HDR Video Camera Market Summary

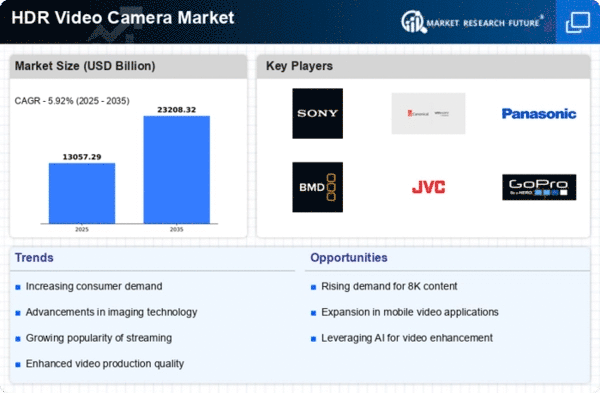

As per MRFR analysis, the HDR Video Camera Market Size was estimated at 12327.5 USD Billion in 2024. The HDR Video Camera industry is projected to grow from 13057.32 USD Billion in 2025 to 23208.32 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 5.92 during the forecast period 2025 - 2035.

Key Market Trends & Highlights

The HDR Video Camera Market is experiencing robust growth driven by technological advancements and increasing consumer demand for high-quality content.

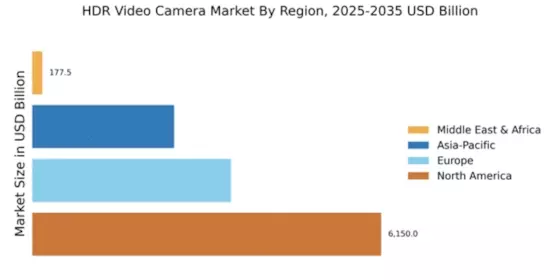

- North America remains the largest market for HDR video cameras, driven by a strong demand in professional broadcasting.

- The Asia-Pacific region is the fastest-growing market, fueled by a surge in live streaming and content creation activities.

- The broadcasting segment continues to dominate, while the amateur segment is rapidly gaining traction due to rising interest in personal video production.

- Technological advancements in imaging and the integration of AI features are key drivers propelling market growth.

Market Size & Forecast

| 2024 Market Size | 12327.5 (USD Billion) |

| 2035 Market Size | 23208.32 (USD Billion) |

| CAGR (2025 - 2035) | 5.92% |

Major Players

Sony (JP), Canon (JP), Panasonic (JP), Blackmagic Design (AU), JVC (JP), GoPro (US), RED Digital Cinema (US), Nikon (JP), Fujifilm (JP)