Shift Towards Preventive Healthcare

The shift towards preventive healthcare is emerging as a key driver in the Hormonal Contraceptive Market. As healthcare systems worldwide emphasize preventive measures, the role of hormonal contraceptives in preventing unintended pregnancies is gaining recognition. This paradigm shift is supported by a growing body of evidence linking access to contraceptives with improved health outcomes. Market analysts indicate that the preventive healthcare trend could lead to an increase in the adoption of hormonal contraceptives, as individuals seek to take proactive steps in managing their reproductive health. Consequently, the Hormonal Contraceptive Market may see a notable uptick in demand as more people prioritize preventive strategies.

Rising Awareness of Women's Health Issues

The growing awareness of women's health issues is a significant driver in the Hormonal Contraceptive Market. As discussions surrounding reproductive health become more prevalent, women are increasingly informed about their contraceptive options. Educational campaigns and advocacy efforts are playing a vital role in disseminating information about hormonal contraceptives and their benefits. Market Research Future suggests that this heightened awareness is correlated with an increase in contraceptive usage, particularly among younger demographics. As women become more empowered to make informed choices about their reproductive health, the Hormonal Contraceptive Market is likely to experience sustained growth.

Growing Demand for Family Planning Services

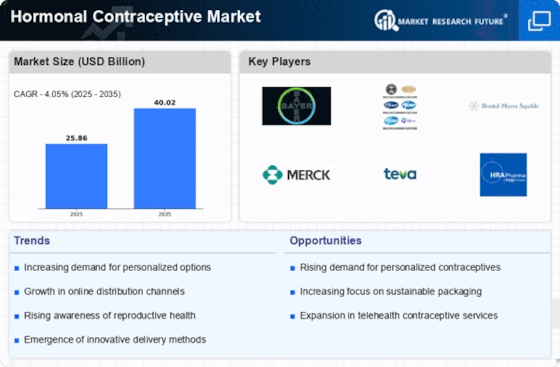

The rising demand for family planning services is a pivotal driver in the Hormonal Contraceptive Market. As individuals and couples increasingly seek to manage their reproductive health, the need for effective contraceptive options has surged. According to recent estimates, the family planning market is projected to grow at a compound annual growth rate of approximately 6.5% over the next few years. This growth is fueled by a combination of factors, including changing societal norms, increased access to healthcare, and a greater emphasis on women's rights. The Hormonal Contraceptive Market is likely to benefit from this trend, as more people recognize the importance of planning their families and the role that hormonal contraceptives play in achieving this goal.

Increased Government Initiatives and Funding

Government initiatives and funding aimed at improving reproductive health services are crucial drivers in the Hormonal Contraceptive Market. Many governments are recognizing the importance of accessible contraceptive options as part of broader public health strategies. Increased funding for family planning programs and educational campaigns is likely to enhance awareness and accessibility of hormonal contraceptives. For example, several countries have allocated significant budgets to support reproductive health initiatives, which may lead to a rise in contraceptive usage rates. This proactive approach by governments is expected to bolster the Hormonal Contraceptive Market, as more individuals gain access to essential reproductive health services.

Advancements in Hormonal Contraceptive Technologies

Technological advancements in hormonal contraceptives are significantly influencing the Hormonal Contraceptive Market. Innovations such as long-acting reversible contraceptives (LARCs) and novel delivery systems are enhancing the efficacy and convenience of hormonal contraceptives. For instance, the introduction of subdermal implants and intrauterine systems has expanded options for users, leading to increased adoption rates. Market data indicates that the LARC segment is expected to witness substantial growth, with a projected increase in market share by over 20% in the coming years. These advancements not only improve user experience but also contribute to higher satisfaction rates, thereby driving demand within the Hormonal Contraceptive Market.