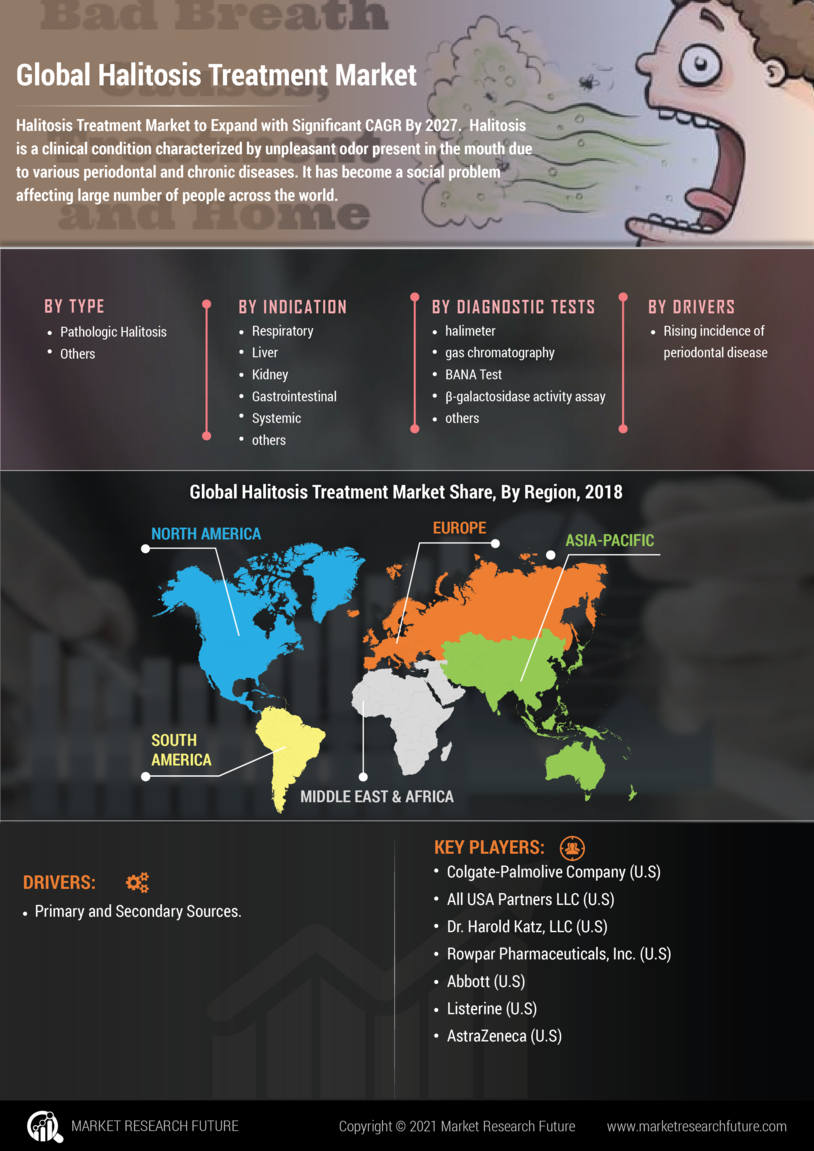

Rising Incidence of Halitosis

The rising incidence of halitosis is a critical driver for the Halitosis Treatment Market. Factors such as poor dietary habits, smoking, and certain medical conditions have contributed to an increase in the prevalence of bad breath among the population. Research indicates that approximately 25% of adults experience halitosis at some point in their lives, creating a substantial market for treatment options. This growing incidence is prompting consumers to seek effective solutions, thereby driving demand for products such as mouthwashes, chewing gums, and breath sprays. Consequently, the Halitosis Treatment Market is likely to witness robust growth as it responds to the needs of an expanding consumer base.

Expansion of E-commerce Platforms

The expansion of e-commerce platforms is transforming the Halitosis Treatment Market. With the increasing reliance on online shopping, consumers are now able to access a wider range of halitosis treatment products from the comfort of their homes. This shift has been accelerated by the convenience and accessibility that e-commerce offers, allowing consumers to compare products and read reviews before making a purchase. Market data shows that online sales of oral care products have surged by 30% in recent years. As a result, manufacturers are increasingly focusing on their online presence and digital marketing strategies to capture this growing segment of the market, thereby enhancing the overall growth potential of the Halitosis Treatment Market.

Increasing Awareness of Oral Hygiene

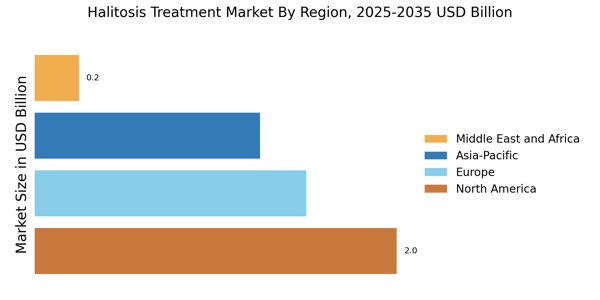

The rising awareness regarding oral hygiene is a pivotal driver for the Halitosis Treatment Market. As individuals become more informed about the implications of poor oral health, the demand for effective halitosis treatments is likely to surge. Educational campaigns and initiatives by dental associations have contributed to this heightened awareness, emphasizing the importance of regular dental check-ups and proper oral care. This trend is reflected in market data, which indicates a steady increase in the sales of mouthwashes and breath fresheners, projected to reach USD 2 billion by 2026. Consequently, the Halitosis Treatment Market is expected to benefit from this growing consumer consciousness, leading to an expansion in product offerings and innovations.

Technological Advancements in Dental Care

Technological advancements in dental care are significantly influencing the Halitosis Treatment Market. Innovations such as smart toothbrushes, mobile applications for oral health tracking, and advanced diagnostic tools are enhancing the effectiveness of halitosis treatments. These technologies not only improve the accuracy of diagnosing halitosis but also facilitate personalized treatment plans for patients. Market data suggests that the integration of technology in dental care has led to a 15% increase in the adoption of oral health products. As consumers increasingly seek out technologically advanced solutions, the Halitosis Treatment Market is poised for growth, with manufacturers investing in research and development to create cutting-edge products.

Growing Demand for Natural and Organic Products

The growing demand for natural and organic products is reshaping the Halitosis Treatment Market. Consumers are increasingly gravitating towards products that are free from synthetic chemicals and artificial additives. This trend is driven by a broader movement towards health and wellness, where individuals prioritize natural ingredients for their oral care routines. Market data indicates that the organic oral care segment is expected to grow at a CAGR of 10% over the next five years. As a result, manufacturers are reformulating their products to include natural ingredients such as essential oils and herbal extracts, thereby catering to the evolving preferences of consumers in the Halitosis Treatment Market.