E-commerce Growth

The surge in e-commerce activities is significantly impacting the supply chain-management market in Germany. With online retail sales projected to reach €100 billion by 2025, companies are compelled to enhance their supply chain capabilities to meet consumer demands for faster delivery and better service. This growth necessitates the implementation of advanced logistics solutions, including automated warehousing and last-mile delivery innovations. As a result, businesses are investing heavily in their supply chain infrastructure to ensure they can efficiently handle increased order volumes. The shift towards e-commerce is not merely a trend; it represents a fundamental change in consumer behavior that is reshaping the supply chain-management market landscape.

Regulatory Compliance

In Germany, stringent regulatory frameworks are shaping the supply chain-management market. Companies must navigate complex regulations related to environmental standards, labor laws, and data protection. Compliance with these regulations is not optional; it is essential for maintaining operational legitimacy and avoiding hefty fines. For instance, the European Union's General Data Protection Regulation (GDPR) imposes strict guidelines on data handling, which directly affects supply chain operations. As businesses strive to align with these regulations, they are likely to invest in compliance technologies and training, thereby influencing their supply chain strategies. This focus on regulatory compliance may lead to increased operational costs but is crucial for long-term sustainability in the supply chain-management market.

Sustainability Pressures

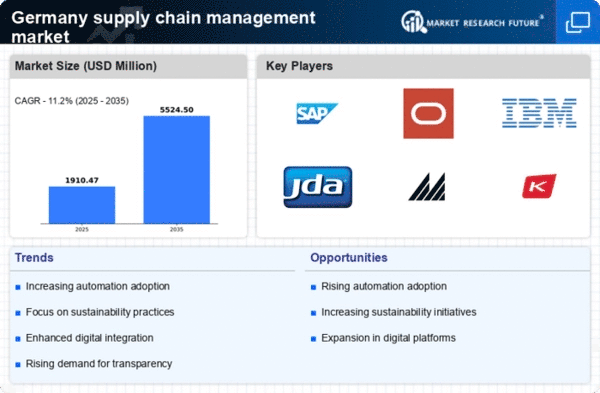

Sustainability pressures are becoming a defining factor in the supply chain-management market in Germany. As environmental concerns rise, companies are increasingly held accountable for their ecological footprints. This has led to a push for sustainable practices, such as reducing carbon emissions and minimizing waste throughout the supply chain. According to recent studies, businesses that adopt sustainable supply chain practices can improve their operational efficiency by up to 20%. Furthermore, consumers are more likely to support brands that demonstrate a commitment to sustainability, making it a critical component of competitive strategy. As such, the integration of sustainable practices is not merely a trend but a necessity for long-term viability in the supply chain-management market.

Technological Advancements

The supply chain management market in Germany is experiencing a notable shift due to rapid technological advancements. Innovations such as artificial intelligence (AI), machine learning, and the Internet of Things (IoT) are being integrated into supply chain processes. These technologies enhance efficiency, reduce operational costs, and improve decision-making capabilities. For instance, AI-driven analytics can optimize inventory management, leading to a potential reduction in excess stock by up to 30%. Furthermore, the adoption of IoT devices allows for real-time tracking of goods, which is crucial for maintaining transparency and accountability in the supply chain-management market. As companies increasingly invest in these technologies, the competitive landscape is likely to evolve, pushing traditional players to adapt or risk obsolescence.

Consumer Demand for Transparency

There is a growing consumer demand for transparency within the supply chain-management market in Germany. Customers are increasingly interested in understanding the origins of products and the ethical practices involved in their production. This trend is prompting companies to adopt more transparent supply chain practices, including traceability systems that allow consumers to track products from source to shelf. As a result, businesses are investing in technologies that facilitate this transparency, such as blockchain, which can provide immutable records of product journeys. This shift not only meets consumer expectations but also enhances brand loyalty and trust, which are vital in the competitive supply chain-management market.