Top Industry Leaders in the Heat Transfer Fluid Market

*Disclaimer: List of key companies in no particular order

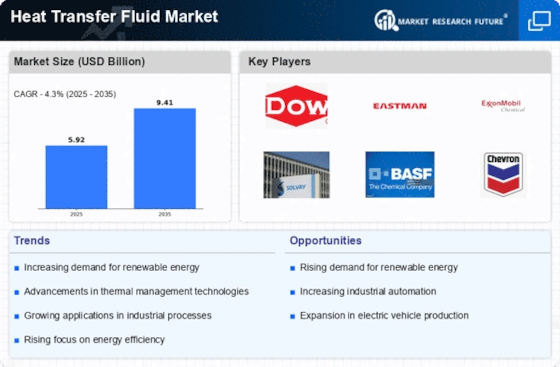

The global heat transfer fluid (HTF) market is witnessing a dynamic transformation fueled by the escalating demand for efficient and sustainable energy transfer solutions. As the competition intensifies, key players are strategically maneuvering to secure market share and meet the evolving requirements across diverse end-use industries.

Market Share Analysis: Unveiling the Dominators

An in-depth analysis of market share in the HTF landscape goes beyond mere volume considerations. Factors such as revenue, product diversification, regional dominance, and customer loyalty provide a more nuanced understanding.

Traditional Titans: Mineral oils continue to dominate, holding the largest share due to their cost-effectiveness and versatility. Companies such as ExxonMobil, Royal Dutch Shell, and BP wield significant market influence.

Glycol Champions: Glycol-based fluids, known for their antifreeze properties, are experiencing rapid growth, driven by the surge in concentrated solar power. Key players in this segment include Dow Chemical, BASF, and Eastman Chemical.

Niche Newcomers: Bio-based and synthetic HTFs are carving out a niche for themselves. Companies like Paratherm and Therminol are at the forefront, capitalizing on the increasing demand for sustainable and environmentally friendly solutions.

Regional Rivalry: The market exhibits geographic diversity, with Asia Pacific leading the way due to industrialization and renewable energy initiatives. North America and Europe follow closely, propelled by mature infrastructure and stringent environmental regulations.

New and Emerging Trends: Paving the Path for Growth

Innovation stands as the lifeblood of the HTF market, with companies continually evolving their offerings to cater to niche demands and capitalize on emerging trends:

Thermal Efficiency Optimization: Companies are developing HTFs with enhanced heat transfer capabilities and lower viscosity to improve system efficiency and reduce energy consumption. Notable players, such as Dow Chemical and Eastman Chemical, are actively investing in research and development in this area.

Sustainability Drive: The demand for bio-based and biodegradable HTFs is surging due to environmental consciousness. Companies like Paratherm are leading the way with innovative plant-based fluids that offer lifecycle assessments and reduced environmental impact.

Digitalization Revolution: Industry 4.0 is making its mark on the HTF market with smart fluid monitoring systems and predictive maintenance solutions. Companies like Emerson and Siemens are offering integrated control and data analytics platforms to optimize system performance and extend fluid life.

Customized Solutions: The era of one-size-fits-all is fading, as end-users seek tailored HTFs for specific applications. Leading players are focusing on offering customized formulations and technical support to address unique operating conditions and industry requirements.

Competitive Scenario: A Tapestry of Collaboration and Rivalry

The competitive landscape of the HTF market is intricate, woven with collaboration and competition:

Strategic Partnerships: Mergers and acquisitions are fostering consolidation, as established players acquire smaller companies to access new technologies, regional markets, and customer bases.

Technological Alliances: Collaborative R&D initiatives are accelerating innovation, with leading players partnering with universities, research institutions, and startups to develop next-generation HTFs and unlock new application possibilities.

Price Wars and Differentiation: Cost remains crucial, especially in mature markets. However, companies are differentiating themselves through superior performance, technical expertise, and value-added services like lifecycle management and sustainability assessments.

Regulatory Landscape: Stringent environmental regulations, particularly in Europe, and global carbon neutrality goals are shaping the competitive landscape. Companies are compelled to develop eco-friendly HTFs and adopt sustainable practices.

Outlook: A Dynamic Future Awaits

The HTF market is poised for dynamic growth in the coming years. With increasing industrialization, a focus on renewable energy, and relentless technological advancements, competition is set to intensify. Companies that remain agile, embrace innovation, and cater to niche demands will be best positioned to navigate this fluid landscape and emerge as leaders in the heat transfer revolution.

Recent Developments and Updates for Specific Companies:

Huntsman Corporation (U.S.)

-

October 26, 2023: Announced a partnership with Solvay to develop and commercialize sustainable heat transfer fluids for the electronics industry. -

September 5, 2023: Launched TERMALOX® HP45, a high-performance heat transfer fluid for concentrated solar power (CSP) plants.

Global Heat Transfer Ltd. (Canada)

-

November 17, 2023: Presented at the SolarPAC Conference on advancements in thermal fluids for CSP applications. -

October 3, 2023: Announced participation in a research project funded by the Canadian government to develop next-generation heat transfer fluids.

Royal Dutch Shell plc (Netherlands)

-

December 5, 2023: Announced investment in a bio-based heat transfer fluid project in collaboration with Neste. -

July 11, 2023: Joined the Consortium for Advanced Research in Thermodynamics of Organic Fluids (CARBON TOF) to develop new heat transfer fluids with improved sustainability.