Focus on Food Safety Standards

In Germany, stringent food safety regulations play a crucial role in shaping the aseptic automatic-filling-machine market. The increasing emphasis on food safety standards necessitates the use of advanced filling technologies that minimize contamination risks. Regulatory bodies have established guidelines that require manufacturers to adopt aseptic processing methods to ensure product integrity. This focus on safety is further amplified by consumer awareness regarding food quality, leading to a heightened demand for aseptic filling solutions. As a result, the aseptic automatic-filling-machine market is likely to witness growth as companies invest in compliant technologies to adhere to these regulations. The market is expected to expand as businesses prioritize safety and quality, aligning with the evolving landscape of food production in Germany.

Growth of the Beverage Industry

The beverage industry in Germany is witnessing substantial growth, which directly impacts the aseptic automatic-filling-machine market. With a rising consumer preference for non-alcoholic beverages, including juices and dairy alternatives, manufacturers are increasingly turning to aseptic filling technologies to ensure product quality and safety. The beverage sector is projected to expand at a CAGR of around 5% over the next few years, creating a favorable environment for aseptic filling solutions. This growth is likely to encourage investments in state-of-the-art filling machines that can handle diverse product lines while maintaining high standards of hygiene. Consequently, the aseptic automatic-filling-machine market stands to gain from the burgeoning beverage industry, as companies seek efficient solutions to meet consumer demands.

Rising Demand for Packaged Foods

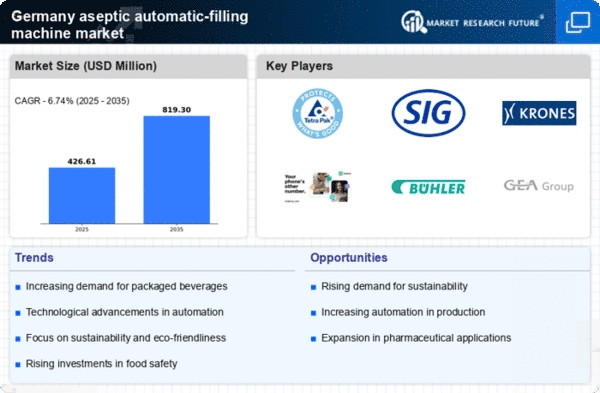

The aseptic automatic-filling-machine market experiences a notable surge in demand for packaged foods in Germany. This trend is driven by changing consumer preferences towards convenience and longer shelf life. As more consumers opt for ready-to-eat meals and beverages, manufacturers are increasingly investing in aseptic filling technologies to meet these needs. The market for packaged foods in Germany is projected to grow at a CAGR of approximately 4.5% over the next five years, indicating a robust opportunity for aseptic filling solutions. This growth is likely to propel the adoption of advanced filling machines, which ensure product safety and quality while extending shelf life. Consequently, the aseptic automatic-filling-machine market is poised to benefit significantly from this rising demand, as manufacturers seek efficient and reliable solutions to enhance their production capabilities.

Sustainability and Eco-Friendly Practices

Sustainability initiatives are becoming increasingly relevant in the aseptic automatic-filling-machine market in Germany. As consumers become more environmentally conscious, manufacturers are compelled to adopt eco-friendly practices in their production processes. This includes the use of sustainable materials and energy-efficient technologies in aseptic filling operations. The market is likely to see a shift towards machines that not only meet production needs but also align with sustainability goals. Companies that invest in environmentally friendly technologies may gain a competitive edge, as consumers favor brands that demonstrate a commitment to sustainability. The aseptic automatic-filling-machine market is expected to evolve in response to these trends, with a growing emphasis on reducing environmental impact while maintaining product quality.

Technological Integration in Manufacturing

The integration of advanced technologies in manufacturing processes significantly influences the aseptic automatic-filling-machine market in Germany. Automation and digitalization are becoming increasingly prevalent, allowing manufacturers to enhance efficiency and reduce operational costs. The adoption of Industry 4.0 principles facilitates real-time monitoring and data analytics, which can optimize production lines. This technological shift is expected to drive the demand for sophisticated aseptic filling machines that can seamlessly integrate with existing systems. As manufacturers seek to improve productivity and maintain competitive advantages, the aseptic automatic-filling-machine market is likely to experience growth. The potential for increased efficiency and reduced waste presents a compelling case for investment in these advanced technologies.