Environmental Concerns

Growing environmental concerns and the need for sustainable practices are influencing the Global Ground Penetrating Radar Market Industry. GPR technology plays a crucial role in environmental assessments, such as detecting contamination in soil and groundwater. Regulatory bodies are increasingly mandating thorough subsurface investigations before construction projects, thereby boosting the demand for GPR systems. This trend is expected to contribute to the market's growth, with projections indicating a value of 1.52 USD Billion by 2035. The ability of GPR to provide non-invasive and accurate data aligns with the global push for environmentally responsible practices.

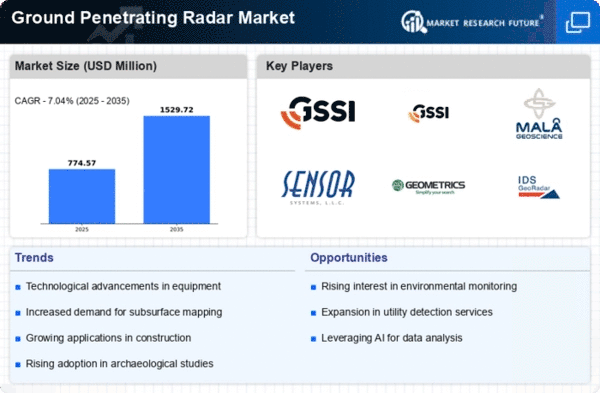

Market Growth Projections

The Global Ground Penetrating Radar Market Industry is poised for substantial growth, with projections indicating a market value of 0.72 USD Billion in 2024 and an anticipated increase to 1.52 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 7.03% from 2025 to 2035, reflecting the rising adoption of GPR technology across various sectors. The increasing recognition of GPR's capabilities in subsurface analysis, coupled with advancements in technology, positions the market for continued expansion in the coming years.

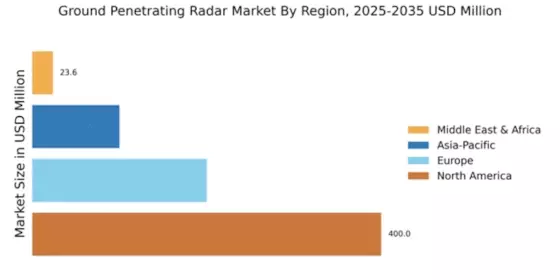

Infrastructure Development

Rapid infrastructure development across various regions significantly propels the Global Ground Penetrating Radar Market Industry. Governments and private entities are increasingly investing in infrastructure projects, including roads, bridges, and tunnels, necessitating effective subsurface investigation to ensure safety and compliance. The market is projected to reach 0.72 USD Billion in 2024, reflecting the growing demand for GPR systems in construction and civil engineering. As urbanization continues to rise, the need for precise subsurface mapping becomes paramount, further driving the adoption of GPR technology in infrastructure projects.

Technological Advancements

The Global Ground Penetrating Radar Market Industry experiences substantial growth driven by continuous technological advancements. Innovations in radar technology, such as improved signal processing and enhanced imaging capabilities, enable more accurate subsurface analysis. For instance, the integration of artificial intelligence and machine learning algorithms into GPR systems has the potential to enhance data interpretation, leading to more reliable results. As these technologies evolve, they are likely to attract a wider range of applications, including environmental monitoring and archaeological investigations, thereby expanding the market's reach and increasing its value.

Growing Demand in Utility Mapping

The Global Ground Penetrating Radar Market Industry is experiencing a surge in demand for utility mapping applications. As urban areas become increasingly congested, the need for accurate subsurface utility mapping is critical to avoid costly damages during construction projects. GPR technology provides precise location data for underground utilities, such as pipelines and cables, thereby reducing risks and enhancing project efficiency. The market is expected to witness a compound annual growth rate of 7.03% from 2025 to 2035, indicating a robust demand for GPR systems in utility mapping and management.

Increased Adoption in Archaeology

The Global Ground Penetrating Radar Market Industry sees increased adoption in archaeological applications, driven by the need for non-invasive exploration techniques. Archaeologists utilize GPR to locate buried artifacts and structures without disturbing the site, preserving historical integrity. This method has proven effective in various archaeological digs worldwide, leading to significant discoveries. As awareness of GPR's capabilities grows within the archaeological community, its usage is likely to expand, contributing to market growth. The integration of advanced GPR systems enhances the efficiency of archaeological surveys, making it an attractive option for researchers.