Global Gold Derivatives and Futures Market Overview:

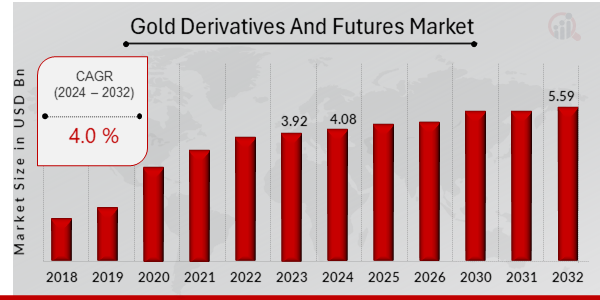

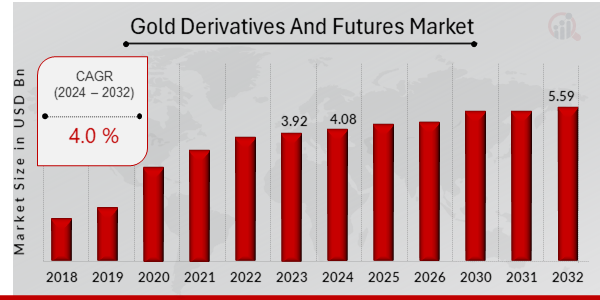

Gold Derivatives and Futures Market Size was estimated at 3.92 (USD Billion) in 2023. The Gold Derivatives and Futures Market Industry is expected to grow from 4.08 (USD Billion) in 2024 to 5.59 (USD Billion) by 2032. The Gold Derivatives and Futures Market CAGR (growth rate) is expected to be around 4.0% during the forecast period (2024 - 2032).

Key Gold Derivatives and Futures Market Trends Highlighted

Numerous factors can be seen as responsible for the continued growth of gold derivatives and future markets globally. The popularity of gold as a safe-haven asset during times of economic uncertainty has led to increased investment in gold derivatives and futures. As a result, these derivative instruments have experienced unprecedented growth due to the involvement of more institutional investors and hedge funds in the gold market.

Some key drivers include rising inflation, increased institutional demand, and new financial products that allow people to invest in gold. Areas for further exploration or exploitation include expanding the emerging economies’ gold derivative and future markets, launching physically settled futures contracts for gold, and incorporating blockchain technology for improved transparency and efficiency.

What we have recently noticed in the Gold Derivatives and Futures Market is the increased application of gold futures by mining companies as risk management tools, the increase of the over-the-counter gold derivatives market and the development of digital gold derivatives that provide easy access to gold prices. These trends indicate that there is an increasing demand for gold futures and options as investment instruments and for risk management, which is driving the growth of this market.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Gold Derivatives and Futures Market Drivers

Rising Demand for Gold as a Safe Haven

Investors usually feel that gold is the safest heaven at a time when there are uncertainties and geopolitical instabilities. Gold has often been perceived as an inflation hedge, a currency hedge, or a safe haven during times of high political risk. In the future, global demand will continue to create more opportunities for growth in this market segment. The Global Gold Derivatives and Future Market Industry should show some growth owing to these movements.

Growing Popularity of Gold ETFs and Other Investment Products

The gold exchange-traded funds (ETFs) and other investment products are gaining popularity, thus assisting investors to have gold outcomes without purchasing the physical metal. They diversify portfolios and hedge against risk in a convenient and low-cost manner. The Gold Derivatives and Futures Market Industry will be further driven by the expected growth of demand for gold derivatives and futures resulting from the increased acceptance of gold ETFs and other investment products.

Technological Advancements in the Gold Market

Moreover, technological growth has also been a key factor responsible for the significant increase in the Gold Derivatives and Futures Market industry. The use of electronic trading platforms and online brokerage services has simplified the trading of gold derivatives and futures, thus enhancing their market availability and liquidity. Furthermore, blockchain technology, among other innovative solutions, is anticipated to improve further effectiveness and transparency in the gold market, thereby attracting more players as well as pushing market expansion.

