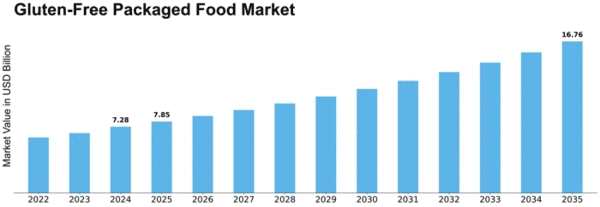

Gluten Free Packaged Food Size

Gluten-Free Packaged Food Market Growth Projections and Opportunities

The consumption of gluten-free packaged food commodities market is impacted by multiple elements which underlie the percentage of its production and volatility. One particular variable is the advancement in gluten intolerance and celiac disease. As cases of gluten sensitive illnesses, or individuals choosing gluten free diet for health reasons continue to grow, so does consumers’ demand for packaged gluten free food products. The highly motivated customer edge pushes the increases of the gluten-free market size and manufacturers are pushed to be innovative or diversify their product offerings and meet the unique and changing eating desires of the eating population.

So, people's changed lifestyles with their new diets bring a crucial impact into the market on gluten-free packaged food products. Impacting consumers' lives with hectic schedules, grab-and-go nutrition trends, and a bigger interest in healthy eating, gluten-free options that are at the same time convenient and high in nutrition have increased in demand. Customers are more and more attracted to goods that are gluten-free in comparison with traditional items that are made from wheat, such as bread, pasta, snacks and baking mixtures, which stimulates gluten-free product growth.

Socio-economic factors as well as economic forces shape the market of gluten-free packed food products. The rumor that gluten-free products are more expensive has been disputed by the extensive manufacturing processes together with economies of scale that have been able to lower the costs of production, making cost-effective gluten-free products available to individuals from all classes of income. Also, the fact that gluten-free market spreads as competition between manufacturers is going agin each other so new market will grow even more boosted by prices and other competitors.

The stocking and checking of ingredients production is absolutely critical for the product market of gluten-free packaged foods. Producers of gluten-free foods use diverse regular grains like rice, corn, quinoa, and oats, as well as other conventional flours and starches to produce their products. Either a shortage or increase in the prices of those primary ingredients may cause the production prices to go very high or make the products overpriced. Also, the ingredients that are pure and safe, which are the basis of food security as well as meeting standard regulations, are very important for the quality of gluten-free products.

About the demographic trends changing also direct influence on the market of specialty food product packaging. Factors constituted by the number of people, urbanization, and aging populations affecting demand and consumer behavior come in respond to consumer preferences and consumption patterns. Such as, being more health conscious, millennials and Gen Z youths are probable to go for gluten-free products and the older consumers may select gluten free alternatives to manage some special health diets or in case of some restrictions.

Leave a Comment