Government Support and Subsidies

Government initiatives play a crucial role in shaping the Grain Silos Storage System Market. Various governments are implementing policies and providing subsidies to encourage the construction and modernization of grain storage facilities. For instance, financial assistance programs aimed at farmers and agricultural businesses are becoming increasingly common, facilitating investments in advanced silo technologies. This support not only enhances storage capabilities but also promotes sustainable agricultural practices. In some regions, government-backed programs have led to a 15% increase in the adoption of modern grain storage solutions. Such initiatives are expected to continue, fostering a favorable environment for market growth and encouraging stakeholders to upgrade their storage systems.

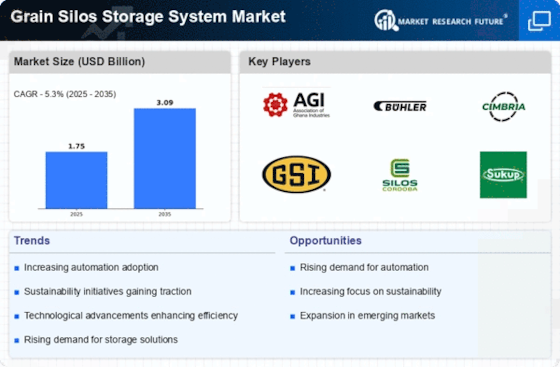

Increasing Global Population and Food Demand

The Grain Silos Storage System Market is being propelled by the increasing global population and the corresponding rise in food demand. With the world population projected to reach approximately 9.7 billion by 2050, the pressure on agricultural production systems is intensifying. This demographic shift necessitates the development of robust grain storage solutions to ensure food security and minimize waste. As a response, stakeholders in the agricultural sector are investing in expanding their storage capacities and improving existing facilities. The market is expected to grow as producers seek to meet the escalating demand for grains, thereby driving the need for efficient and reliable storage systems.

Technological Innovations in Storage Systems

Technological advancements are significantly influencing the Grain Silos Storage System Market. Innovations such as automated monitoring systems, temperature control technologies, and smart silos are transforming traditional grain storage practices. These technologies enable real-time data collection and analysis, allowing for better management of grain quality and reducing the risk of spoilage. The integration of Internet of Things (IoT) devices in storage systems is becoming increasingly prevalent, providing farmers and operators with valuable insights into storage conditions. As a result, the market is witnessing a shift towards more sophisticated and efficient storage solutions, which are likely to enhance operational efficiency and reduce costs in the long run.

Rising Demand for Efficient Storage Solutions

The Grain Silos Storage System Market is experiencing a notable increase in demand for efficient storage solutions. As agricultural production continues to rise, the need for effective grain storage becomes paramount. In recent years, the global grain production has reached approximately 2.7 billion metric tons, necessitating advanced storage systems to prevent spoilage and ensure quality. This trend is further fueled by the growing awareness of food security and the need to minimize post-harvest losses. Consequently, manufacturers are investing in innovative silo designs and technologies that enhance storage capacity and reduce operational costs. The emphasis on efficiency in grain handling and storage is likely to drive the market forward, as stakeholders seek to optimize their supply chains and improve overall productivity.

Focus on Sustainability and Environmental Impact

Sustainability concerns are becoming increasingly prominent within the Grain Silos Storage System Market. Stakeholders are recognizing the importance of environmentally friendly practices in grain storage and management. This focus on sustainability is leading to the adoption of eco-friendly materials and energy-efficient technologies in silo construction. Additionally, the implementation of practices that reduce carbon footprints and enhance resource efficiency is gaining traction. As consumers become more environmentally conscious, the demand for sustainable storage solutions is likely to rise. This trend not only aligns with The Grain Silos Storage System Market, potentially attracting a broader customer base.