Growth in Biomedical Applications

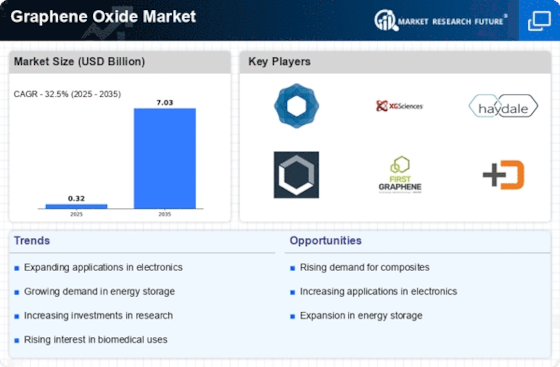

The Graphene Oxide Market is witnessing growth driven by its expanding applications in the biomedical field. Graphene oxide is being utilized for drug delivery systems, biosensors, and tissue engineering due to its biocompatibility and ability to facilitate cellular interactions. Recent research suggests that graphene oxide can improve the efficacy of drug delivery by enabling targeted release mechanisms. The market for graphene-based biomedical products is projected to reach several billion dollars in the coming years, as healthcare providers and researchers explore its potential. This trend indicates a promising future for the Graphene Oxide Market, as it aligns with the increasing demand for innovative healthcare solutions.

Innovations in Composite Materials

The Graphene Oxide Market is significantly influenced by innovations in composite materials. Graphene oxide is being integrated into polymers and metals to create lightweight, strong, and durable composites. These materials are gaining traction in industries such as aerospace, automotive, and construction, where performance and weight reduction are paramount. For instance, the incorporation of graphene oxide can enhance the tensile strength of composites by over 50%. This capability not only improves product performance but also contributes to energy efficiency in manufacturing processes. As industries increasingly prioritize material performance, the Graphene Oxide Market is likely to see a rise in demand for these advanced composite solutions.

Advancements in Energy Storage Solutions

The Graphene Oxide Market is experiencing a surge in demand due to advancements in energy storage technologies. Graphene oxide is being explored for its potential in enhancing the performance of batteries and supercapacitors. The unique properties of graphene oxide, such as high conductivity and large surface area, allow for faster charge and discharge rates. Recent studies indicate that incorporating graphene oxide into lithium-ion batteries can increase their energy density by up to 30%. This trend is likely to drive investments in research and development, as companies seek to leverage these benefits for commercial applications. As energy storage becomes increasingly critical in various sectors, the Graphene Oxide Market is poised for substantial growth.

Rising Interest in Environmental Applications

The Graphene Oxide Market is benefiting from a rising interest in environmental applications. Graphene oxide is being investigated for its potential in water purification, air filtration, and environmental remediation. Its high adsorption capacity allows for the effective removal of pollutants from water and air, making it a valuable material in addressing environmental challenges. Recent studies have shown that graphene oxide membranes can achieve over 90% rejection of contaminants in water treatment processes. As environmental regulations become stricter and the need for sustainable solutions grows, the Graphene Oxide Market is likely to expand, driven by these eco-friendly applications.

Increased Investment in Research and Development

The Graphene Oxide Market is experiencing increased investment in research and development, which is crucial for its growth. Governments and private entities are allocating funds to explore the diverse applications of graphene oxide across various sectors. This investment is fostering innovation and facilitating the commercialization of new technologies. For instance, funding for projects focused on graphene oxide in electronics and energy storage has seen a notable rise, with several initiatives aiming to bring products to market by 2026. This trend suggests a robust future for the Graphene Oxide Market, as ongoing research is likely to yield breakthroughs that enhance its applicability and market reach.