Grow Light Market Summary

As per Market Research Future analysis, the Grow Lights Market Size was estimated at 3.14 USD Billion in 2024. The Grow Lights industry is projected to grow from 3.973 USD Billion in 2025 to 41.83 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 26.54% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Grow Lights Market is experiencing robust growth driven by technological advancements and increasing demand for sustainable agricultural practices.

- Technological advancements in lighting are reshaping the Grow Lights Market, enhancing efficiency and effectiveness.

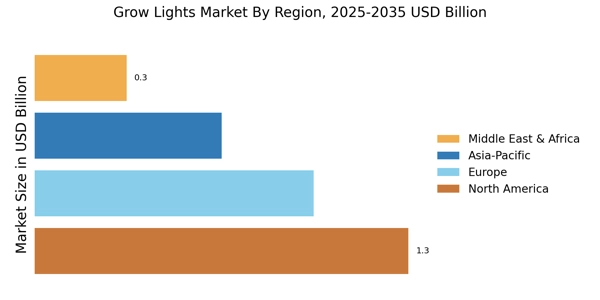

- North America remains the largest market, while Asia-Pacific is emerging as the fastest-growing region for grow lights.

- The hardware segment dominates the market, whereas the software and services segment is witnessing rapid growth.

- Key market drivers include the rising demand for indoor farming and a focus on sustainable agriculture practices.

Market Size & Forecast

| 2024 Market Size | 3.14 (USD Billion) |

| 2035 Market Size | 41.83 (USD Billion) |

| CAGR (2025 - 2035) | 26.54% |

Major Players

Signify (NL), Osram (DE), Cree (US), Hydrofarm (US), Illumitex (US), Gavita (NL), Spectrum King (US), California Lightworks (US), Black Dog LED (US), including leading led grow light companies and suppliers of advanced industrial grow light solutions such as illumitex grow lights