Gold Derivatives and Futures Market Segment Insights:

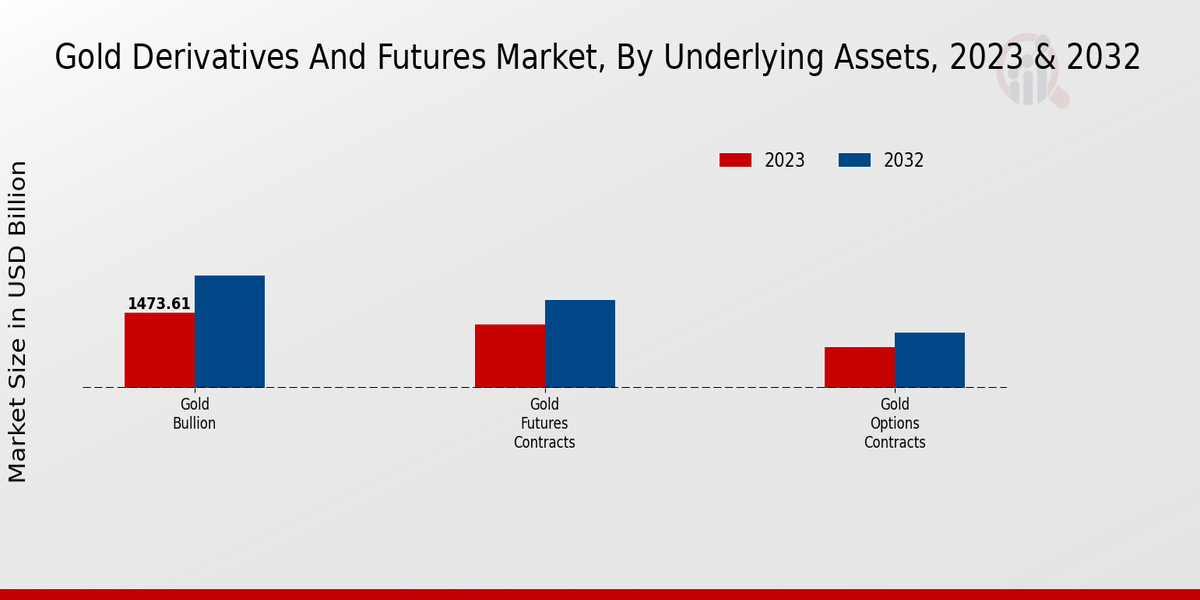

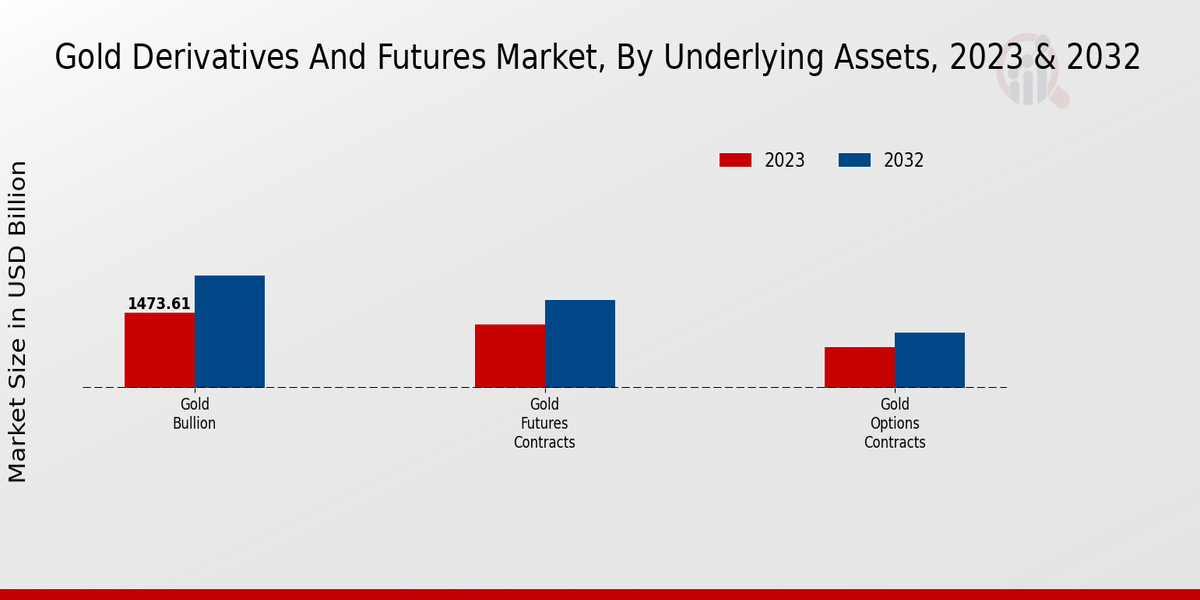

Gold Derivatives and Futures Market Underlying Assets Insights

The Gold Derivatives and Futures Market is segmented by underlying assets into physical gold, gold futures contracts, and gold options contracts. Physical gold remains the most traded underlying asset, accounting for over 60% of the market share in 2023. However, gold futures contracts are expected to witness the highest growth rate during the forecast period, owing to their increasing popularity as a hedging tool against price volatility. Gold options contracts, on the other hand, are expected to gain traction due to their ability to provide downside protection while offering limited upside potential.

The Gold Derivatives and Futures Market is driven by several factors, including rising demand for gold as a safe-haven asset, increasing participation from institutional investors, and growing adoption of gold-backed exchange-traded funds (ETFs). The market is also benefiting from the growing popularity of online trading platforms, which are making it easier for individual investors to access the market. In terms of regional segmentation, the Asia-Pacific region is expected to dominate the Gold Derivatives and Futures Market, accounting for over 40% of the market share in 2023.This growth is attributed to the increasing demand for gold in emerging economies such as China and India. North America and Europe are also expected to witness significant growth in the coming years.

The Gold Derivatives and Futures Market is a highly competitive landscape with a number of established players. Some of the key players in the market include HSBC, JPMorgan Chase, and Bank of America Merrill Lynch. These players offer a range of products and services to meet the diverse needs of investors. Overall, the Gold Derivatives and Futures Market is expected to witness steady growth in the coming years.The market is supported by strong fundamentals and is expected to benefit from the increasing demand for gold as a safe-haven asset and the growing adoption of gold-backed ETFs.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Gold Derivatives and Futures Market Contract Types Insights

