Increased Defense Spending

In recent years, there has been a marked increase in defense spending across various nations, which is significantly impacting the Guided Munitions Market. Governments are prioritizing military modernization and readiness in response to evolving geopolitical threats. This surge in defense budgets is leading to enhanced procurement of advanced weaponry, including guided munitions. For instance, countries such as India and Japan have announced substantial increases in their defense expenditures, with projections indicating a growth rate of around 7% annually. This financial commitment is likely to drive demand for sophisticated guided munitions, as military forces seek to enhance their operational capabilities. The increased allocation of resources towards defense is expected to sustain the growth trajectory of the Guided Munitions Market in the coming years.

Shift Towards Unmanned Systems

The Guided Munitions Market is witnessing a significant shift towards the adoption of unmanned systems, including drones and autonomous vehicles. These platforms are increasingly being equipped with precision-guided munitions, allowing for more flexible and effective military operations. The use of unmanned aerial vehicles (UAVs) has become a game-changer in modern warfare, enabling forces to conduct strikes with minimal risk to personnel. As military strategies evolve, the integration of guided munitions with unmanned systems is expected to grow. Reports suggest that the UAV market alone is projected to reach USD 50 billion by 2025, with a substantial portion allocated to guided munitions. This trend indicates a transformative phase for the Guided Munitions Market, as unmanned systems redefine operational paradigms.

Emerging Markets and Defense Collaborations

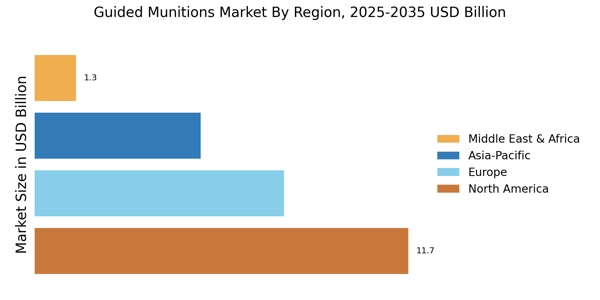

Emerging markets are becoming increasingly important players in the Guided Munitions Market, as countries seek to develop indigenous defense capabilities. Nations such as Brazil, South Africa, and Indonesia are investing in local defense industries, which includes the production of guided munitions. Additionally, international defense collaborations and partnerships are facilitating technology transfer and joint development programs. These initiatives are likely to enhance the capabilities of emerging economies, allowing them to participate more actively in The Guided Munitions Market. The potential for growth in these regions is substantial, with estimates suggesting that the defense market in Asia-Pacific could reach USD 500 billion by 2027. This trend indicates a shift in the dynamics of the Guided Munitions Market, as new players emerge and contribute to the overall landscape.

Geopolitical Tensions and Regional Conflicts

Ongoing geopolitical tensions and regional conflicts are driving demand within the Guided Munitions Market. As nations face threats from both state and non-state actors, there is an increasing emphasis on enhancing military capabilities. Countries involved in territorial disputes or facing insurgent threats are likely to invest in guided munitions to ensure effective deterrence and response strategies. For example, the Middle East and Eastern Europe have seen heightened military activities, prompting nations to procure advanced guided munitions to bolster their defense postures. This environment of uncertainty is expected to sustain demand for precision-guided munitions, as military forces seek to maintain operational superiority. Analysts predict that the market will continue to expand as nations adapt to the evolving security landscape.

Technological Advancements in Precision Targeting

The Guided Munitions Market is experiencing a notable transformation due to rapid technological advancements in precision targeting systems. Innovations such as GPS-guided munitions and laser-guided bombs have significantly enhanced the accuracy and effectiveness of military operations. The integration of artificial intelligence and machine learning into these systems is expected to further improve targeting capabilities, reducing collateral damage and increasing mission success rates. As nations invest in modernizing their arsenals, the demand for advanced guided munitions is projected to rise. According to recent estimates, the market for precision-guided munitions is anticipated to reach USD 30 billion by 2026, reflecting a compound annual growth rate of approximately 5.5%. This trend underscores the critical role of technology in shaping the future of the Guided Munitions Market.