Economic Recovery

The ongoing economic recovery is a significant driver of the Home Mortgage Finance Market. As employment rates improve and consumer confidence rises, more individuals are likely to consider homeownership. Recent statistics indicate that home sales have increased by approximately 10% year-over-year, reflecting a growing demand for mortgages. This recovery is also accompanied by rising wages, which may enhance affordability for potential buyers. However, the interplay between economic growth and housing supply remains critical, as limited inventory could constrain market expansion. Overall, the economic recovery appears to be a vital factor propelling the Home Mortgage Finance Market forward.

Demographic Shifts

Demographic shifts are playing a pivotal role in the evolution of the Home Mortgage Finance Market. The millennial generation, now entering their prime homebuying years, is expected to significantly influence market trends. This demographic is characterized by a preference for urban living and sustainable housing options. As they seek to purchase homes, lenders are adapting their offerings to meet these preferences, including eco-friendly financing options. Furthermore, the increasing diversity within the population is prompting lenders to develop tailored products that cater to various cultural and financial backgrounds. These shifts may lead to a more inclusive Home Mortgage Finance Market, fostering innovation and new product development.

Regulatory Changes

Regulatory changes are a constant factor affecting the Home Mortgage Finance Market. Recent reforms aimed at enhancing consumer protection and promoting fair lending practices have reshaped the landscape for mortgage providers. For example, the implementation of stricter underwriting standards has led to a more cautious lending environment. While these regulations are designed to prevent predatory lending, they may also limit access to credit for some borrowers. Consequently, lenders must navigate these complexities while remaining competitive. The ongoing evolution of regulations will likely continue to influence the strategies employed by institutions within the Home Mortgage Finance Market.

Rising Interest Rates

The Home Mortgage Finance Market is currently experiencing a notable impact from rising interest rates. As central banks adjust monetary policies to combat inflation, mortgage rates have seen a significant increase. For instance, the average 30-year fixed mortgage rate has risen to approximately 7.5%, which is a considerable jump from previous years. This rise in rates may deter some potential homebuyers, leading to a slowdown in mortgage applications. However, it could also encourage existing homeowners to refinance their loans, thereby stimulating activity within the Home Mortgage Finance Market. The interplay between interest rates and consumer behavior remains a critical factor influencing market dynamics.

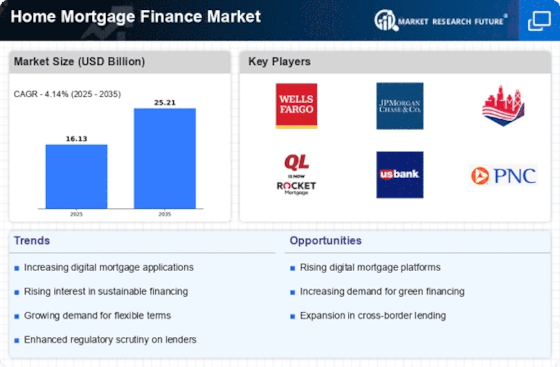

Technological Advancements

Technological advancements are reshaping the Home Mortgage Finance Market in profound ways. The integration of artificial intelligence and machine learning into mortgage processing has streamlined operations, reducing the time required for loan approvals. According to recent data, lenders utilizing advanced technology have reported a 30% decrease in processing times. Additionally, digital platforms are enhancing customer experiences, allowing for more personalized services. As consumers increasingly demand efficiency and transparency, the adoption of technology in the Home Mortgage Finance Market is likely to continue growing, driving competition among lenders and improving overall market efficiency.