Expansion of 5G Networks

The rollout of 5G networks is a pivotal driver for the High-Speed Optical Transceiver Market. As telecommunications companies invest heavily in 5G infrastructure, the demand for high-speed optical transceivers is likely to increase significantly. 5G technology promises to deliver faster data rates, lower latency, and improved connectivity, which in turn requires advanced optical solutions to support the backhaul and fronthaul segments of the network. Analysts project that the 5G infrastructure market will reach USD 1 trillion by 2025, creating substantial opportunities for optical transceiver manufacturers. This expansion not only enhances mobile broadband services but also facilitates the growth of IoT applications, further driving the need for high-speed optical connectivity.

Increasing Internet Traffic

The High-Speed Optical Transceiver Market is experiencing a surge in demand due to the exponential growth of internet traffic. As more users connect to the internet and consume data-heavy applications, the need for high-speed data transmission becomes critical. Reports indicate that global internet traffic is expected to reach 4.8 zettabytes per year by 2025, necessitating advanced optical transceivers to handle this load efficiently. This trend is further fueled by the proliferation of cloud computing and streaming services, which require robust infrastructure to support high-speed data transfer. Consequently, manufacturers are focusing on developing transceivers that can operate at higher speeds and greater distances, thereby enhancing the overall performance of network systems.

Growing Adoption of Cloud Services

The High-Speed Optical Transceiver Market is being propelled by the increasing adoption of cloud services across various sectors. Organizations are migrating their operations to cloud platforms to enhance flexibility, scalability, and cost-effectiveness. This shift necessitates robust data transmission capabilities, which high-speed optical transceivers provide. The cloud services market is projected to grow to USD 832 billion by 2025, indicating a strong demand for high-performance optical solutions. As businesses rely more on cloud-based applications, the need for efficient data centers equipped with high-speed optical transceivers becomes paramount. This trend underscores the importance of optical technology in supporting the backbone of modern digital infrastructure.

Technological Advancements in Optical Components

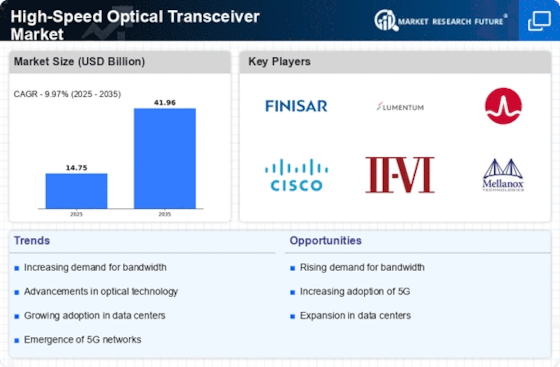

Technological advancements in optical components are a crucial driver for the High-Speed Optical Transceiver Market. Innovations in materials, design, and manufacturing processes are enabling the development of transceivers that offer higher speeds, improved performance, and greater energy efficiency. For instance, the introduction of silicon photonics technology is revolutionizing the way optical transceivers are designed, allowing for more compact and efficient solutions. As the market for high-speed optical transceivers is projected to grow at a CAGR of 15% through 2025, these advancements are likely to play a pivotal role in meeting the increasing demands for bandwidth and speed in telecommunications and data centers. This continuous evolution in technology is essential for maintaining competitive advantage in the rapidly changing landscape of optical communications.

Emergence of Artificial Intelligence and Big Data

The integration of artificial intelligence (AI) and big data analytics is significantly influencing the High-Speed Optical Transceiver Market. As organizations increasingly leverage AI for data processing and decision-making, the volume of data generated is escalating rapidly. This surge in data necessitates high-speed optical transceivers capable of handling large data streams efficiently. The big data market is expected to reach USD 274 billion by 2025, driving the demand for advanced optical solutions that can support high-speed data transfer and processing. Consequently, manufacturers are innovating to develop transceivers that not only meet speed requirements but also enhance data integrity and reliability, thereby addressing the evolving needs of AI-driven applications.