Remote Work Enablement

The shift towards remote work arrangements is reshaping the business software-services market in Germany. With a significant portion of the workforce now operating remotely, companies are increasingly reliant on software solutions that facilitate collaboration and productivity. Data suggests that around 50% of German employees are working remotely at least part-time, creating a demand for tools that support virtual communication and project management. This trend is likely to drive the growth of the business software-services market as organizations seek to implement effective solutions that enhance remote work capabilities. Software providers are responding by developing innovative applications that cater to the unique needs of remote teams, thereby expanding their offerings in the business software-services market.

Growing Demand for Customization

The business software-services market in Germany is witnessing a growing demand for customized solutions tailored to specific industry needs. As businesses strive to differentiate themselves in competitive markets, the need for software that aligns with unique operational requirements is becoming increasingly apparent. Recent surveys indicate that approximately 65% of German companies prefer customized software solutions over off-the-shelf products. This trend is likely to drive innovation within the business software-services market, as providers focus on developing flexible and adaptable software offerings. The ability to customize software not only enhances user experience but also improves overall efficiency, making it a critical factor for businesses looking to optimize their operations.

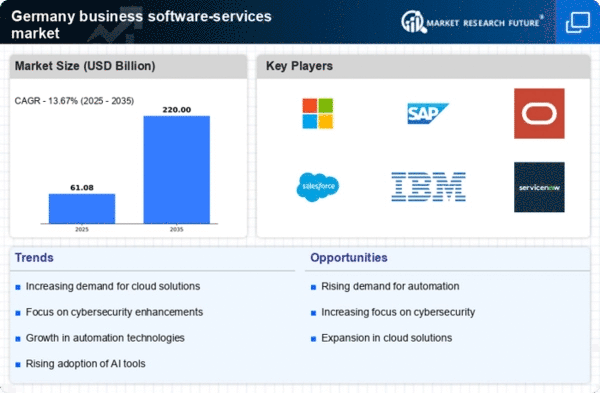

Increased Focus on Cybersecurity

As cyber threats become more sophisticated, the emphasis on cybersecurity within the business software-services market is intensifying. German companies are recognizing the critical need to protect sensitive data and maintain customer trust. Recent statistics indicate that over 60% of businesses in Germany have reported experiencing cyber incidents, prompting a surge in demand for robust cybersecurity software solutions. This heightened awareness is driving organizations to invest in comprehensive software services that offer advanced security features. the business software-services market will benefit from this trend, as companies prioritize cybersecurity measures to safeguard their operations and comply with regulatory requirements. The integration of cybersecurity into software offerings is becoming a key differentiator for service providers in this competitive landscape.

Digital Transformation Initiatives

The ongoing digital transformation initiatives across various sectors in Germany are driving the business software-services market. Organizations are increasingly investing in software solutions to enhance operational efficiency and customer engagement. According to recent data, approximately 70% of German companies have initiated digital transformation projects, which often necessitate the adoption of advanced software services. This trend is likely to continue as businesses seek to remain competitive in a rapidly evolving market. The integration of innovative technologies, such as cloud computing and data analytics, is becoming essential for organizations aiming to optimize their processes. Consequently, the demand for tailored software solutions is expected to rise, further propelling the growth of the business software-services market in Germany.

Sustainability and Green Initiatives

Sustainability is becoming a pivotal concern for businesses in Germany, influencing the business software-services market. Companies are increasingly seeking software solutions that support their sustainability goals, such as reducing carbon footprints and enhancing resource efficiency. Recent reports indicate that around 55% of German firms are prioritizing sustainability in their operational strategies. This shift is likely to drive demand for software services that facilitate sustainable practices, such as energy management and waste reduction. As organizations strive to meet regulatory standards and consumer expectations regarding environmental responsibility, the business software-services market is expected to evolve, with providers offering solutions that align with these sustainability objectives.