Gum Rosin Size

Gum Rosin Market Growth Projections and Opportunities

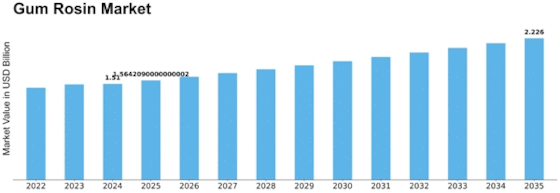

The global gum rosin market is expected to grow significantly from 2022 to 2030. In 2021, the market was valued at USD 1,333.31 million and is anticipated to reach USD 1,877.12 million by 2030, with a Compound Annual Growth Rate (CAGR) of 4.06%. In volume terms, the market was 742.94 kilotons in 2021 and is projected to increase to 995.78 kilotons by 2030, exhibiting a CAGR of 3.56%.

Gum rosin is a substance derived from pine trees' oleoresin through a process called scarification. Its unique properties make it versatile for various applications such as adhesives, paper sizing agents, printing inks, and more. The global gum rosin market is influenced by factors like increased demand in industries like paints & coatings, rubber, and its use in adhesives for construction. Additionally, there are growth opportunities in Latin America and the Middle East & Africa.

One of the primary uses of gum rosin is in the paint industry, where it dissolves easily in alcohol, gasoline, turpentine, and other organic solvents. It is often refined with drying oils to produce lacquers. In the papermaking industry, gum rosin serves as a sizing agent, enhancing paper strength, smoothness, and resistance to abrasion. It also finds application in the rubber industry as a cost-effective tackifier and softener. The improved chemical and physical properties of gum rosin contribute to its use across various industries, fostering market growth.

The gum rosin market is segmented based on type, application, and region. In terms of type, the WW segment, which includes various applications like printing inks, varnishes, adhesives, soap, paper sizing, soda, soldering fluxes, and sealing wax, held the largest share at 35.08% in 2021. This segment was valued at USD 467.67 million in 2021 and is expected to reach USD 687.70 million by 2030, with a CAGR of 4.57%. In volume terms, the WW segment was 259.11 kilotons in 2021, projected to grow to 362.86 kilotons by 2030, exhibiting a CAGR of 4.07%.

In terms of applications, the adhesives & sealants segment dominated the market in 2021 with a 37.77% share by value. This is due to the increasing use of gum rosin in adhesives & sealants as an intermediate product. The printing ink segment followed with a market share of 25.44%, expected to grow at a CAGR of 3.88% by 2030.

Geographically, the Asia-Pacific region held the largest market share of 33.28% in 2021, driven by aggressive growth in end-use applications such as adhesives, paints & coatings. The North American region is projected to register a CAGR of 3.75% to reach USD 586.79 million by 2030.

The market outlook suggests positive growth, with the potential for increased demand in various industries and expanding into untapped regions. Factors like urbanization, residential construction, and infrastructure spending are expected to contribute to the market's development. Overall, the global gum rosin market is on track for healthy expansion in the coming years.

Leave a Comment