Enhanced Regulatory Frameworks

The regulatory landscape surrounding the ancillary services-power market in Germany is undergoing significant enhancements. Recent reforms aim to streamline market participation and improve the efficiency of ancillary services procurement. The Federal Network Agency has introduced new guidelines that promote competition and transparency in the ancillary services market. These changes are expected to attract more market participants, thereby increasing the overall capacity and reliability of ancillary services. The ancillary services-power market is likely to see a boost in investment and innovation as a result of these regulatory improvements, fostering a more robust and resilient energy system.

Evolving Consumer Participation Models

The role of consumers in the ancillary services-power market is evolving, with more individuals and businesses participating in demand-side management programs. This shift is driven by the increasing availability of smart technologies and the growing awareness of energy efficiency. In Germany, consumer participation in ancillary services is projected to account for around 20% of the total ancillary services market by 2027. This trend indicates a significant transformation in how ancillary services are delivered and utilized. The ancillary services-power market is adapting to these changes by creating new business models that empower consumers to contribute to grid stability while potentially benefiting from financial incentives.

Growing Demand for Flexibility Services

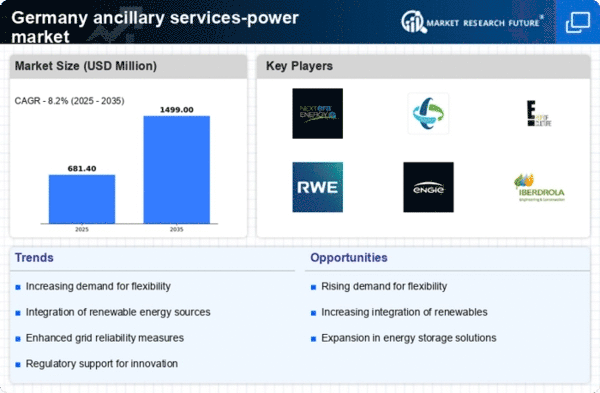

The increasing integration of variable renewable energy sources in Germany has led to a heightened demand for flexibility services within the ancillary services-power market. As the share of renewables in the energy mix rises, grid operators require more ancillary services to maintain system stability. This demand is reflected in the market, where the value of ancillary services is projected to reach approximately €1.5 billion by 2026. Flexibility services, such as demand response and energy storage, are becoming essential to balance supply and demand, ensuring reliability in the power system. The ancillary services-power market is thus evolving to accommodate these needs, with innovative solutions being developed to enhance grid resilience.

Rising Importance of Frequency Regulation

Frequency regulation is becoming increasingly critical in the ancillary services-power market, particularly as Germany transitions to a more decentralized energy system. With the growing reliance on intermittent renewable energy sources, maintaining grid frequency within acceptable limits is essential for system stability. The ancillary services-power market is responding to this challenge by developing more sophisticated frequency regulation services. Market data indicates that the demand for frequency response services has surged by approximately 30% over the past two years, highlighting the urgency of this issue. As a result, market participants are investing in technologies that can provide rapid response capabilities to support grid stability.

Increased Investment in Smart Grid Technologies

Investment in smart grid technologies is transforming the ancillary services-power market in Germany. These technologies facilitate real-time monitoring and management of electricity flows, enhancing the efficiency of ancillary services. The German government has allocated over €1 billion to smart grid initiatives, aiming to modernize the energy infrastructure. This investment is expected to improve the integration of distributed energy resources, thereby increasing the demand for ancillary services. The ancillary services-power market is likely to benefit from these advancements, as they enable better coordination between generation and consumption, ultimately leading to a more reliable and efficient power system.