The Gold Derivatives and Futures Market is segmented by Contract Types into Forward contracts, Futures contracts, and Options contracts. Among these, the Futures contracts segment held the largest market share in 2023, accounting for over 38.0% of the Gold Derivatives and Futures Market revenue. The growth of this segment can be attributed to the increasing popularity of futures contracts as a hedging tool against price fluctuations in the gold market.

Forward contracts are expected to witness the fastest growth during the forecast period, owing to their flexibility and customization options.Options contracts, on the other hand, provide the buyer with the right but not the obligation to buy or sell gold at a specified price on a specified date and are expected to contribute significantly to the Gold Derivatives and Futures Market growth over the coming years.

Gold Derivatives and Futures Market Settlement Type Insights

Settlement Type The Gold Derivatives and Futures Market is segmented by settlement type into physical settlement and cash settlement. Physical settlement refers to the delivery of physical gold bullion to the buyer upon the expiration of the contract. Cash settlement refers to the settlement of the contract in cash based on the difference between the spot price of gold and the contract price.

This avoids the need for physical delivery of gold. In 2023, the physical settlement segment accounted for a larger share of the Gold Derivatives and Futures Market revenue due to the preference for physical gold as a store of value and a hedge against inflation.However, the cash settlement segment is expected to grow at a faster CAGR during the forecast period due to its convenience and lower transaction costs.

Gold Derivatives and Futures Market Market Participants Insights

The Gold Derivatives and Futures Market is segmented into various market participants, such as central banks, commercial banks, investment funds, and traders. This segmentation allows for a deeper understanding of the market dynamics and provides insights into the key players involved in the industry. Central banks play a significant role in the Gold Derivatives and Futures Market, using gold as a reserve asset and a tool for monetary policy. Commercial banks offer gold-related products and services to their customers, including gold trading, storage, and financing.Investment funds, such as hedge funds and mutual funds, use gold derivatives and futures to manage risk and enhance returns.

