High Altitude Long Endurance Market Summary

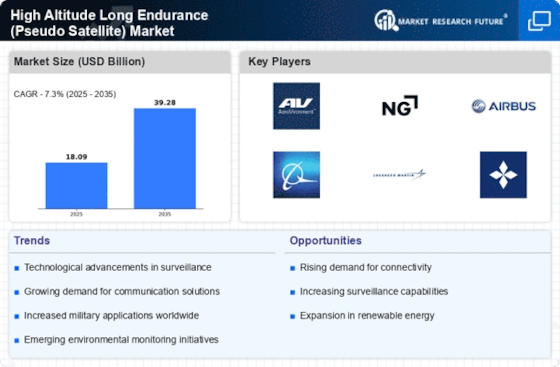

As per Market Research Future analysis, the High Altitude Long Endurance Market (Pseudo Satellite) Market Size was estimated at 18.09 USD Billion in 2024. The High Altitude Long Endurance Market (Pseudo Satellite) industry is projected to grow from 19.41 USD Billion in 2025 to 39.28 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 7.3% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The High Altitude Long Endurance Market (Pseudo Satellite) Market is experiencing robust growth driven by technological advancements and increasing applications across various sectors.

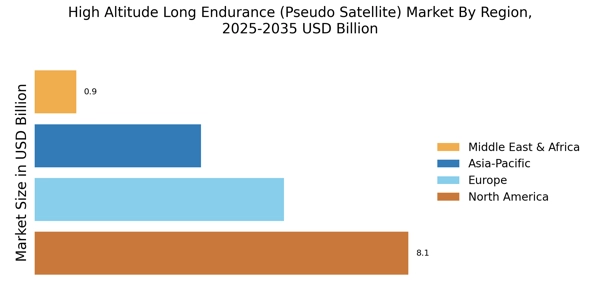

- Technological advancements in UAVs are propelling the High Altitude Long Endurance Market forward, particularly in North America, which remains the largest market.

- The Asia-Pacific region is emerging as the fastest-growing area, driven by rising commercial interest and military applications.

- The solar cell type segment dominates the market, while lithium-ion batteries are gaining traction as the fastest-growing segment.

- Key market drivers include regulatory support and policy frameworks, alongside the increasing demand for environmental monitoring and disaster management.

Market Size & Forecast

| 2024 Market Size | 18.09 (USD Billion) |

| 2035 Market Size | 39.28 (USD Billion) |

| CAGR (2025 - 2035) | 7.3% |

Major Players

AeroVironment (US), Northrop Grumman (US), Airbus (FR), Boeing (US), Lockheed Martin (US), General Atomics (US), Thales Group (FR), Leonardo (IT), L3Harris Technologies (US)