Advancements in GNSS Technology

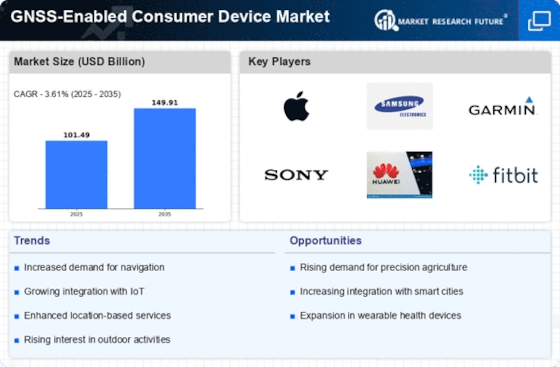

Technological advancements play a crucial role in shaping the GNSS-Enabled Consumer Device Market Industry. Innovations such as multi-constellation GNSS, which incorporates signals from various satellite systems, enhance accuracy and reliability. The introduction of new frequency bands and improved signal processing techniques also contributes to better performance in challenging environments. As a result, consumer devices are becoming increasingly sophisticated, offering features like real-time tracking and enhanced navigation capabilities. Market data suggests that the adoption of advanced GNSS technology is expected to grow at a compound annual growth rate of 15% over the next five years. This growth is indicative of the industry's commitment to meeting the evolving needs of consumers and businesses alike.

Expansion of Smart City Initiatives

The GNSS-Enabled Consumer Device Market Industry is poised to benefit from the expansion of smart city initiatives. Urban areas are increasingly adopting smart technologies to improve infrastructure, transportation, and public services. GNSS technology plays a vital role in these developments, enabling efficient traffic management, public transportation systems, and emergency response services. As cities invest in smart solutions, the demand for GNSS-enabled devices is expected to rise, facilitating better connectivity and data-driven decision-making. Recent reports indicate that investments in smart city projects are projected to exceed USD 1 trillion by 2025, highlighting the potential for growth in the GNSS-enabled consumer device sector as cities seek to enhance urban living through technology.

Growing Popularity of Smart Wearables

The rise of smart wearables significantly impacts the GNSS-Enabled Consumer Device Market Industry. Devices such as smartwatches, fitness trackers, and health monitors increasingly incorporate GNSS technology to provide users with accurate location tracking and activity monitoring. This trend is driven by a growing consumer interest in health and fitness, as well as the desire for connected devices that offer real-time data. Market analysis indicates that the wearable technology sector is projected to reach USD 60 billion by 2025, with GNSS-enabled devices capturing a substantial share of this market. As consumers seek more integrated solutions for health management and lifestyle tracking, the demand for GNSS-enabled wearables is likely to continue its upward trajectory.

Increased Demand for Location-Based Services

The GNSS-Enabled Consumer Device Market Industry experiences a notable surge in demand for location-based services. As consumers increasingly rely on navigation, mapping, and location tracking applications, the need for accurate positioning technology becomes paramount. According to recent data, the market for location-based services is projected to reach USD 100 billion by 2026, indicating a robust growth trajectory. This demand is driven by various sectors, including transportation, logistics, and tourism, which utilize GNSS technology to enhance operational efficiency and customer experience. Consequently, the proliferation of smartphones and other consumer devices equipped with GNSS capabilities further fuels this trend, as users seek seamless integration of location services in their daily lives.

Rising Consumer Awareness of Safety and Security

Consumer awareness regarding safety and security is increasingly influencing the GNSS-Enabled Consumer Device Market Industry. As individuals prioritize personal safety, the demand for devices equipped with GNSS technology for tracking and emergency response is on the rise. Applications such as personal safety devices, vehicle tracking systems, and child monitoring solutions are gaining traction. Market data suggests that the personal safety device segment is expected to grow at a rate of 12% annually, reflecting a heightened focus on security among consumers. This trend underscores the importance of GNSS technology in providing peace of mind and enhancing safety measures, thereby driving growth in the consumer device market.