Rising Cybersecurity Threats

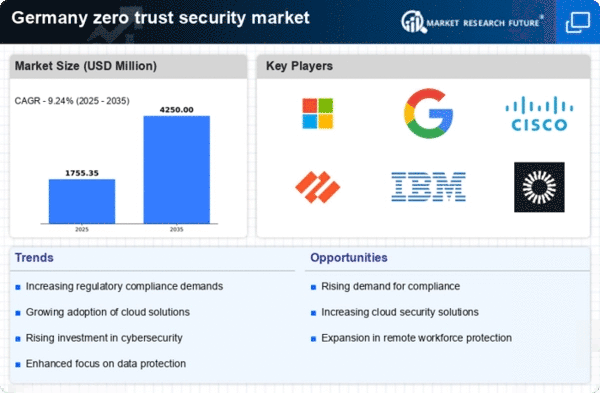

The zero trust security market in Germany Organizations are recognizing that traditional perimeter-based security models are insufficient. As a result, there is a shift towards zero trust architectures that assume no user or device is trustworthy by default. According to recent data, cybercrime costs in Germany are projected to reach €200 billion annually by 2025, prompting businesses to invest in more robust security measures. This trend indicates a strong demand for zero trust solutions, as companies seek to protect sensitive data and maintain operational integrity. The zero trust-security market is thus positioned to expand as organizations prioritize comprehensive security frameworks that address these evolving threats.

Increased Remote Work Culture

The shift towards a remote work culture in Germany is significantly impacting the zero trust-security market. As more employees work from home or other remote locations, traditional security measures are becoming less effective. Zero trust models, which require verification for every access request, are becoming essential in this new work environment. A survey indicates that 60% of German companies plan to maintain flexible work arrangements post-pandemic, highlighting the need for robust security frameworks. This trend suggests that organizations are increasingly adopting zero trust principles to secure remote access to corporate resources. Consequently, the zero trust-security market is likely to expand as businesses invest in technologies that facilitate secure remote work while protecting sensitive information.

Digital Transformation Initiatives

Germany's ongoing digital transformation initiatives are significantly influencing the zero trust-security market. As businesses increasingly adopt digital technologies, the need for enhanced security measures becomes paramount. The integration of IoT devices, cloud computing, and remote work solutions necessitates a shift towards zero trust principles, which focus on verifying every access request regardless of location. Reports suggest that 70% of German companies are investing in digital transformation, with a substantial portion allocating budgets towards security enhancements. This trend underscores the importance of zero trust frameworks in safeguarding digital assets and ensuring compliance with data protection regulations. Consequently, the zero trust-security market is likely to see accelerated growth as organizations align their security strategies with their digital transformation goals.

Growing Awareness of Data Breaches

The rising awareness of data breaches among German consumers and businesses is driving the zero trust-security market. High-profile incidents have raised concerns about data privacy and security, prompting organizations to reevaluate their security strategies. As a result, there is a growing recognition of the need for zero trust architectures that minimize the risk of unauthorized access. Research indicates that 80% of German consumers are concerned about their personal data security, influencing companies to adopt more stringent security measures. This heightened awareness is likely to propel the zero trust-security market forward, as organizations seek to implement solutions that not only protect their data but also build trust with their customers.

Regulatory Pressures and Compliance

The zero trust security market in Germany With the implementation of the General Data Protection Regulation (GDPR) and other data protection laws, organizations are compelled to adopt security measures that protect personal data. Non-compliance can result in hefty fines, which can reach up to €20 million or 4% of annual global turnover, whichever is higher. This regulatory landscape is pushing companies to consider zero trust architectures that provide granular access controls and continuous monitoring. As businesses strive to meet these compliance mandates, the zero trust-security market is expected to grow, as organizations seek solutions that not only enhance security but also ensure adherence to legal obligations.