Traders, including proprietary trading firms and individual speculators, actively participate in the market to capitalize on price fluctuations. The Gold Derivatives and Futures Market is expected to exhibit steady growth over the coming years, driven by increasing demand for gold as a safe-haven asset and a hedge against inflation. The growing adoption of gold derivatives and futures by institutional investors and the expansion of gold trading platforms are expected to further contribute to market growth.

Gold Derivatives and Futures Market Trading Platforms Insights

Over-the-counter (OTC) markets and exchange-traded markets are two key trading platforms in the Gold Derivatives and Futures Market. OTC markets, where transactions are conducted directly between two parties without the involvement of an exchange, accounted for the majority of the Gold Derivatives and Futures Market revenue in 2023. These markets offer greater flexibility and customization, allowing participants to tailor contracts to their specific needs.

On the other hand, exchange-traded markets, where standardized contracts are traded on a centralized exchange, provide greater transparency and liquidity.The growth of exchange-traded markets is expected to accelerate in the coming years, driven by the increasing adoption of electronic trading platforms and the need for risk management tools.

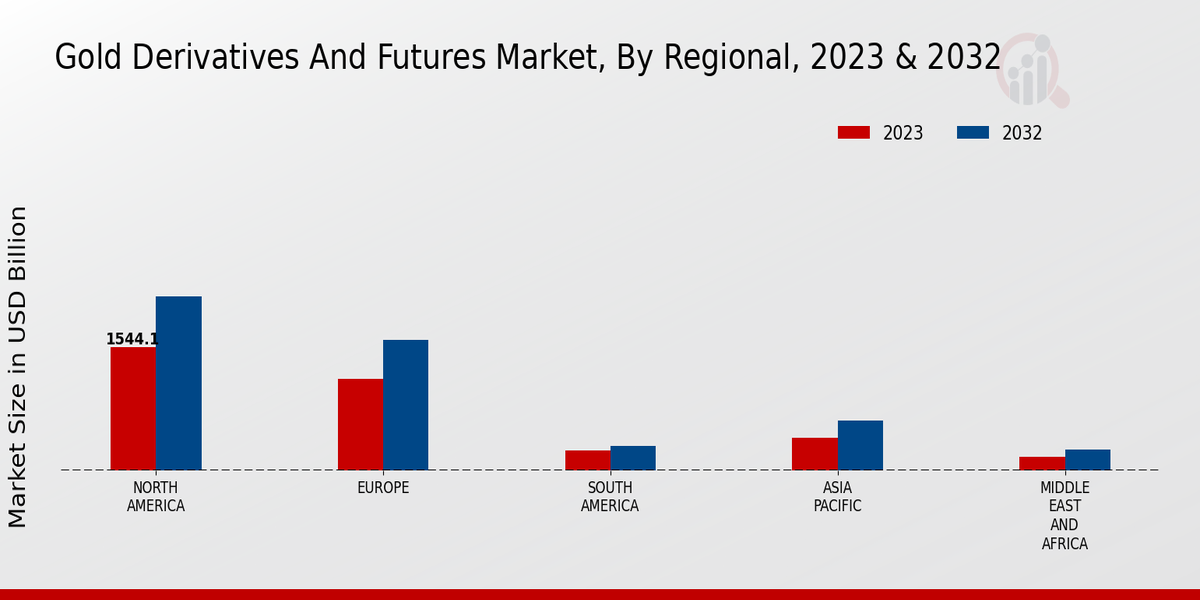

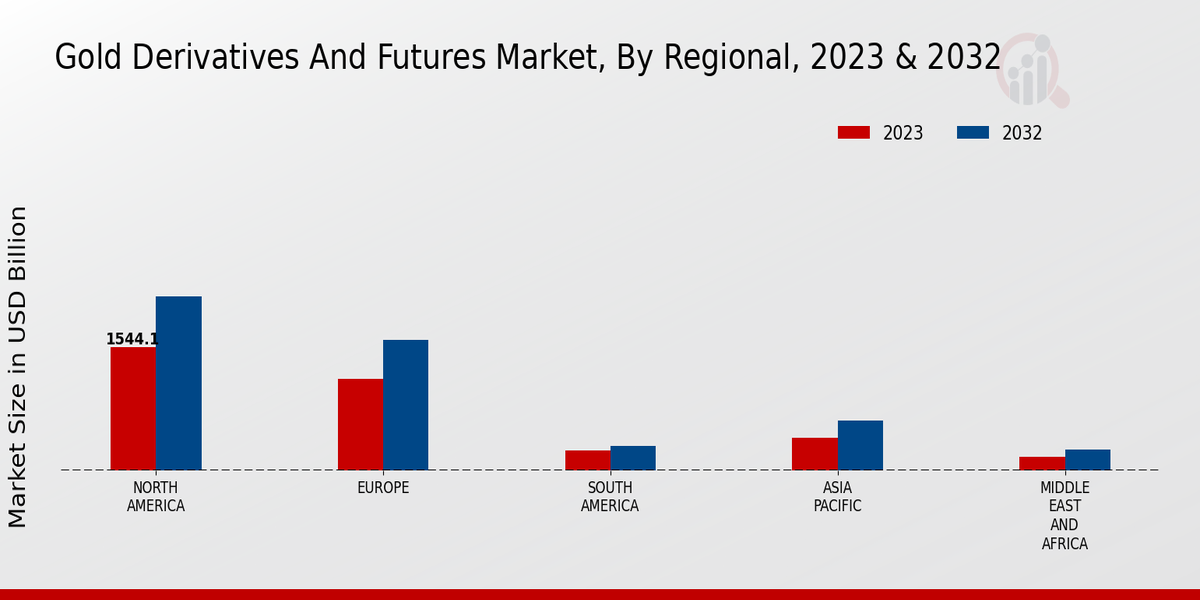

Gold Derivatives and Futures Market Regional Insights

The regional segmentation of the Gold Derivatives and Futures Market comprises North America, Europe, APAC, South America, and MEA. In 2023, North America held the largest market share, followed by Europe. The APAC region is projected to experience the highest growth rate during the forecast period, owing to the increasing demand for gold as a safe-haven asset and the growing number of high-net-worth individuals in the region. South America and MEA are expected to witness moderate growth rates, driven by the rising popularity of gold derivatives and futures as hedging instruments.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Gold Derivatives and Futures Market Key Players And Competitive Insights:

