Rising Awareness of Patient-Centric Care

The Hemodynamic Monitoring Equipment Market is witnessing a shift towards patient-centric care, which emphasizes the importance of personalized treatment plans. This trend is driven by an increasing awareness among healthcare providers and patients regarding the benefits of continuous monitoring. As patients demand more involvement in their healthcare decisions, the need for accurate and real-time data becomes paramount. Hemodynamic monitoring equipment plays a crucial role in delivering this data, enabling healthcare professionals to tailor treatments to individual patient needs. The market is likely to expand as healthcare systems adopt technologies that facilitate patient engagement and improve overall care quality. Furthermore, the emphasis on patient satisfaction and outcomes is expected to drive investments in advanced hemodynamic monitoring solutions, thereby enhancing the market landscape.

Increasing Prevalence of Cardiovascular Diseases

The rising prevalence of cardiovascular diseases is a significant driver for the Hemodynamic Monitoring Equipment Market. As the global population ages, the incidence of heart-related conditions continues to escalate, necessitating effective monitoring solutions. According to recent statistics, cardiovascular diseases account for nearly 31% of all global deaths, underscoring the urgent need for advanced hemodynamic monitoring. Healthcare providers are increasingly adopting sophisticated monitoring equipment to manage these conditions effectively. This trend is expected to propel the market, with a projected increase in demand for hemodynamic monitoring devices in hospitals and outpatient settings. The focus on early detection and management of cardiovascular diseases is likely to further stimulate market growth, as healthcare systems prioritize patient outcomes and resource optimization.

Regulatory Support for Hemodynamic Monitoring Equipment

The Hemodynamic Monitoring Equipment Market benefits from robust regulatory support that fosters innovation and ensures patient safety. Regulatory bodies are increasingly recognizing the importance of advanced monitoring technologies in critical care settings. This support is evident in the streamlined approval processes for new devices, which encourages manufacturers to invest in research and development. In recent years, the approval of several innovative hemodynamic monitoring devices has been expedited, reflecting a commitment to enhancing patient care. Additionally, regulatory guidelines are evolving to accommodate the integration of digital health solutions, which further propels the market forward. As a result, the hemodynamic monitoring equipment market is expected to witness sustained growth, with an estimated market value reaching USD 1.5 billion by 2030.

Growth in Surgical Procedures Requiring Hemodynamic Monitoring

The Hemodynamic Monitoring Equipment Market is experiencing growth due to the increasing number of surgical procedures that necessitate precise hemodynamic monitoring. As surgical techniques advance and become more complex, the need for accurate monitoring of cardiovascular parameters during and after surgery becomes critical. The rise in elective surgeries, particularly in areas such as cardiology and orthopedics, is contributing to the demand for sophisticated monitoring equipment. It is estimated that the number of surgical procedures requiring hemodynamic monitoring will increase by approximately 5% annually over the next five years. This trend is likely to drive investments in hemodynamic monitoring technologies, as healthcare facilities seek to enhance patient safety and improve surgical outcomes. Consequently, the market for hemodynamic monitoring equipment is poised for substantial growth.

Technological Advancements in Hemodynamic Monitoring Equipment

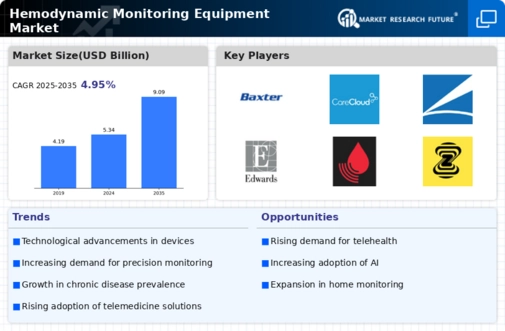

The Hemodynamic Monitoring Equipment Market is experiencing a surge in technological advancements that enhance the accuracy and efficiency of patient monitoring. Innovations such as non-invasive monitoring devices and advanced software algorithms are being integrated into existing systems. These advancements not only improve patient outcomes but also streamline clinical workflows. The market for hemodynamic monitoring equipment is projected to grow at a compound annual growth rate of approximately 6.5% from 2025 to 2030, driven by the increasing adoption of these advanced technologies. Furthermore, the integration of artificial intelligence and machine learning into monitoring systems is expected to provide real-time data analysis, thereby facilitating timely clinical decisions. As healthcare providers seek to improve patient care, the demand for technologically advanced hemodynamic monitoring equipment is likely to rise.