Rising Demand for Quality Assurance

The GMP Testing Service Market is experiencing a notable increase in demand for quality assurance across various sectors, particularly in pharmaceuticals and biotechnology. As companies strive to meet stringent regulatory requirements, the need for reliable testing services has surged. This trend is underscored by the fact that the pharmaceutical sector alone is projected to reach a market size of approximately 1.5 trillion USD by 2025, necessitating robust quality control measures. Consequently, organizations are increasingly investing in GMP testing services to ensure compliance and maintain product integrity. The emphasis on quality assurance not only enhances consumer trust but also mitigates the risk of costly recalls and legal repercussions, thereby driving growth in the GMP Testing Service Market.

Increasing Focus on Biopharmaceuticals

The GMP Testing Service Market is witnessing a shift towards biopharmaceuticals, which are becoming increasingly prominent in the healthcare landscape. As the biopharmaceutical market is projected to exceed 500 billion USD by 2025, the demand for specialized testing services tailored to biologics is on the rise. This trend is driven by the complexity of biopharmaceutical products, which require rigorous testing to ensure safety and efficacy. Consequently, companies are seeking GMP testing services that can cater to the unique challenges posed by biologics, including stability testing and contamination control. This growing focus on biopharmaceuticals is likely to propel the expansion of the GMP Testing Service Market, as organizations prioritize compliance and product quality.

Regulatory Compliance and Quality Standards

Regulatory compliance remains a critical driver for the GMP Testing Service Market. With regulatory bodies enforcing stringent quality standards, companies are compelled to adopt comprehensive testing protocols to avoid penalties and ensure product safety. The increasing complexity of regulations, particularly in the pharmaceutical and food sectors, necessitates a robust approach to quality assurance. For instance, the implementation of the FDA's Quality System Regulation has heightened the need for effective GMP testing services. As a result, organizations are investing in these services to navigate the regulatory landscape effectively, thereby fostering growth in the GMP Testing Service Market. This focus on compliance not only safeguards public health but also enhances the reputation of companies within the market.

Global Expansion of Pharmaceutical Companies

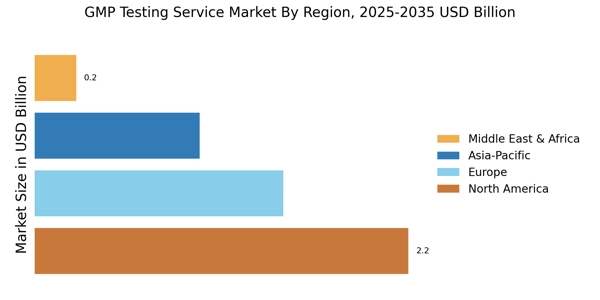

The GMP Testing Service Industry. As companies seek to penetrate new markets, they are increasingly required to adhere to local regulatory standards, which often necessitates the use of GMP testing services. This trend is particularly evident in emerging markets, where the pharmaceutical sector is expected to grow at a rapid pace, potentially reaching 300 billion USD by 2025. Consequently, the demand for GMP testing services is likely to rise as companies establish operations in these regions. This expansion not only drives revenue growth for testing service providers but also emphasizes the importance of maintaining high-quality standards across diverse markets, thereby reinforcing the role of GMP testing in the industry.

Technological Advancements in Testing Methods

Technological advancements are playing a pivotal role in shaping the GMP Testing Service Market. Innovations such as automation, artificial intelligence, and advanced analytical techniques are enhancing the efficiency and accuracy of testing processes. For instance, the integration of AI in data analysis allows for quicker identification of potential issues, thereby streamlining the testing workflow. Moreover, the market for laboratory automation is expected to grow significantly, with estimates suggesting a compound annual growth rate of over 10% in the coming years. These advancements not only reduce operational costs but also improve compliance with regulatory standards, making them essential for companies aiming to stay competitive in the GMP Testing Service Market.