Adoption of Telehealth Services

The Healthcare Data Storage Market is witnessing a notable shift towards telehealth services, which has been accelerated by the increasing acceptance of remote healthcare delivery. As telehealth becomes more prevalent, the volume of data generated from virtual consultations, remote monitoring, and digital health applications is expected to rise significantly.

This shift necessitates the implementation of efficient data storage solutions capable of handling real-time data transmission and storage. The telehealth market is projected to grow substantially, with estimates suggesting a potential market size of over 250 billion dollars by 2027. Consequently, healthcare organizations must invest in scalable storage solutions that can support the influx of telehealth data while ensuring seamless access for healthcare providers and patients alike.

Emergence of Big Data Analytics

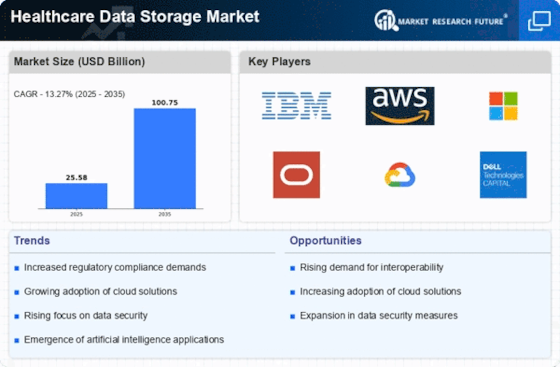

The Healthcare Data Storage Market is increasingly influenced by the emergence of big data analytics, which enables healthcare organizations to derive actionable insights from vast datasets. The integration of analytics into healthcare operations allows for improved decision-making, personalized medicine, and enhanced operational efficiency. As organizations recognize the value of data-driven strategies, the demand for advanced storage solutions that can support big data initiatives is likely to grow. The Healthcare Data Storage Market is anticipated to reach approximately 68 billion dollars by 2025, highlighting the need for robust data storage infrastructures. This trend suggests that healthcare providers must prioritize investments in storage technologies that facilitate the effective management and analysis of large volumes of data.

Growing Demand for Interoperability

The Healthcare Data Storage Market is increasingly driven by the demand for interoperability among various healthcare systems and applications. As healthcare organizations strive to improve care coordination and patient outcomes, the ability to share and access data across different platforms becomes paramount. Interoperability facilitates seamless communication between electronic health records, laboratory systems, and imaging technologies, thereby enhancing the overall efficiency of healthcare delivery. The push for interoperability is likely to drive investments in data storage solutions that support standardized data formats and secure data exchange. This trend may lead to the development of innovative storage technologies that not only accommodate diverse data types but also ensure that healthcare data is readily accessible to authorized users, ultimately improving patient care.

Increasing Volume of Healthcare Data

The Healthcare Data Storage Market is experiencing a surge in the volume of data generated from various sources, including electronic health records, medical imaging, and wearable devices. This increase necessitates robust storage solutions to manage and analyze vast amounts of information. According to estimates, healthcare data is projected to grow at a compound annual growth rate of approximately 36%, indicating a pressing need for scalable storage options. As healthcare providers seek to enhance patient care through data-driven insights, the demand for efficient data storage solutions is likely to escalate. This trend underscores the importance of investing in advanced storage technologies that can accommodate the growing data landscape while ensuring accessibility and reliability.

Regulatory Compliance and Data Governance

The Healthcare Data Storage Market is significantly influenced by stringent regulatory requirements surrounding data privacy and security. Regulations such as HIPAA and GDPR impose strict guidelines on how healthcare organizations manage and store sensitive patient information. Compliance with these regulations is not merely a legal obligation; it is essential for maintaining patient trust and safeguarding against data breaches. As organizations strive to adhere to these regulations, the demand for secure and compliant data storage solutions is expected to rise. This trend may drive investments in technologies that enhance data governance, ensuring that healthcare data is stored, accessed, and shared in accordance with legal standards, thereby fostering a culture of accountability and transparency.