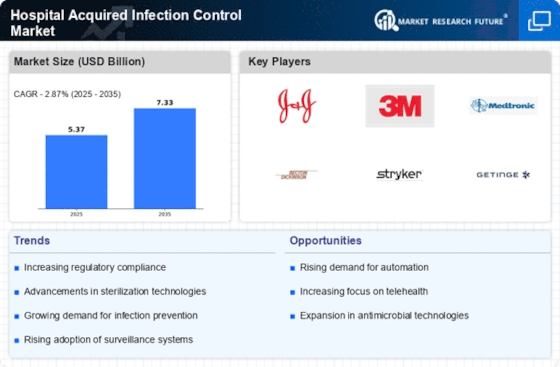

Regulatory Compliance and Standards

The Hospital Acquired Infection Control Market is significantly influenced by stringent regulatory compliance and standards set forth by health authorities. Regulatory bodies are increasingly mandating hospitals to implement comprehensive infection control programs, which include regular monitoring and reporting of infection rates. This regulatory focus not only compels healthcare facilities to invest in advanced infection control solutions but also fosters a culture of accountability and transparency. Data indicates that hospitals adhering to these regulations experience lower rates of hospital-acquired infections, thereby enhancing patient outcomes. As compliance becomes a critical factor in hospital operations, the demand for effective infection control measures is expected to rise, driving growth in the market.

Shift Towards Value-Based Healthcare

The Hospital Acquired Infection Control Market is influenced by the ongoing shift towards value-based healthcare, which emphasizes quality of care and patient outcomes. This paradigm shift encourages healthcare providers to focus on reducing hospital-acquired infections as a means to improve overall patient satisfaction and reduce costs associated with prolonged hospital stays. As reimbursement models increasingly tie financial incentives to infection control performance, hospitals are compelled to adopt effective infection prevention strategies. Data suggests that facilities with robust infection control programs not only enhance patient safety but also achieve better financial outcomes. Consequently, the demand for innovative infection control solutions is likely to grow as healthcare systems adapt to this evolving landscape.

Technological Innovations in Infection Control

The Hospital Acquired Infection Control Market is witnessing a surge in technological innovations aimed at enhancing infection prevention measures. Advanced sterilization technologies, such as ultraviolet (UV) light disinfection and automated cleaning systems, are becoming increasingly prevalent. These innovations not only improve the efficacy of infection control protocols but also reduce the labor intensity associated with traditional cleaning methods. According to recent data, the adoption of these technologies has led to a reported decrease in infection rates by up to 30% in various healthcare settings. As hospitals strive to maintain high standards of patient safety, the integration of cutting-edge technology is likely to play a pivotal role in shaping the future of infection control practices.

Rising Incidence of Hospital-Acquired Infections

The Hospital Acquired Infection Control Market is being propelled by the rising incidence of hospital-acquired infections (HAIs), which pose a serious threat to patient safety and healthcare quality. Data from health organizations indicates that millions of patients are affected by HAIs annually, leading to increased morbidity, extended hospital stays, and higher healthcare costs. This alarming trend has prompted healthcare facilities to prioritize infection control measures, resulting in a surge in demand for effective solutions. Hospitals are now investing in comprehensive infection prevention programs, including surveillance systems and staff training, to mitigate the risks associated with HAIs. As the prevalence of these infections continues to rise, the market for infection control solutions is expected to expand significantly.

Leave a Comment