Homeland Security Emergency Management Market Summary

As per Market Research Future analysis, the Homeland Security and Emergency Management Market was estimated at 759.19 USD Billion in 2024. The Homeland Security and Emergency Management industry is projected to grow from 800.88 USD Billion in 2025 to 1366.99 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 5.49% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Homeland Security and Emergency Management Market is experiencing a dynamic evolution driven by technological advancements and increasing global threats.

- The integration of advanced technologies is reshaping operational capabilities across the sector.

- Cybersecurity remains a focal point as organizations seek to protect critical infrastructure from emerging threats.

- Enhanced training and preparedness programs are being prioritized to ensure effective response strategies.

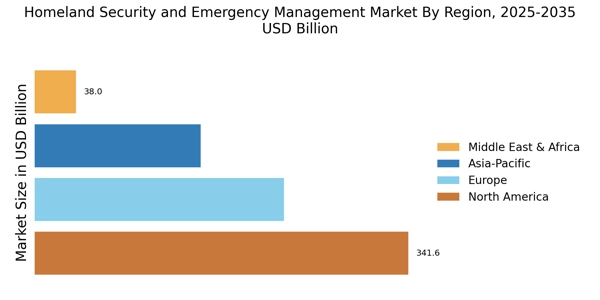

- Increased government spending and rising threats are driving growth, particularly in North America and the Asia-Pacific region, with Fixed Command Centers leading the market and Deployable Command Centers emerging rapidly.

Market Size & Forecast

| 2024 Market Size | 759.19 (USD Billion) |

| 2035 Market Size | 1366.99 (USD Billion) |

| CAGR (2025 - 2035) | 5.49% |

Major Players

Lockheed Martin (US), Northrop Grumman (US), Raytheon Technologies (US), General Dynamics (US), BAE Systems (GB), Thales Group (FR), L3Harris Technologies (US), Honeywell International (US), SAIC (US), Motorola Solutions (US)