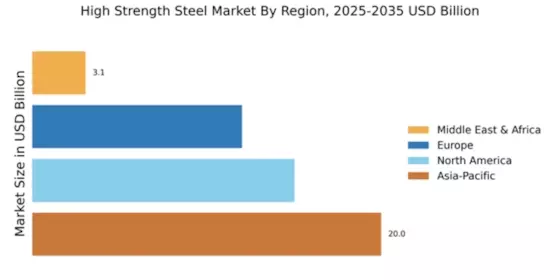

Market Growth Projections

The Global High Strength Steel Market Industry is projected to witness robust growth in the coming years. With a market value of 50.1 USD Billion in 2024, it is anticipated to reach 112.9 USD Billion by 2035. This growth trajectory indicates a compound annual growth rate (CAGR) of 7.67% from 2025 to 2035. The increasing adoption of high strength steel across various sectors, including automotive, construction, and energy, is driving this expansion. As industries seek to enhance performance while adhering to sustainability goals, the demand for high strength steel is likely to continue rising, positioning it as a critical material in future developments.

Growing Environmental Regulations

The Global High Strength Steel Market Industry is increasingly influenced by growing environmental regulations aimed at reducing carbon footprints. Governments worldwide are implementing stringent policies to promote the use of sustainable materials in construction and manufacturing. High strength steel, known for its recyclability and lower environmental impact compared to traditional steel, is becoming a preferred material choice. This shift is particularly relevant as industries seek to comply with regulations while maintaining performance standards. As sustainability becomes a core focus, the demand for high strength steel is likely to rise, positioning it as a key player in the transition towards greener practices across various sectors.

Rising Demand in Automotive Sector

The Global High Strength Steel Market Industry is experiencing a notable surge in demand driven primarily by the automotive sector. As manufacturers increasingly prioritize lightweight materials to enhance fuel efficiency and reduce emissions, high strength steel has emerged as a preferred choice. In 2024, the market is projected to reach 50.1 USD Billion, reflecting the automotive industry's shift towards sustainable practices. Automakers are adopting high strength steel to meet stringent regulatory standards while maintaining vehicle safety and performance. This trend is expected to continue, with the market anticipated to grow significantly as electric vehicles gain traction, further propelling the demand for advanced steel solutions.

Infrastructure Development Initiatives

Infrastructure development initiatives across various regions are significantly influencing the Global High Strength Steel Market Industry. Governments are investing heavily in infrastructure projects, including bridges, highways, and railways, to stimulate economic growth. High strength steel is favored for its durability and ability to withstand extreme conditions, making it ideal for critical infrastructure applications. The ongoing global push for modernization and urbanization is likely to sustain this demand. As countries prioritize infrastructure resilience, the market is expected to witness substantial growth, contributing to an anticipated market value of 112.9 USD Billion by 2035, with a CAGR of 7.67% from 2025 to 2035.

Emerging Applications in Renewable Energy

Emerging applications in the renewable energy sector are contributing to the growth of the Global High Strength Steel Market Industry. As the world shifts towards sustainable energy sources, high strength steel is increasingly utilized in the construction of wind turbines, solar panels, and other renewable energy infrastructures. Its strength and durability make it suitable for demanding environments, ensuring longevity and reliability. The expansion of renewable energy projects globally is expected to drive demand for high strength steel, aligning with the broader trend of sustainable development. This sector's growth potential may further enhance the market's trajectory, reflecting a growing recognition of high strength steel's role in supporting renewable energy initiatives.

Technological Advancements in Steel Production

Technological advancements in steel production processes are reshaping the Global High Strength Steel Market Industry. Innovations such as advanced manufacturing techniques and automation are enhancing the efficiency and quality of high strength steel production. These developments enable manufacturers to produce steel with superior mechanical properties, catering to diverse applications across industries. As production costs decrease and quality improves, the adoption of high strength steel is likely to rise. This trend is particularly evident in sectors like construction and aerospace, where high performance is paramount. The ongoing evolution in production technology is expected to bolster market growth and expand the range of applications for high strength steel.