Major players in the Gold Derivatives and Futures Market industry are continuously developing and launching new products to cater to the growing demand for gold derivatives and futures. Leading Gold Derivatives and Futures Market players are investing heavily in research and development to create innovative products that meet the needs of their customers. The Gold Derivatives and Futures Market industry is highly competitive, with a number of large, well-established players.

These players have a strong market presence and a wide distribution network. They also have a strong brand reputation and a loyal customer base.One of the leading companies in the Gold Derivatives and Futures Market industry is CFTC. CFTC is a global provider of financial services, including gold derivatives and futures. The company has a strong track record of success and a reputation for providing high-quality products and services. CFTC has a wide range of products and services to meet the needs of its customers. The company offers a variety of gold derivatives, including futures, options, and swaps. CFTC also offers a variety of gold-related services, such as physical gold storage and transportation.

A competitor to CFTC in the Gold Derivatives and Futures Market industry is CME Group. CME Group is a global exchange group that offers a variety of financial products, including gold derivatives and futures. The company has a strong track record of success and a reputation for providing high-quality products and services. CME Group has a wide range of products and services to meet the needs of its customers. The company offers a variety of gold derivatives, including futures, options, and swaps. CME Group also offers a variety of gold-related services, such as physical gold storage and transportation.

Key Companies in the Gold Derivatives and Futures Market Include:

Gold Derivatives and Futures Industry Developments

The Gold Derivatives and Futures Market is projected to experience steady growth from 2023 to 2032, driven by increasing demand for gold as a safe-haven asset amid global economic uncertainties and geopolitical tensions. In 2023, the market was valued at approximately USD 3,510.93 billion, and it is expected to reach USD 5,000.0 billion by 2032, exhibiting a CAGR of 4.01%. Recent news developments include the launch of new gold-backed exchange-traded funds (ETFs) and the growing adoption of blockchain technology in gold trading. These factors are expected to contribute to the market's growth in the coming years.

