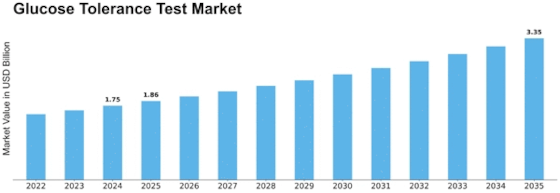

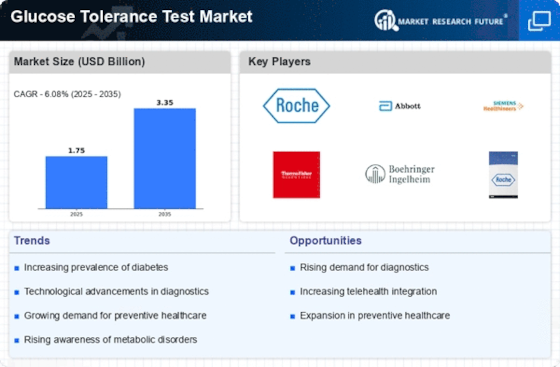

Glucose Tolerance Test Size

Glucose Tolerance Test Market Growth Projections and Opportunities

The Glucose Tolerance Test (GTT) market is influenced by several key factors that shape its growth and development. Firstly, the increasing prevalence of diabetes and metabolic disorders worldwide drives the demand for glucose tolerance testing. Diabetes has reached epidemic proportions globally, with millions of individuals affected by the condition and its associated complications. Glucose tolerance testing plays a crucial role in diagnosing prediabetes, gestational diabetes, and type 2 diabetes by assessing the body's ability to regulate blood sugar levels. As awareness about diabetes and metabolic health grows, there is a rising demand for accurate and reliable glucose tolerance tests, fueling market expansion.

Secondly, advancements in diagnostic technologies and testing methodologies drive innovation in the GTT market. Manufacturers are continually developing new and improved glucose tolerance testing protocols, devices, and assays that offer enhanced sensitivity, specificity, and convenience. These advancements include the development of point-of-care testing devices, continuous glucose monitoring systems, and non-invasive testing methods, which improve the efficiency and accessibility of glucose tolerance testing. As healthcare providers adopt these innovative technologies, the demand for glucose tolerance tests increases, driving market growth.

Furthermore, increasing awareness about the importance of early detection and intervention in diabetes and metabolic disorders contributes to market expansion. Healthcare organizations, patient advocacy groups, and public health campaigns play a vital role in raising awareness about the risk factors, symptoms, and complications of diabetes. Greater awareness leads to increased screening efforts, including glucose tolerance testing, among at-risk populations such as overweight individuals, those with a family history of diabetes, and pregnant women. As awareness levels rise, there is a corresponding increase in the demand for glucose tolerance tests, driving market growth.

Moreover, demographic trends such as aging populations and lifestyle changes influence the GTT market. Aging is a significant risk factor for impaired glucose tolerance and diabetes, with the prevalence of these conditions increasing with advancing age. Additionally, changes in lifestyle factors such as sedentary behavior, unhealthy dietary habits, and obesity contribute to the development of insulin resistance and metabolic dysfunction. As the global population ages and urbanization continues, there is a growing pool of individuals at risk of diabetes and impaired glucose tolerance, driving market demand for glucose tolerance testing.

Additionally, government initiatives and healthcare policies aimed at promoting preventive care, improving access to healthcare services, and reducing disease burden also influence the GTT market. Governments worldwide are investing in diabetes prevention and management programs, including screening initiatives, lifestyle interventions, and access to affordable healthcare services. Furthermore, healthcare policies promoting reimbursement for glucose tolerance testing and diabetes management services ensure that individuals have access to essential diagnostic tests and treatments, driving market demand.

On the other hand, challenges such as cost constraints, limited access to healthcare services, and patient discomfort during testing may hinder market growth. Glucose tolerance testing can be expensive, particularly for individuals without adequate insurance coverage or access to healthcare services. Moreover, disparities in healthcare infrastructure and resources in certain regions may limit the availability and accessibility of glucose tolerance testing, especially in underserved communities. Addressing these challenges through initiatives to improve healthcare affordability, expand access to diagnostic services, and enhance patient education and support is essential to unlock the full potential of the GTT market.

Leave a Comment