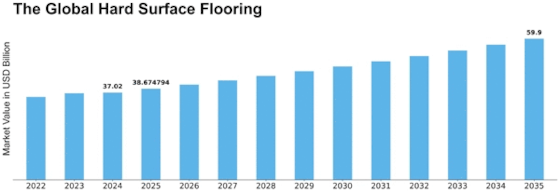

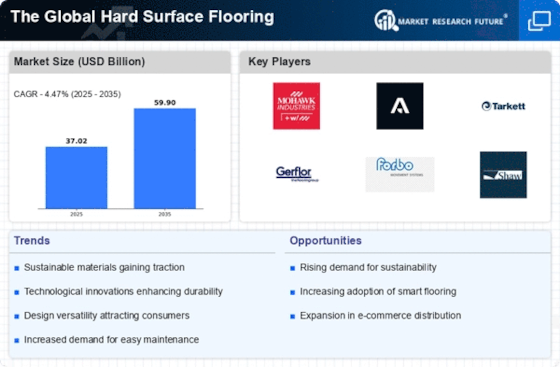

Hard Surface Flooring Size

Hard Surface Flooring Market Growth Projections and Opportunities

Many key factors influence the dynamics and growth trajectory of the hard surface flooring industry. To make wise judgments, stakeholders—manufacturers, retailers, and investors—need to keep a careful eye on these variables. The following are the main market variables that affect the market for hard surface flooring: Trends in Housing and Construction: Hard surface flooring demand is closely related to developments in the building and housing industries. Strong residential building and remodeling projects fuel demand for long-lasting and aesthetically beautiful flooring options, which in turn propels market expansion. Consumer Preferences for Durability and Aesthetics: An important factor in the hard surface flooring market is consumer preferences. Product innovation is driven by consumer preferences for visually appealing, durable, and low-maintenance flooring solutions. Customers especially like flooring materials that replicate natural textures like stone and wood. Technological Developments in Flooring Materials: New hard surface flooring materials have been created as a result of technological advancements. The market is impacted by the development of luxury vinyl tiles (LVT), engineered hardwood, and other technologically advanced materials, which allow consumers a variety of options. Sustainability & Eco-Friendly Flooring: As people become more conscious of environmental issues, there is a growing need for eco-friendly and sustainable flooring solutions. In response, producers are creating low volatile organic compound (VOC) hard surface flooring materials and using ecologically friendly production techniques. Global Economic Conditions: The hard surface flooring market is heavily impacted by the state of the world economy. Economic downturns may cause consumer spending on home renovation projects and construction to slow down, which would hinder the market's overall growth. Market Penetration of Luxury Vinyl Tiles (LVT): Because of their affordability, resilience, and adaptability, LVT has seen significant growth in the last several years. The market dynamics have changed as a result of LVT's growing popularity, encouraging manufacturer innovation and competitiveness. Markets are divided into two categories: residential and commercial. Each category has a different set of requirements. The commercial sector may place a higher priority on durability, maintenance, and adherence to safety regulations than residential users, who frequently place a higher value on comfort and aesthetics.

Leave a Comment