Graphical User Interface Design Software Size

Graphical User Interface Design Software Market Growth Projections and Opportunities

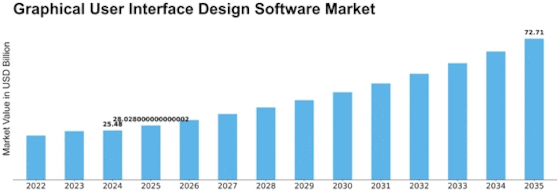

Over the past years, the global market for graphical user interface (GUI) design software has shown significant growth, with projections indicating it could reach USD 1,496.2 million by 2027. Forecasts suggest a Compound Annual Growth Rate (CAGR) of 9.8% during the forecast period spanning from 2021 to 2027.

The market for graphical user interface design software has been categorized based on various factors. Deployment options divide the market into cloud-based and on-premises solutions. Organization size segments the market into small and medium enterprises (SMEs) and large enterprises. Additionally, verticals such as Banking, Financial Services, and Insurance (BFSI), IT & telecom, manufacturing, automotive, medical & healthcare, media & entertainment, and other sectors are key sectors where this software finds application.

Furthermore, geographical segmentation highlights different regional markets. North America, Europe, Asia-Pacific, the Middle East & Africa, and South America represent key regions where the graphical user interface design software market is analyzed and predicted to exhibit varying trends and growth patterns. This segmentation offers insights into the diverse landscape of GUI software adoption and its market potential across different parts of the globe.

In 2020, North America dominated the market with nearly 51.3% of the global share, driven by substantial investments in digital transformation and the widespread adoption of digital solutions across various industries. Sectors like IT & telecom, retail & e-commerce, manufacturing, automotive, media & entertainment, government, education & corporate learning, and medical & healthcare significantly contributed to this growth by leveraging GUI design software for optimized business operations. North America is anticipated to maintain a robust Compound Annual Growth Rate (CAGR) of 8.7% during the forecast period, with the US being the primary driver, accounting for 90.6% of the regional market share in FY2020.

In the same year, Europe secured the second-largest market share, approximately 22.3%, propelled by increasing mobile and desktop application adoption, cloud computing integration, and the emergence of Software as a Service (SaaS) platforms. Countries like the UK, Germany, and France acted as key growth catalysts for the European GUI design software market. The region is projected to sustain a CAGR of 10.2% in the forecast period, buoyed by well-established industries such as BFSI, manufacturing, and automotive, which are significant contributors to the demand for GUI design software systems.

Leave a Comment