Top Industry Leaders in the Hardware Encryption Market

Competitive Landscape of Hardware Encryption Market

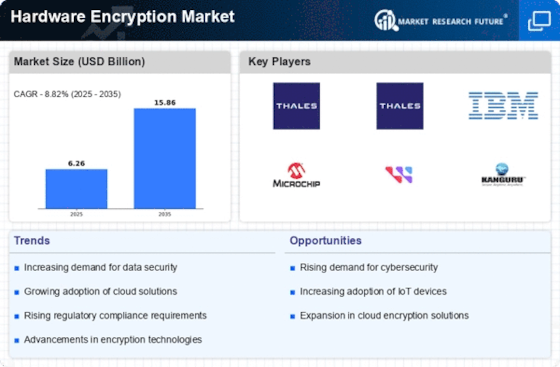

The global hardware encryption market stands as a critical line of defense in the digital age. These solutions safeguard sensitive data stored on physical devices, ranging from personal computers to enterprise servers, against unauthorized access and cyberattacks. Understanding the competitive landscape in this dynamic market is crucial for both established players and new entrants aiming to secure their footing.

Some of the Hardware Encryption companies listed below:

- Thales e-security

- Samsung Electronics

- Win Magic Inc

- Toshiba Corporation

- NetApp

- Western Digital Corporation

- Maxim Integrated Products, Inc

- Kingston Technology

- Kanguru Solutions

Strategies Adopted by Key Players:

- Innovation and R&D: Continuous investment in research and development fuels advancements in encryption algorithms, security protocols, and device performance.

- Strategic Partnerships and Acquisitions: Collaborations with technology giants and security specialists expand market reach and offer comprehensive data protection solutions.

- Vertical Integration: Some companies integrate vertically, controlling the entire value chain from chip design to device manufacturing, improving cost-efficiency and security control.

- Focus on Ease of Use and Scalability: User-friendly encryption solutions and scalable cloud-based offerings attract customers and address specific market demands.

Factors for Market Share Analysis:

- Product Type: The market encompasses a diverse range of products, from self-encrypting drives (SEDs) and solid-state drives (SSDs) to network encryptors and dedicated encryption appliances. Each segment caters to specific needs and budgets, influencing market share distribution.

- Target Customer: The market caters to various segments, including enterprises, government agencies, healthcare institutions, and financial organizations. Understanding their respective security needs and compliance requirements is crucial for targeting the right audience.

- Technology Adoption: The market witnesses a constant influx of new encryption technologies, like quantum-resistant algorithms and homomorphic encryption. Identifying early adopters and analyzing their technology choices can provide valuable insights.

- Geographical Landscape: The market is dominated by North America and Europe, but Asia Pacific and Latin America are experiencing rapid growth. Understanding regional trends and regulations is essential for strategic expansion.

New and Emerging Companies:

- Cloud-Native Startups: Companies offer cloud-based encryption solutions, appealing to organizations seeking centralized management and scalability.

- Open-Source Solutions: Open-source platforms offer cost-effective alternatives to proprietary encryption software, gaining traction among tech-savvy users.

- Security-Focused Companies: Established security players are expanding their portfolios to include hardware encryption solutions, offering integrated security suites.

Latest Company Updates:

Thales e-security:

- December 14, 2023: Announced the launch of SafeNet Data Protection on Google Cloud, offering cloud-based encryption and key management for sensitive data stored in Google Cloud Platform.

- October 26, 2023: Partnered with Microsoft to integrate Thales' Vormetric Data Security Platform with Microsoft Azure Active Directory for unified access control and data encryption.

Samsung Electronics:

- November 1, 2023: Introduced the Samsung Knox Vault, a hardware-based security enclave integrated into the company's Exynos mobile processors, providing secure storage for cryptographic keys and sensitive data on smartphones and other mobile devices.

- August 23, 2023: Announced a collaboration with Thales to integrate Thales' Vormetric solutions with Samsung's SmartSSD lineup, offering enhanced data encryption for enterprise storage.