Top Industry Leaders in the Glass Market

Glass Market

The glass market is a kaleidoscope of shifting dynamics, where innovation and strategic maneuvering hold the key to success. As players navigate the evolving landscape, from regional ambitions to technological advancements, one thing remains certain: the future of glass will be shaped by those who can adapt, innovate, and shine brighter than the rest.

Strategies Driving Market Share:

-

Product Innovation:Differentiation is key in a crowded market. Leading players like AGC, Saint-Gobain, and NSG Group are investing heavily in R&D, producing specialized glasses with self-cleaning, self-healing, and energy-efficient properties. AGC's Dragontrail, known for its scratch resistance, is a prime example. -

Geographic Expansion:Emerging markets like China and India are witnessing explosive growth in construction and consumer goods, attracting established players like Guardian Glass and Shahe Glass to set up new production facilities. Local players are also seizing this opportunity, gaining market share through cost-effective solutions. -

Vertical Integration:To secure raw materials and control costs, companies like Corning are vertically integrating, acquiring mines and developing their own silica sand processing facilities. This approach ensures quality control and supply chain resilience. -

Sustainability Focus:Environmental concerns are prompting a shift towards sustainable production processes. Pilkington NSG's Pilkington Optiwhite™ range of low-e glass reduces energy consumption in buildings, while Schott AG's Xensation® Cover glass for smartphones is made from recycled glass. -

Partnerships and Acquisitions:Collaboration is key to navigating the complex global market. Strategic partnerships and acquisitions are enabling knowledge transfer, market access, and product diversification. Corning and Dow Chemical's joint venture to develop lightweight glass for the aerospace industry is a successful example.

Factors Shaping Market Dynamics:

-

Raw Material Costs:Fluctuations in the price of silica sand, soda ash, and other raw materials directly impact production costs and product pricing. Geopolitical instability and supply chain disruptions can further exacerbate these price swings. -

Construction Industry Trends:The construction sector is a major driver of glass demand. Infrastructure development, urbanization, and changing trends in architectural design influence both the volume and type of glass consumed. -

Technological Advancements:New technologies like smart glass, OLED displays, and photovoltaic glass are creating new opportunities and reshaping traditional segments. Companies investing in these advancements gain a competitive edge. -

Sustainability Regulations:Stringent environmental regulations are pushing manufacturers to adopt cleaner production processes and develop energy-efficient products. This adds cost pressures but also opens up new markets for green glass solutions. -

Consumer Preferences:Evolving consumer preferences for high-tech gadgets, energy-efficient homes, and aesthetically pleasing designs influence the glass types in demand. Manufacturers who cater to these preferences gain an edge.

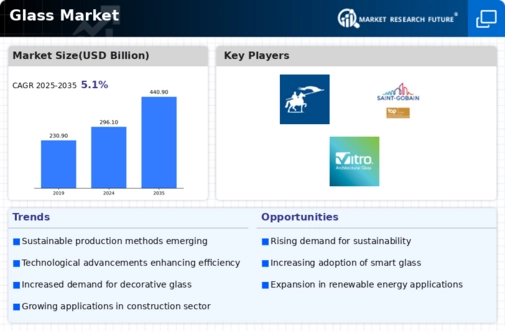

Key Companies in the Glass market include

- AGC Inc.

- Fuyao Glass Industry Group Co. Ltd.

- Guardian Industries

- Saint-Gobain

- O-I Glass Inc.

- AGI glaspac

- Nihon Yamaura Glass Co., Ltd.

- Vitro

- 3B- the fiberglass company

Recent News

September 2021 Gerresheimer announced that its Lohr, France facility would employ hybrid technology for glass processing. The company intends to significantly reduce CO2 emissions from producing glass tubes and containers with this technology.

September 2022 AGC Glass Europe S.A., a wholly-owned subsidiary of AGC, a world-leading manufacturer of Glass, chemicals, and high-tech materials, announced that it would produce float glass with a significantly reduced carbon footprint of less than 7 kg of CO2 per square meter for clear Glass (4 mm thickness) by the end of 2022.

In September 2023, Nippon Sheet Glass Co Ltd Pilkington introduced a new series of low-emissivity glass for both residential and commercial buildings. This product line improves thermal performance by enforcing heat retention in winter and reducing heat gain during summer. These glass solutions are not only practical but also contribute to energy savings and sustainability efforts, as stressed by the company.

In August 2023, the Turkish production facilities of Şişecam were further modernized with an additional furnace which improves glass production capabilities. The company claims that such expansion will help cover the growing requirements for high quality float glass from both the local and export markets. The spending is a part of an overall plan of Şişecam to capture a larger share in the international market.