Rising Prevalence of Epilepsy

The increasing prevalence of epilepsy in Germany is a crucial driver for the epilepsy devices market. Recent estimates suggest that approximately 600,000 individuals in Germany are affected by epilepsy, which translates to about 0.8% of the population. This growing patient base necessitates the development and adoption of advanced epilepsy devices, such as seizure detection monitors and neurostimulation devices. As awareness of epilepsy rises, healthcare providers are more likely to recommend these devices, thereby expanding the market. Furthermore, the aging population in Germany, which is more susceptible to neurological disorders, is likely to contribute to the demand for innovative solutions in the epilepsy devices market.

Technological Innovations in Device Design

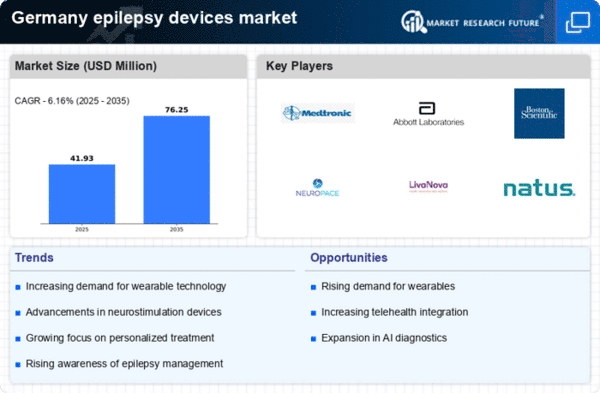

Technological innovations play a pivotal role in shaping the epilepsy devices market. The introduction of wearable devices equipped with advanced sensors and artificial intelligence capabilities has transformed the landscape of epilepsy management. These devices can monitor seizure activity in real-time, providing critical data to both patients and healthcare providers. In Germany, the market for wearable epilepsy devices is projected to grow at a CAGR of 10% over the next five years. This growth is driven by the increasing demand for non-invasive monitoring solutions that enhance patient quality of life. As technology continues to evolve, the epilepsy devices market is likely to witness further advancements, leading to more effective and user-friendly products.

Growing Awareness and Education Initiatives

Growing awareness and education initiatives regarding epilepsy are crucial for the epilepsy devices market. In Germany, numerous organizations and healthcare providers are actively working to educate the public about epilepsy, its symptoms, and available treatment options. This increased awareness is likely to lead to higher rates of diagnosis and, consequently, a greater demand for epilepsy devices. Educational campaigns that emphasize the importance of early intervention and effective management strategies are particularly influential. As more individuals and families become informed about the benefits of using specialized devices, the epilepsy devices market is expected to expand, catering to the needs of a more knowledgeable patient population.

Increased Investment in Research and Development

Investment in research and development (R&D) is a significant driver for the epilepsy devices market. In Germany, both public and private sectors are allocating substantial funds to develop innovative epilepsy management solutions. The German government has recognized the importance of addressing neurological disorders and has initiated various funding programs aimed at fostering innovation in medical technology. This commitment to R&D is expected to yield new devices that improve seizure detection and patient outcomes. As a result, the epilepsy devices market is likely to benefit from a steady influx of novel products, enhancing the overall treatment landscape for individuals living with epilepsy.

Supportive Healthcare Policies and Reimbursement Models

Supportive healthcare policies and reimbursement models are essential drivers for the epilepsy devices market. In Germany, the healthcare system is structured to provide coverage for various medical devices, including those used for epilepsy management. The introduction of favorable reimbursement policies encourages healthcare providers to prescribe these devices, thereby increasing their adoption among patients. Additionally, the German health insurance system is evolving to include more comprehensive coverage for innovative technologies, which is likely to enhance access to epilepsy devices. As these policies continue to develop, the epilepsy devices market is expected to experience growth, driven by improved patient access and affordability.