Market Trends

Key Emerging Trends in the Healthcare Information Systems Market

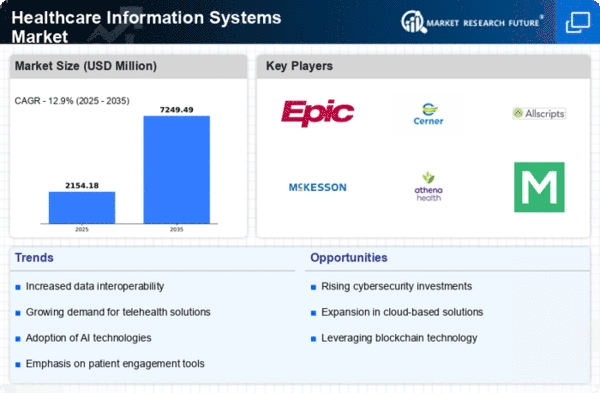

Telehealth is developing as a prevailing pattern in the healthcare information systems market. The expanded interest for distant healthcare administrations, particularly advanced by the Coronavirus pandemic, is driving the incorporation of telehealth stages into healthcare information systems to work with virtual counsels and far off persistent checking. Interoperability stays a vital concentration in the healthcare information systems market. Endeavours to work on the consistent trade of patient information among various healthcare systems and suppliers are building up momentum, improving consideration coordination and patient results. Artificial intelligence is increasingly being incorporated into healthcare information systems. Applications of computer-based intelligence, such as AI calculations for perceptual analysis, normal language processing, and diagnostics, are improving dynamic cycles and focusing on silent consideration. The adoption of healthcare information systems built on the cloud is related to the rise. Cloud computing technology provides cost-effectiveness, flexibility, and adaptability, enabling healthcare organizations to securely store, use, and access vast amounts of patient data. Network security is becoming more and more important in the industry as healthcare data becomes more digitally connected. Healthcare information system providers should fundamentally consider protecting sensitive patient data from online threats and ensuring compliance with information assurance standards. Executives' well-being is becoming increasingly superior as healthcare systems move toward a more preventative and all-encompassing approach. Systems for tracking population health are being integrated into healthcare information systems to analyze data, identify trends, and implement strategies that will improve overall community health. To improve patient engagement and provide favorable access to wellbeing information, portable applications for well-being are being integrated into healthcare information systems. Flexible apps for scheduling, medication updating, and monitoring well-being are turning become essential components of healthcare delivery. Healthcare information systems are increasingly using information examination devices to extract meaningful insights from large datasets. Futuristic analysis and data-driven navigation are enabling healthcare providers to focus on clinical outcomes, optimize asset allocation, and enhance operational competence. Blockchain technology is gaining traction as a means of enhancing data security and integrity in healthcare IT systems. By keeping simple and secure health records, its decentralized and change-safe structure helps to reduce the risk of information breaches. The number of requests for remote patient observation plans is flooding the market. Healthcare information systems are starting to depend heavily on related devices and wearables that enable regular monitoring of patients' vital signs and limits.

Leave a Comment