- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

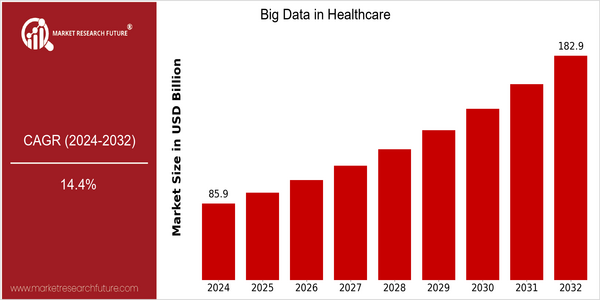

| Year | Value |

|---|---|

| 2024 | USD 85.91 Billion |

| 2032 | USD 182.95 Billion |

| CAGR (2024-2032) | 14.4 % |

Note – Market size depicts the revenue generated over the financial year

The Big Data in Healthcare market is poised for significant growth, with a current valuation of USD 85.91 billion in 2024, projected to reach USD 182.95 billion by 2032. This represents a robust compound annual growth rate (CAGR) of 14.4% over the forecast period. Such growth underscores the increasing reliance on data analytics to enhance patient outcomes, streamline operations, and reduce costs within the healthcare sector. As healthcare organizations continue to adopt advanced data management solutions, the demand for big data technologies is expected to surge, driven by the need for improved decision-making and personalized medicine. Several key factors are propelling this market expansion, including the rising prevalence of chronic diseases, the growing emphasis on value-based care, and the integration of artificial intelligence and machine learning in healthcare analytics. Innovations in cloud computing and the Internet of Things (IoT) are also facilitating the collection and analysis of vast amounts of health data, further fueling market growth. Notable players in this space, such as IBM Watson Health, Cerner Corporation, and Optum, are actively engaging in strategic initiatives, including partnerships and investments in cutting-edge technologies, to enhance their service offerings and maintain competitive advantages in the evolving landscape of healthcare data management.

Regional Market Size

Regional Deep Dive

The Big Data in Healthcare Market is experiencing significant growth across various regions, driven by the increasing volume of healthcare data, advancements in analytics technologies, and a growing emphasis on personalized medicine. In North America, the market is characterized by a high adoption rate of big data solutions, fueled by the presence of major healthcare IT companies and a supportive regulatory environment. Europe is witnessing a surge in data-driven healthcare initiatives, particularly in response to the EU's General Data Protection Regulation (GDPR), which emphasizes data privacy and security. The Asia-Pacific region is rapidly emerging as a key player, with governments investing heavily in digital health infrastructure and a rising demand for healthcare analytics. Meanwhile, the Middle East and Africa are gradually adopting big data solutions, driven by the need to improve healthcare delivery and outcomes. Latin America is also beginning to embrace big data in healthcare, although at a slower pace due to economic challenges and varying levels of technological readiness.

Europe

- The European Union's GDPR has prompted healthcare organizations to adopt more robust data governance frameworks, influencing how big data is collected, stored, and utilized in healthcare settings.

- Countries like Germany and the UK are investing in national health data platforms, such as the NHS Digital in the UK, which aims to harness big data for improving public health outcomes.

Asia Pacific

- China's government has initiated the Healthy China 2030 plan, which emphasizes the use of big data in healthcare to improve health services and outcomes across the nation.

- India is witnessing a rise in startups focusing on healthcare analytics, with companies like Practo and SigTuple leveraging big data to enhance patient engagement and diagnostic accuracy.

Latin America

- Brazil is increasingly adopting big data analytics in healthcare, with initiatives aimed at improving public health surveillance and disease management through data-driven insights.

- Countries like Mexico are beginning to explore big data applications in healthcare, although progress is hampered by infrastructure challenges and varying levels of digital literacy.

North America

- The U.S. government has launched initiatives like the Precision Medicine Initiative, which aims to leverage big data to tailor treatments to individual patients, significantly impacting research and clinical practices.

- Major companies such as IBM Watson Health and Cerner are innovating in the field, developing advanced analytics platforms that integrate big data to enhance patient care and operational efficiency.

Middle East And Africa

- The UAE's Ministry of Health and Prevention has launched the 'Health Data Strategy,' which aims to utilize big data analytics to improve healthcare services and patient outcomes in the region.

- South Africa is seeing a growing number of partnerships between tech companies and healthcare providers to develop big data solutions that address local health challenges, such as disease outbreaks.

Did You Know?

“Approximately 30% of healthcare organizations in North America are currently using big data analytics to improve patient outcomes and operational efficiency.” — Healthcare Information and Management Systems Society (HIMSS)

Segmental Market Size

The Big Data in Healthcare segment plays a crucial role in enhancing patient outcomes and operational efficiency, currently experiencing robust growth. Key drivers include the increasing demand for personalized medicine, which necessitates the analysis of vast datasets, and regulatory policies promoting data interoperability and transparency, such as the 21st Century Cures Act in the U.S. Additionally, technological advancements in artificial intelligence and machine learning are enabling more sophisticated data analytics capabilities, further fueling demand. Currently, the adoption stage of Big Data in Healthcare is transitioning from pilot phases to scaled deployment, with notable leaders like IBM Watson Health and Google Health spearheading initiatives. Primary applications include predictive analytics for patient care, operational analytics for hospital management, and genomics research for drug development. Macro trends such as the COVID-19 pandemic have accelerated the integration of big data solutions, highlighting the need for real-time data analysis in public health. Technologies like cloud computing and advanced analytics platforms are shaping the segment's evolution, enabling healthcare providers to harness data effectively.

Future Outlook

The Big Data in Healthcare market is poised for significant growth from 2024 to 2032, with a projected market value increase from $85.91 billion to $182.95 billion, reflecting a robust compound annual growth rate (CAGR) of 14.4%. This growth trajectory is driven by the increasing adoption of advanced analytics, artificial intelligence (AI), and machine learning technologies, which are enhancing the ability of healthcare providers to derive actionable insights from vast amounts of patient data. By 2032, it is anticipated that over 70% of healthcare organizations will leverage big data analytics to improve patient outcomes and operational efficiency, marking a substantial increase in market penetration compared to current levels. Key technological advancements, such as the integration of Internet of Things (IoT) devices and the expansion of cloud computing capabilities, are expected to further propel the market. These innovations facilitate real-time data collection and analysis, enabling healthcare professionals to make informed decisions swiftly. Additionally, supportive government policies and regulations aimed at promoting data interoperability and patient privacy will play a crucial role in shaping the landscape. Emerging trends, including personalized medicine and predictive analytics, will also drive demand, as stakeholders increasingly recognize the value of data-driven strategies in enhancing healthcare delivery and reducing costs. Overall, the Big Data in Healthcare market is set to transform the industry, fostering a more efficient, patient-centered approach to healthcare.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2023 | USD 25.1 billion |

| Growth Rate | 18.48% (2024-2032) |

Global Big Data Healthcare Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.