Gum Turpentine Oil Size

Gum Turpentine Oil Market Growth Projections and Opportunities

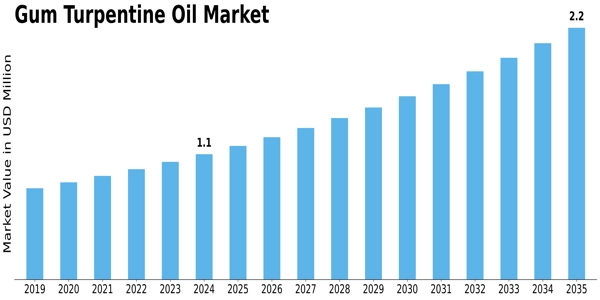

The global gum turpentine oil market is expected to experience substantial growth, projecting a Compound Annual Growth Rate (CAGR) of 6.52%. In 2022, the market is estimated to be USD 952,855.65 thousand and is anticipated to reach USD 1,579,832.97 thousand by 2030. In terms of volume, the market was 267,676.83 tons in 2021, with projections reaching 415,212.80 tons by 2030, showcasing a CAGR of 5.34%.

Pine trees play a crucial role in this market, as they are harvested for their chemical components, particularly gum turpentine oil. This oil finds application in various everyday products such as paints, adhesives, fragrances, soaps, household cleansers, vehicle tires, and more. Manufacturers are increasingly opting for sustainable alternatives due to stricter environmental regulations and the rising costs associated with addressing carbon dioxide emissions from natural gas and crude oil. This sustainable approach is especially significant in industries dealing with scent compounds, adhesives, and resins.

The demand for gum turpentine oil is driven by industries like perfumery, cosmetics, paints, and coatings. The industry's focus on sustainability aligns with the growing preference for environmentally friendly ingredients. Opportunities for gum turpentine oil manufacturers include an increase in tappers in developing nations, providing economic benefits during the forecast period. However, overall demand is influenced by factors such as substitute availability, pine and tapper considerations, and evolving government regulations in the pine-chemicals market.

MRFR analysis indicates that wood turpentine is expected to play a crucial role in the gum turpentine oil market, accounting for a significant portion. In 2021, it represented nearly 36.25% of the entire market, valued at USD 334,861.83 thousand, and is projected to grow at a CAGR of 6.77% to reach USD 584,586.10 thousand by 2030. Sulfate turpentine is the second major contributor, accounting for approximately 32.55% of the market, valued at USD 300,682.82 thousand in 2021. It is expected to grow at a CAGR of 7.04%, reaching USD 537,264.78 thousand by 2030. Sulfate turpentine remains an attractive market, with its expanding usage across various industries as a solvent or diluent in the production of various products, including binders, resins, oils, paints, and polishes. It is becoming an essential component in the production of paints and varnishes due to its role in accelerating the drying process.

In terms of applications, the paints and coatings industry is poised to be a significant contributor to the gum turpentine oil market, accounting for nearly 31.92% in 2021 and valued at USD 294,826.4 thousand. It is expected to grow at a CAGR of 6.79%, reaching USD 515,713.70 thousand by 2030. Perfumes and fragrances are the second major application, representing around 26.88% of the market and valued at USD 248,311.25 thousand in 2021. It is projected to grow at a CAGR of 6.99%, reaching USD 441,619.53 thousand by 2030. Perfumes and fragrances are expected to remain an attractive market to invest in.

North America has been the fastest-growing and largest region, accounting for 35.96% value share in the overall market. This is attributed to aggressive growth in the paints and coatings, as well as the perfume industries in the region. North America is anticipated to grow at a CAGR of 6.67% during 2022-2030, reaching USD 575,375.2 thousand by 2030. Asia Pacific follows closely, accounting for 30.66% and poised to grow at the highest CAGR of 7.25% during 2022-2030.

Leave a Comment