Gold Derivatives and Futures Market Segmentation Insights

-

Gold Derivatives and Futures Market Underlying Assets Outlook

-

Gold bullion

-

Gold futures contracts

-

Gold options contracts

-

Gold Derivatives and Futures Market Contract Types Outlook

-

Forward contracts

-

Futures contracts

-

Options contracts

-

Gold Derivatives and Futures Market Settlement Type Outlook

-

Physical settlement

-

Cash settlement

-

Gold Derivatives and Futures Market Market Participants Outlook

-

Central banks

-

Commercial banks

-

Investment funds

-

Traders

-

Gold Derivatives and Futures Market Trading Platforms Outlook

-

Gold Derivatives and Futures Market Regional Outlook

-

North America

-

Europe

-

South America

-

Asia Pacific

-

Middle East and Africa

| Report Attribute/Metric |

Details |

| Market Size 2023 |

3.92 (USD Billion) |

| Market Size 2024 |

4.08 (USD Billion) |

| Market Size 2032 |

5.59 (USD Billion) |

| Compound Annual Growth Rate (CAGR) |

4.0% (2024 - 2032) |

| Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Base Year |

2023 |

| Market Forecast Period |

2024 - 2032 |

| Historical Data |

2019 - 2023 |

| Market Forecast Units |

USD Billion |

| Key Companies Profiled |

TD Securities, China Gold International Holdings Limited, Societe Generale, Credit Suisse, Deutsche Bank, Goldman Sachs, ScotiaMocatta, MKS PAMP Group, Morgan Stanley, Bank of China, HSBC, UBS, BNP Paribas, JPMorgan Chase, Bank of America Merrill Lynch |

| Segments Covered |

Underlying Assets, Contract Types, Settlement Type, Market Participants, Trading Platforms, Regional |

| Key Market Opportunities |

Growing demand for hedging and price risk managementRising geopolitical and economic uncertaintiesTechnological advancements in trading platformsIncreasing accessibility to gold derivativesGovernment initiatives to promote the use of gold as a financial asset |

| Key Market Dynamics |

Growing demand for gold as a safe haven assetIncreasing institutional investment in gold futuresRising geopolitical uncertaintiesFluctuating gold pricesAdvancements in technology and data analytics |

| Countries Covered |

North America, Europe, APAC, South America, MEA |

Frequently Asked Questions (FAQ) :

The Gold Derivatives and Futures Market is expected to reach USD 4.08 billion in 2024 and is projected to grow at a CAGR of 4.0% to reach USD 5.59 billion by 2032.

The Asia Pacific region is expected to hold the largest market share in the Gold Derivatives and Futures Market, followed by North America and Europe. The growing demand for gold as a safe-haven asset and increasing investments in gold-backed exchange-traded funds (ETFs) are driving the growth in these regions.

Gold Derivatives And Futures are primarily used for hedging against price volatility, speculation, and portfolio diversification. They are also used by central banks and other financial institutions to manage their gold reserves.

The key competitors in the Gold Derivatives and Futures Market include Bank of America, Citigroup, HSBC, JPMorgan Chase, and Goldman Sachs.

The key growth drivers of the Gold Derivatives and Futures Market include increasing demand for gold as a safe-haven asset, growing investments in gold-backed ETFs, and rising interest rates.

The Gold Derivatives and Futures Market faces challenges such as regulatory changes, geopolitical uncertainty, and competition from other financial instruments.

The Gold Derivatives and Futures Market is expected to grow at a CAGR of 4.0% from 2023 to 2032.

The key trends in the Gold Derivatives and Futures Market include the increasing use of electronic trading platforms, growing demand for physical gold, and the development of new gold-linked financial products.

The future prospects of the Gold Derivatives and Futures Market are positive, driven by the increasing demand for gold as a safe-haven asset, growing investments in gold-backed ETFs, and rising interest rates.

The key opportunities in the Gold Derivatives and Futures Market include expanding into new markets, developing new gold-linked financial products, and leveraging technology to improve efficiency.